3 German Dividend Stocks Yielding Up To 9.3%

As global markets react to weak U.S. economic data and the European Central Bank considers further rate cuts, Germany's DAX index has seen a significant decline of 4.11%. Despite these challenges, dividend stocks in Germany remain an attractive option for investors seeking steady income. In this environment, a good dividend stock typically offers a reliable yield and demonstrates resilience amid market volatility. Here are three German dividend stocks yielding up to 9.3% that could provide such stability in your portfolio.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.64% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 5.06% | ★★★★★★ |

Siemens (XTRA:SIE) | 3.05% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 9.37% | ★★★★★☆ |

Südzucker (XTRA:SZU) | 7.59% | ★★★★★☆ |

INDUS Holding (XTRA:INH) | 5.99% | ★★★★★☆ |

MLP (XTRA:MLP) | 5.42% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.24% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.36% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.35% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top German Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Mercedes-Benz Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mercedes-Benz Group AG operates as an automotive company in Germany and internationally, with a market cap of €54.71 billion.

Operations: Mercedes-Benz Group AG generates revenue primarily through its Mercedes-Benz Cars segment (€109.58 billion), Mercedes-Benz Vans segment (€20.22 billion), and Mercedes-Benz Mobility segment (€26.78 billion).

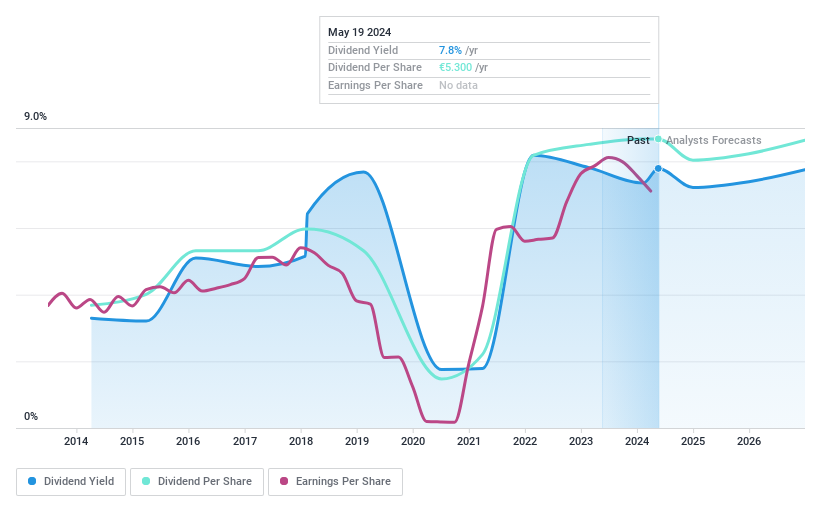

Dividend Yield: 9.4%

Mercedes-Benz Group's dividend payments are well covered by earnings (payout ratio: 43.3%) but less so by cash flows (cash payout ratio: 81.4%). While the dividend yield is in the top 25% of German market payers, its history shows volatility and unreliability over the past decade. Recent Q2 earnings showed a decline, with net income at €3.02 billion compared to €3.56 billion a year ago, impacting future sustainability considerations for dividends.

Logwin

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Logwin AG offers logistics and transport solutions across Germany, Austria, other European countries, the Asia/Pacific region, and internationally with a market cap of €760.11 million.

Operations: Logwin AG's revenue segments consist of Solutions (€275.78 million) and Air + Ocean (€954.25 million).

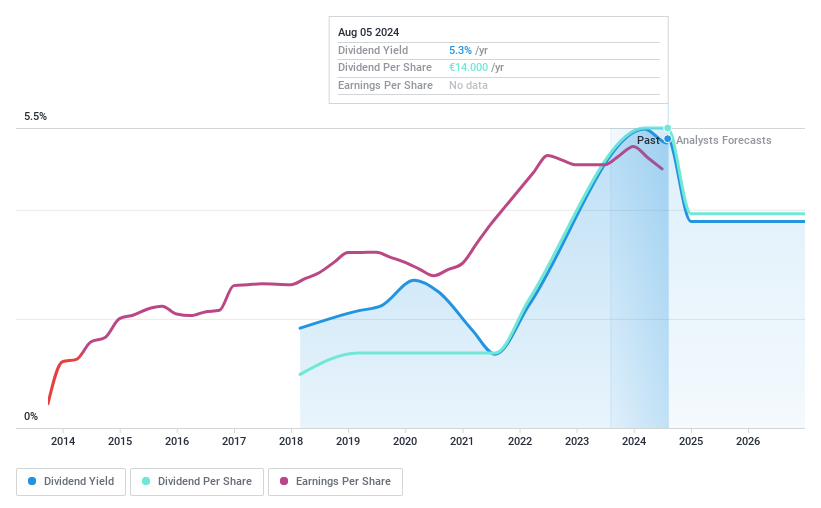

Dividend Yield: 5.3%

Logwin AG's dividend payments are well-covered by both earnings (57% payout ratio) and cash flows (59.4% cash payout ratio), though the company has only paid dividends for six years. Recent earnings for H1 2024 showed a decline, with sales at €643.5 million and net income at €31.86 million, compared to €672.97 million and €40.49 million respectively a year ago, potentially affecting future dividend sustainability despite its high yield in the German market.

technotrans

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: technotrans SE operates as a global technology and services company with a market cap of €102.92 million.

Operations: technotrans SE generates revenue from two main segments: €63.04 million from Services and €188.31 million from Technology.

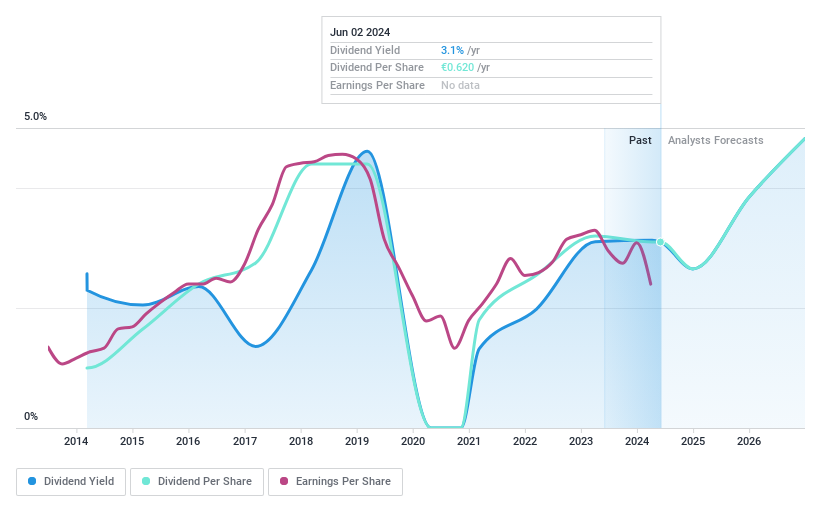

Dividend Yield: 4.2%

technotrans' dividends are covered by earnings (64.7% payout ratio) and cash flows (37.5% cash payout ratio), but its dividend history has been volatile over the past decade. Despite a recent decline in Q1 2024 earnings, with revenue at €56.04 million and net income at €0.059 million, the company trades at 54% below its estimated fair value and offers a lower-than-top-tier dividend yield of 4.16%.

Turning Ideas Into Actions

Reveal the 31 hidden gems among our Top German Dividend Stocks screener with a single click here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:MBG XTRA:TGHN and XTRA:TTR1.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com