Why the Fed shouldn’t be afraid to make a rate cut ‘mistake’ right now

With the market consensus in recent weeks shifting definitively towards a July rate cut, one top economist says the Fed has little to lose by pulling the trigger.

“If you cut rates and the economy ends up being OK and it looks like maybe the rate cut wasn't necessary, the cost of that mistake seems relatively low,” NatWest Markets Chief U.S. Economist Michelle Girard told Yahoo Finance’s The Final Round.

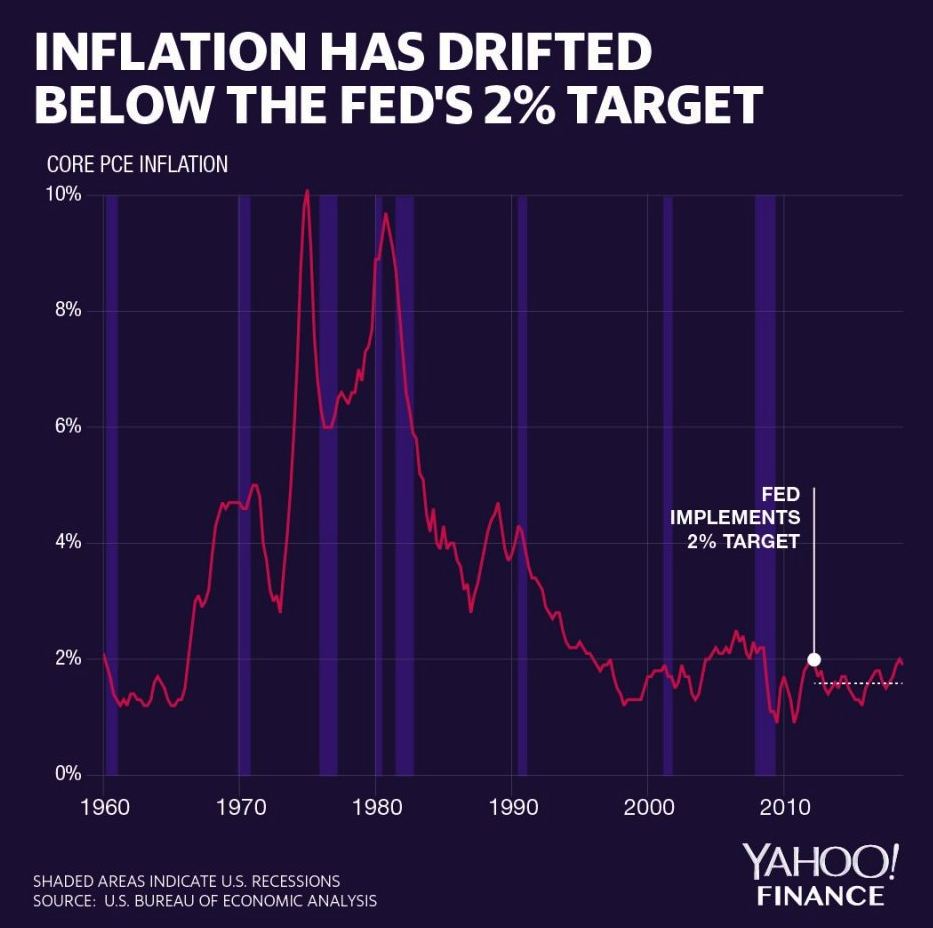

Girard pointed to an inflation rate that’s been sitting well below the Fed’s mandated 2% level. A rate cut would be far more risky if inflation were running hot.

In fact, another argument for the Fed to consider cutting rates sooner rather than later is to help fix what some are calling a ‘credibility issue’ thanks to the surprisingly low inflation rate. Girard points out that the July rate cut could somewhat fix this problem.

“If inflation were to rise as a result of this unnecessary rate cut, I feel like the Fed would cheer for that outcome at this point,” said Girard, who expects the core PCE inflation rate to hold at 1.5% or 1.6% until August.

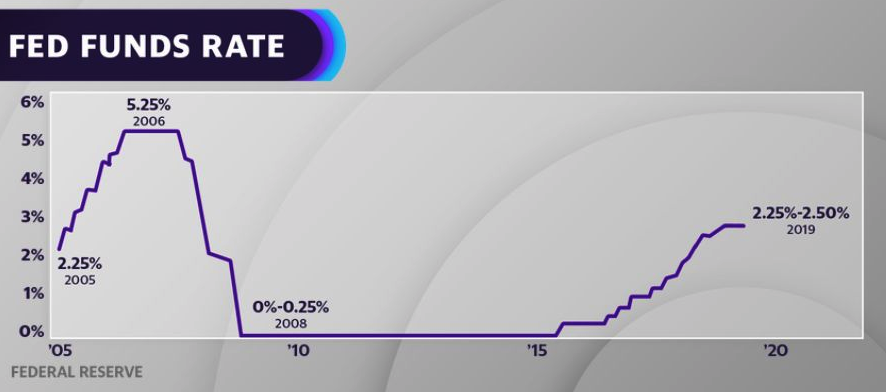

Girard and her team at NatWest expects a 25 basis point rate cut at the July FOMC meeting, followed by another 25 basis point reduction in September.

“Quite honestly the discussion is not IF they'll cut, but by how much will they cut?” Girard said. “Will they move by just 25 basis points, which is our expectation, or could they make a larger move and actually cut by half of a percentage point?”

As of now, the market is pricing in a 100% chance of a quarter-point cut in July. But fewer are betting on a more aggressive move by the Fed, with the Fed Funds futures showing a 29% chance of a 50 basis point reduction.

July is a critical time for the Fed

The next policy decision the FOMC makes will be a critical point for the central bank that will likely send a strong message to the markets about the remainder of the year. Analysts at UBS, for example, believe that if a cut doesn’t happen in July, it might not actually happen at all because the economic sentiment could likely improve in the 2nd half of the year.

“To some extent it does feel like the point of maximum risk is right now, with uncertainty around the outcome of the trade negotiations and concerns about global growth,” said Girard. “If we get good news on trade and if some of the uncertainty wanes, the economy arguably could do better in the second half of the year. But that's a big if.”

Girard points out that some of the expectations for the improving economy are based on the action that the Fed will be taking to provide more accommodation to give the economy some insurance.

“If the Fed were not to cut now and we saw financial conditions tighten and the markets sold off in disappointment, then I think your outlook for the second half of the year would be called into question,” Girard said, adding that the Fed would then ultimately have to take action later in the year.

Rates outlook for the remainder of 2019

Assuming the Fed moves on rates in July and September, the NatWest Markets team isn’t expecting another policy move from the Central Bank for the remainder of the year.

“At this time, we continue to characterize these actions as ‘insurance’ against mounting downside growth risks rather than the start of an extended easing cycle,” Girard writes in a note to clients. “Thus, for now, we are not adding additional rate cuts to 2019 Q4 or 2020.”

What if there’s a U.S.-China trade deal?

The uncertainty around trade has dampened the economic outlook which largely plays into the Fed’s decision on rates. Many market participants point out that should there be any progress on the trade front, the FOMC easing could potentially be off the table. However, Girard thinks the odds of a near-term U.S.-China trade agreement are low.

“Instead, the ‘best case’ scenario may be a delay in new tariffs being instituted while extended negotiations continue,” Girard writes. “Of course, in that event, uncertainty will linger, weighing on business sentiment and activity.”

-

Iryna Kirby is a Producer for Yahoo Finance. Follow her on Twitter at @IrynaNesko.

Read more:

The Fed may be suffering from a 'credibility' issue with its inflation target

This top strategist thinks super free money from the Federal Reserve is here to stay

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.