Why Five Below Stock Jumped 17% in September

Shares of retail chain Five Below (NASDAQ: FIVE) jumped 17.1% during September, according to data provided by S&P Global Market Intelligence.

But context is important here: The stock was down more than 30% from the start of July through the end of August. It had also lost about 60% of its value in 2024 prior to September. So it only slightly bounced back from an otherwise dismal performance lately.

Five Below has plummeted for a variety of reasons. For starters, it hasn't been a great year for sales -- the company's same-store sales dropped by 4% in the first half of 2024 compared with the same period of 2023. Moreover, net income is down 23%. And to add an extra dose of uncertainty, its CEO abruptly resigned in July, leaving the company to scramble for a new leader.

Investors have fled Five Below stock for these reasons. And yet the stock has started bouncing back because the business still has plenty of merit. Keep in mind that the company is still growing sales, even if same-store sales are falling, because it's opening many new locations around the country.

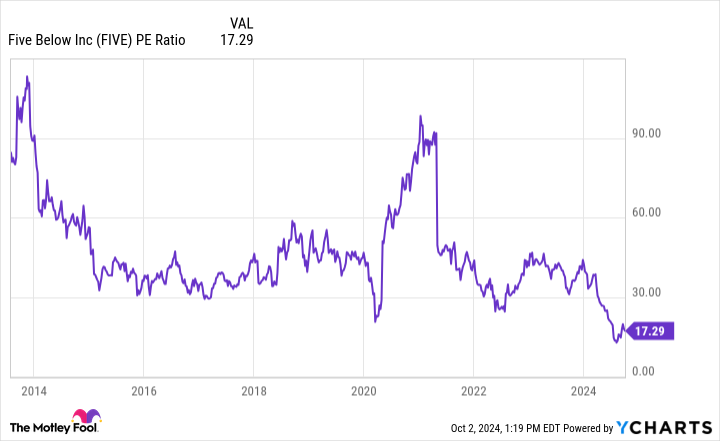

Moreover, Five Below is still profitable despite the dip in profitability. And looking at the stock's valuation from the perspective of its profits, it's quite cheap, with a price-to-earnings (P/E) ratio of just 17.

In other words, there are legitimate reasons that Five Below stock is down. But the business is far from broken. And the investment is less risky now that its valuation is close to the cheapest it's ever been.

What to expect in the near term for Five Below

Five Below's management is pretty hard on itself right now. COO Ken Bull essentially said that the company lost focus on its core customers, overexpanded its inventory, was too aggressive in its goals to grow its store count and profits, got stale, and had too many price points. Management is vowing to course correct.

Changes may be necessary, but it will impact Five Below in the near term. For example, the company expects up to a $13 million net loss in the upcoming third quarter of 2024. And management is slowing down the pace of new store openings, going from 230 new locations in 2024 to only 180 new stores, at most, in 2025.

Keeping the big picture in mind

When looking at the big picture, Five Below will be fine. The company still expects full-year net income of at least $220 million in 2024, even with its Q3 headwind. The company has plenty of cash and no debt, providing financial flexibility while it course corrects. And new stores still have a fast payback period, even if there are ways to improve the customer experience.

I believe September was a great time to buy some shares of Five Below, and I think many investors agreed, based on the stock gains during the month. But I also believe it's still a good buy today as well.

Should you invest $1,000 in Five Below right now?

Before you buy stock in Five Below, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Five Below wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Jon Quast has positions in Five Below. The Motley Fool recommends Five Below. The Motley Fool has a disclosure policy.

Why Five Below Stock Jumped 17% in September was originally published by The Motley Fool