Vanguard Group Inc's Strategic Acquisition of Cable One Inc Shares

Overview of Vanguard's Recent Transaction

On August 30, 2024, Vanguard Group Inc made a notable addition to its investment portfolio by acquiring 566,103 shares of Cable One Inc (NYSE:CABO). This transaction, executed at a price of $352.72 per share, reflects a strategic move by the firm, although it did not significantly alter the overall composition of Vanguard's extensive portfolio. The shares acquired represent a 10.07% position in Cable One within Vanguard's holdings, underscoring a substantial commitment to this specific asset.

Insight into Vanguard Group Inc

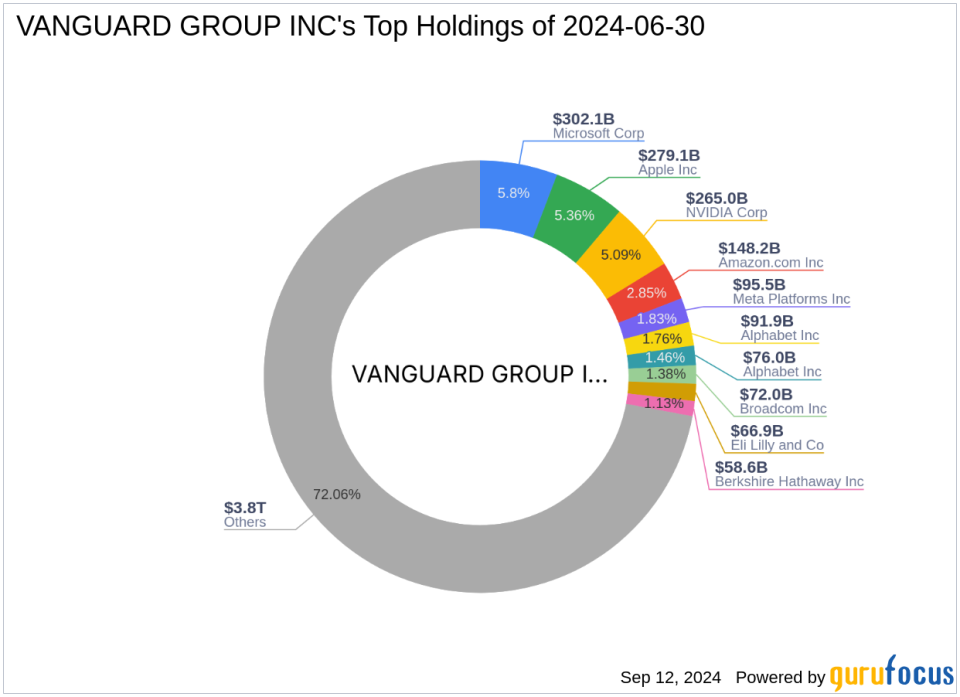

Founded in 1975 by John C. Bogle, Vanguard Group Inc has grown into a leading global investment firm, renowned for its low-cost mutual funds and ETFs. The firm's investment philosophy centers on providing high-value, low-cost investment opportunities to its clients, which now number over 20 million worldwide. Vanguard's strategy of reducing shareholder costs and expanding its product offerings has positioned it as a pivotal player in the investment community. The firm's top holdings include giants like Apple Inc (NASDAQ:AAPL) and Microsoft Corp (NASDAQ:MSFT), with a strong inclination towards technology and financial services sectors.

Cable One Inc at a Glance

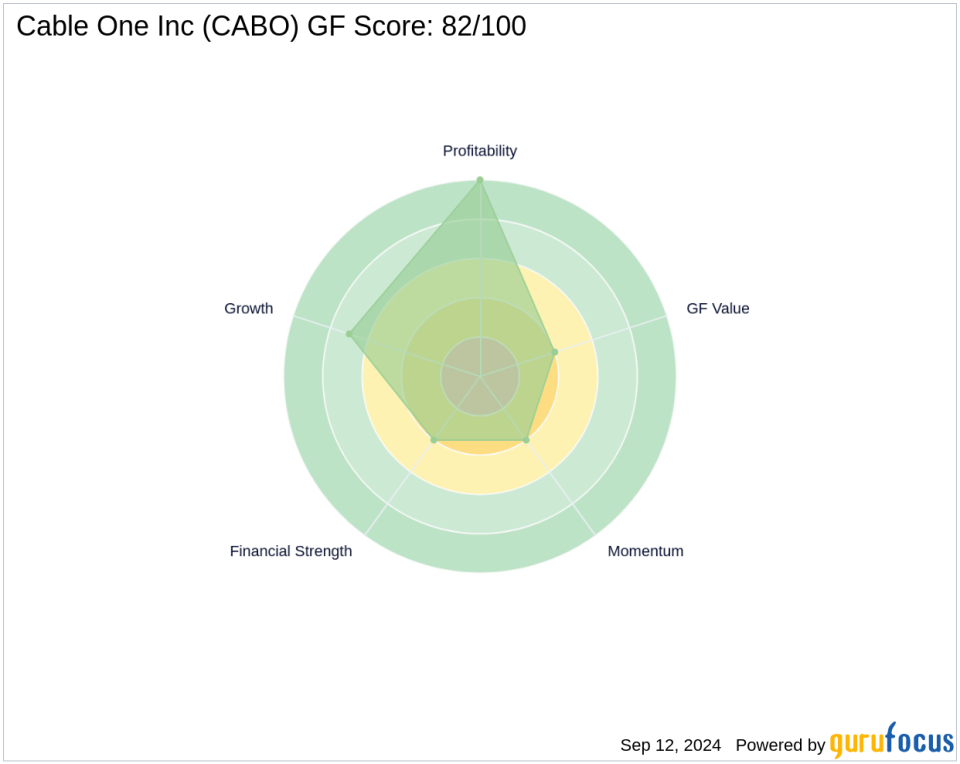

Cable One Inc, a key player in the telecommunications sector, primarily generates revenue through broadband, voice, and video services. With a market capitalization of $1.77 billion and a diverse range of services, Cable One has established a robust business model. The company's financial health is reflected in its high Profitability Rank and consistent revenue growth, making it a significant entity in the telecommunications industry.

Impact of Vanguard's Investment in Cable One

The recent acquisition by Vanguard does not markedly shift the firm's overall investment strategy but reinforces its commitment to diversifying into stable telecommunications assets. Despite the substantial number of shares purchased, this move aligns with Vanguard's broader portfolio objectives, focusing on sectors that promise sustainable growth and stability.

Market Performance and Sector Analysis

Cable One's current market valuation and its performance metrics such as a PE ratio of 7.41 indicate a challenging market perception, labeled as a "Possible Value Trap" by GuruFocus. The telecommunications sector, while stable, presents unique challenges and opportunities which Vanguard seems prepared to navigate given its strategic asset allocation.

Implications for the Market and Other Investors

Vanguard's investment in Cable One could signal a bullish outlook on the telecommunications sector, potentially influencing other investors to reevaluate their positions in similar stocks. This move might also hint at Vanguard's confidence in Cable One's long-term growth prospects despite current market undervaluations.

Concluding Thoughts on Vanguard's Strategic Move

Vanguard Group Inc's acquisition of Cable One shares is a calculated addition to its diverse and expansive portfolio. While the immediate impact on Vanguard's overall strategy appears minimal, the long-term implications could be more pronounced, especially if Cable One navigates its market challenges successfully. Investors and market watchers will undoubtedly keep a close eye on how this investment plays out in the evolving telecommunications landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.