Vanguard Group Inc's Strategic Acquisition of FTAI Aviation Ltd Shares

Overview of the Recent Transaction

On September 30, 2024, Vanguard Group Inc made a significant addition to its investment portfolio by acquiring 10,363,209 shares of FTAI Aviation Ltd (NASDAQ:FTAI). This transaction, executed at a price of $132.90 per share, marks a notable expansion in Vanguard's holdings in the aerospace sector. The shares added represent a 5.96% increase, bringing Vanguard's total ownership in FTAI to a substantial 10.13% of its portfolio.

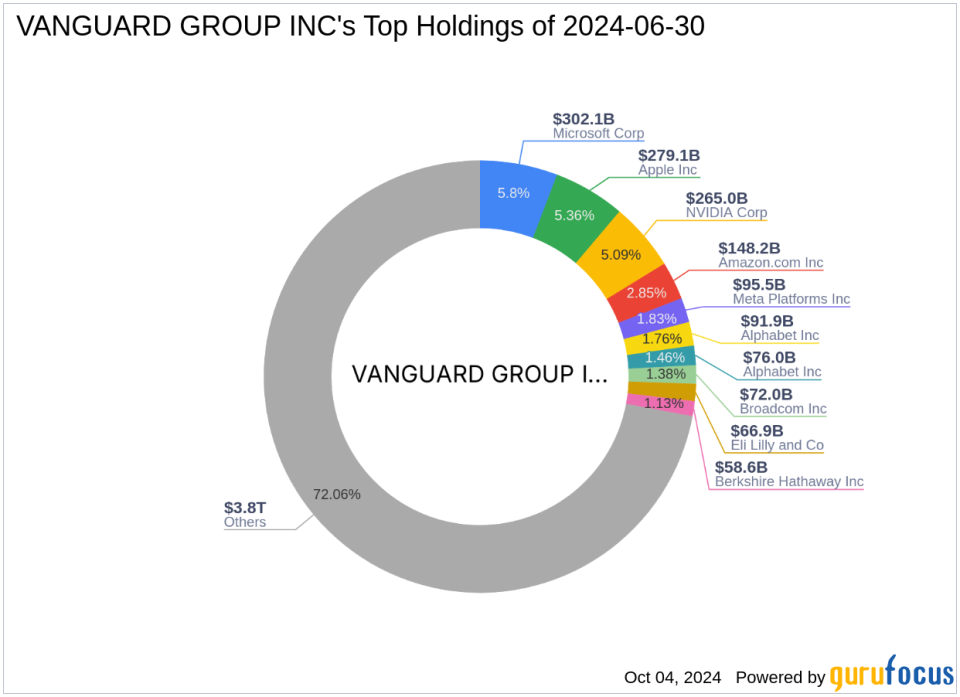

Profile of Vanguard Group Inc

Founded in 1975 by John C. Bogle, Vanguard Group Inc has grown into a premier mutual funds company with a unique client-owned structure. This structure allows Vanguard to focus on reducing costs and maximizing returns for its investors. Known for its pioneering role in creating index mutual funds, Vanguard continues to lead with cost-efficient investment solutions across a broad spectrum of asset classes. Vanguard's global presence and commitment to investor success have helped it manage over $5.2 trillion in assets worldwide.

Introduction to FTAI Aviation Ltd

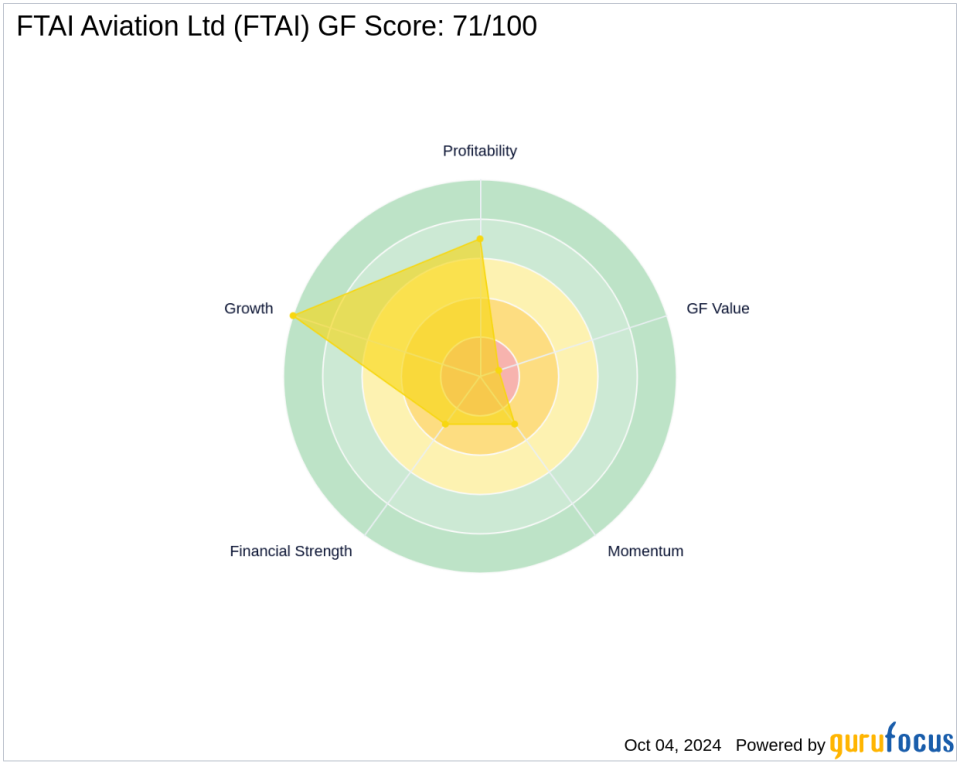

FTAI Aviation Ltd, established with its IPO in 2015, operates in the aerospace industry, focusing on the leasing and maintenance of commercial jet engines and aircraft. With a market capitalization of $14.28 billion, FTAI has been recognized for its robust business model that leverages stable cash flows from aviation assets to drive growth and asset appreciation. Despite its significant market presence, the company's current financial metrics indicate challenges, as reflected in its GF Value and profitability indicators.

Analysis of the Transaction's Impact

The recent acquisition by Vanguard is poised to have a dual impact. Firstly, it increases Vanguard's influence in FTAI, aligning with its strategy to invest in high-potential sectors like aerospace. Secondly, this move could signal to the market a positive endorsement of FTAI's future prospects, potentially influencing other investors' perceptions and the stock's market performance.

Market Context and Stock Valuation

FTAI's stock is currently priced at $139.69, which is significantly above its GF Value of $62.68, indicating that the stock is currently overvalued. This valuation suggests caution, as the price exceeds the intrinsic value calculated based on historical performance and future business estimates.

Performance Metrics and Rankings

FTAI's GF Score of 71 indicates an average performance potential. The company has a high Growth Rank of 10/10 but scores low in Financial Strength and Momentum Rank, which could be areas of concern for potential investors.

Sector and Industry Analysis

Vanguard's top sectors include Technology and Financial Services, with Business Services, where FTAI operates, also being a significant area of focus. This sector alignment suggests that Vanguard's investment in FTAI is strategic, aiming to capitalize on the growth potential within the aerospace and business services industries.

Other Significant Investors

Notably, First Eagle Investment (Trades, Portfolio) Management, LLC, along with other investors like Mario Gabelli (Trades, Portfolio) and Jefferies Group (Trades, Portfolio), also hold significant stakes in FTAI. This collective interest from prominent investment firms could be indicative of FTAI's strong investment appeal in the market.

In conclusion, Vanguard's recent acquisition of FTAI shares is a strategic move that aligns with its broader investment philosophy and sector focus. While the current stock valuation suggests a cautious approach, the involvement of significant investors and positive growth metrics provide a balanced view of FTAI's investment potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.