Top Dividend Stocks On Euronext Amsterdam In August 2024

As European markets experience a boost from the Paris Olympics and anticipate potential interest rate cuts by the ECB, investors are increasingly looking for stable income sources amidst fluctuating economic conditions. In this environment, dividend stocks on Euronext Amsterdam offer an attractive option for those seeking reliable returns.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Koninklijke Heijmans (ENXTAM:HEIJM) | 3.36% | ★★★★☆☆ |

Aalberts (ENXTAM:AALB) | 3.22% | ★★★★☆☆ |

Signify (ENXTAM:LIGHT) | 7.14% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 5.26% | ★★★★☆☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.78% | ★★★★☆☆ |

ING Groep (ENXTAM:INGA) | 6.92% | ★★★★☆☆ |

Acomo (ENXTAM:ACOMO) | 6.48% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Aalberts

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aalberts N.V. provides mission-critical technologies for aerospace, automotive, building, and maritime sectors with a market cap of €3.87 billion.

Operations: Aalberts N.V. generates revenue primarily from Building Technology (€1.74 billion) and Industrial Technology (€1.49 billion).

Dividend Yield: 3.2%

Aalberts' dividend payments are well-covered by earnings (41% payout ratio) and cash flows (60.4% cash payout ratio), though they have been volatile over the past decade. The stock trades at 50.8% below its estimated fair value, presenting a good relative value compared to peers. Recent earnings showed a slight decline with sales at €1.62 billion and net income at €149.2 million for H1 2024, down from €160 million a year ago.

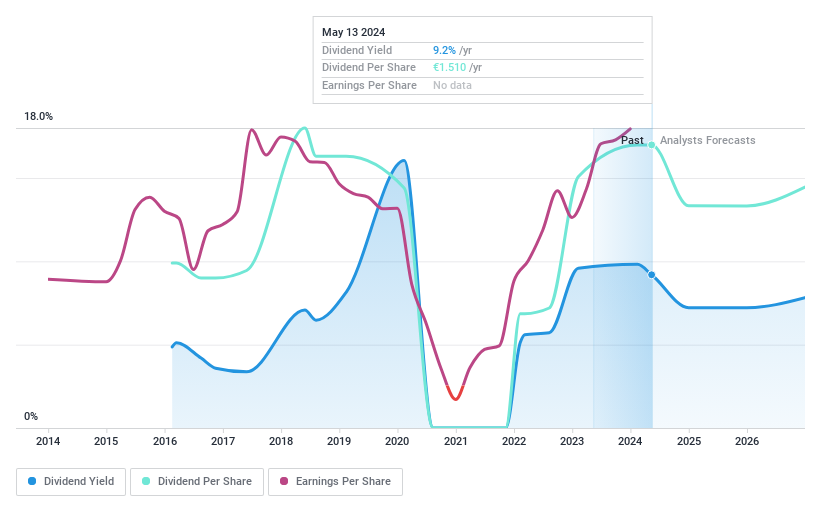

ABN AMRO Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and internationally, with a market cap of €12.86 billion.

Operations: ABN AMRO Bank N.V.'s revenue segments include Corporate Banking (€3.46 billion), Wealth Management (€1.55 billion), and Personal & Business Banking (€4.02 billion).

Dividend Yield: 9.8%

ABN AMRO Bank's dividend payments are covered by earnings (50.5% payout ratio) and forecast to remain sustainable (47.1% in 3 years), but have been volatile over the past 9 years. The stock trades at a significant discount to its estimated fair value, enhancing its appeal for value investors. Recent earnings showed a slight decline with net income at €1.32 billion for H1 2024, down from €1.39 billion a year ago, and an interim dividend set at €0.60 per share (€500 million).

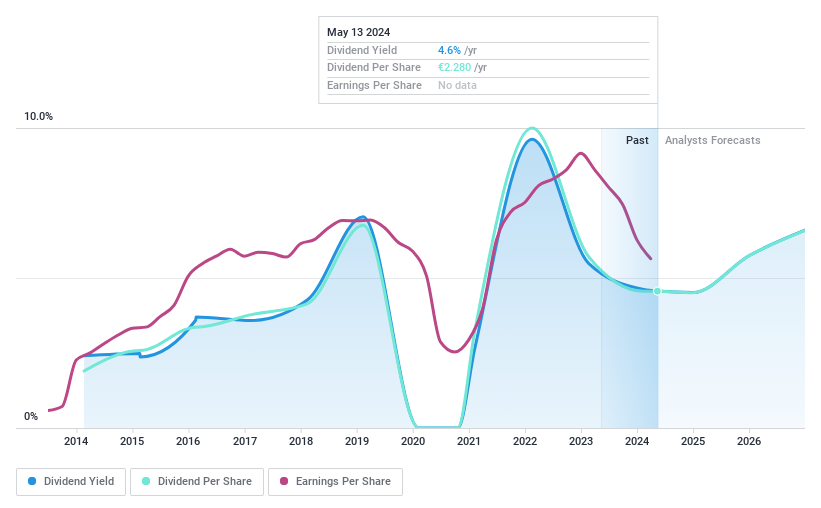

Randstad

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Randstad N.V. offers work and human resources (HR) services solutions, with a market cap of €7.61 billion.

Operations: Randstad N.V. generates revenue from various segments in the field of work and HR services.

Dividend Yield: 5.3%

Randstad's dividend payments have been volatile over the past decade but are covered by earnings (81.3% payout ratio) and cash flows (51.5% cash payout ratio). The company trades at a significant discount to its estimated fair value, offering good relative value compared to peers. Recent earnings showed a decline, with Q2 2024 net income at €78 million, down from €137 million a year ago. Randstad completed a share buyback worth €399.95 million in July 2024.

Take a closer look at Randstad's potential here in our dividend report.

The valuation report we've compiled suggests that Randstad's current price could be quite moderate.

Taking Advantage

Navigate through the entire inventory of 7 Top Euronext Amsterdam Dividend Stocks here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:AALB ENXTAM:ABN and ENXTAM:RAND.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com