Wellington Management Group LLP Reduces Stake in Squarespace Inc

Overview of the Recent Transaction

On September 30, 2024, Wellington Management Group LLP executed a significant transaction involving the shares of Squarespace Inc (NYSE:SQSP). The firm reduced its holdings by 7,080,363 shares, resulting in a new total of 5,124,530 shares. This move reflects a -58.01% change in their previous holding, impacting their portfolio by -0.06%. The shares were traded at a price of $46.43 each. This reduction has adjusted Wellington's position in Squarespace to 5.65% of their holdings, representing a 0.04% ratio in their overall portfolio.

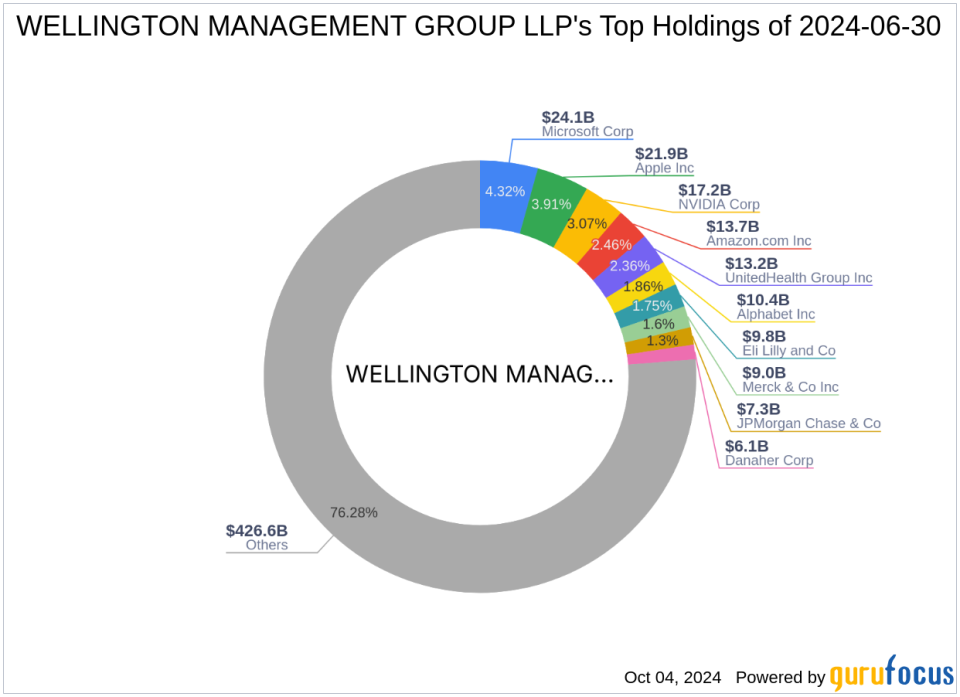

Profile of Wellington Management Group LLP

Founded in 1928, Wellington Management Group LLP has grown from pioneering the first balanced mutual fund in the U.S. to becoming a global powerhouse in investment management. With over $900 billion in assets under management, Wellington employs nearly 600 investment professionals across 12 offices worldwide. The firm is renowned for its diversified investment strategies and in-depth quantitative and qualitative analysis. Wellington's top holdings include major names like Apple Inc (NASDAQ:AAPL) and Amazon.com Inc (NASDAQ:AMZN), with a strong focus on technology and healthcare sectors.

Insight into Squarespace Inc

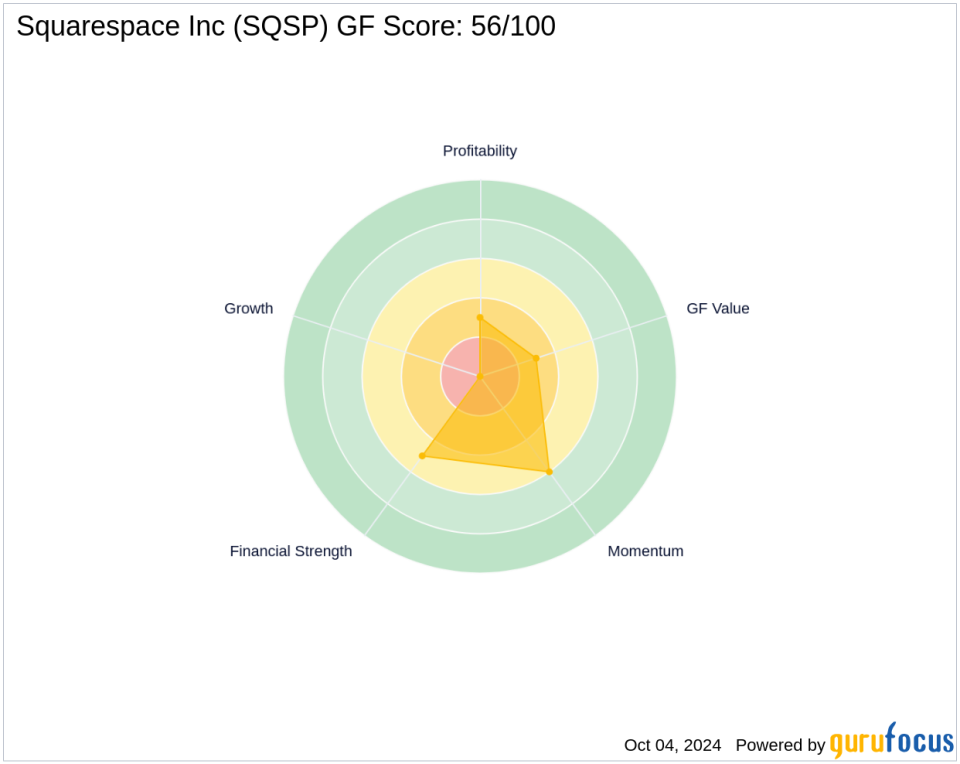

Squarespace Inc, known for its subscription-based website-building software, caters primarily to entrepreneurs and small businesses. Since its IPO on May 19, 2021, the company has expanded its offerings to include tools for social media, email marketing, and hospitality management. Despite a challenging market, Squarespace maintains a market capitalization of $6.46 billion. However, the stock is currently deemed significantly overvalued with a GF Value of $31.95, suggesting a potential misalignment with its intrinsic value.

Impact of the Trade on Wellington's Portfolio

The recent transaction has slightly decreased Wellington's exposure to Squarespace, now accounting for just 0.04% of its total portfolio. This reduction might reflect a strategic realignment or risk management decision, considering the current overvaluation of Squarespace shares.

Market Context and Comparative Insights

Other significant shareholders in Squarespace include GAMCO Investors and Joel Greenblatt (Trades, Portfolio), indicating a continued interest from major investment firms despite the stock's recent performance. Squarespace's year-to-date price increase of 46.27% contrasts with its overall decline since IPO, highlighting the volatile nature of its market valuation.

Future Outlook for Squarespace Inc

Looking ahead, Squarespace faces both challenges and opportunities. The tech sector's dynamic nature and the evolving demands of digital commerce could fuel further innovations and growth for Squarespace. However, its current financial health and market overvaluation pose significant risks that could impact its future performance.

Closing Analysis

The decision by Wellington Management Group LLP to reduce its stake in Squarespace Inc is a strategic move that aligns with the firm's rigorous investment analysis and portfolio management principles. As the market continues to evaluate Squarespace's financial health and growth potential, Wellington's adjustment serves as a critical indicator of its investment strategy in response to prevailing market conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.