US Rig Count Rises: Should Investors Watch EOG & MTDR Stocks?

In its weekly release, Baker Hughes Company BKR stated that the U.S. rig count was higher than the prior week’s figure. The rotary rig count, issued by BKR, is usually published in major newspapers and trade publications.

Baker Hughes’ data, issued at the end of every week since 1944, helps energy service providers gauge the overall business environment of the oil and gas industry. The number of active rigs and its comparison with the week-ago figure indicates the demand trajectory for the company’s oilfield services from exploration and production companies.

Amid an increasing weekly rig count, should investors keep an eye on leading oil and gas exploration companies like EOG Resources Inc. EOG and Matador Resources MTDR? Before diving into that, let's explore the latest rig count data details.

Baker Hughes’ Data: Rig Count in Detail

Total U.S. Rig Count Rises: The number of rigs engaged in the exploration and production of oil and natural gas in the United States was 590 in the week ended Sept. 13, higher than theweek-ago count of 582. However, the current national rig count declined from the year-ago level of 641, reflecting the fact that there has been a slowdown in drilling activities. Some analysts see this downside as a sign of increased efficiency among shale producers, who may need fewer rigs. However, there are doubts among a few about whether certain producers have sufficient promising land for drilling.

Onshore rigs in the week that ended on Sept. 13 totaled 568, higher than the prior week's count of 562. In offshore resources, 21 rigs were operating, an increase from the week-ago count of 19.

U.S. Oil Rig Count Rises: The oil rig count was 488 in the week ending Sept. 13, which was higher than the week-ago figure of 483. The current number of oil rigs — far from the peak of 1,609 attained in October 2014 — was, however, down from the year-ago figure of 515.

U.S. Natural Gas Rig Count Increases: The natural gas rig count of 97 was higher than the week-ago figure of 94. The count of rigs exploring the commodity was, however, below the year-ago week’s tally of 121. Per the latest report, the number of natural gas-directed rigs is 94% lower than the all-time high of 1,606 recorded in 2008.

Rig Count by Type: The number of vertical drilling rigs totaled 15 units, increasing from the week-ago count of 14. The horizontal/directional rig count (encompassing new drilling technology with the ability to drill and extract gas from dense rock formations, also known as shale formations) of 575 was higher than the prior-week level of 568.

Rig Tally in the Most Prolific Basin

Permian — the most prolific basin in the United States — recorded a weekly oil and gas rig count of 306, in line with the week-ago figure. The count was, however, below the prior-year level of 322.

Handsome Oil Prices Offer Incentives: EOG, MTDR to Gain

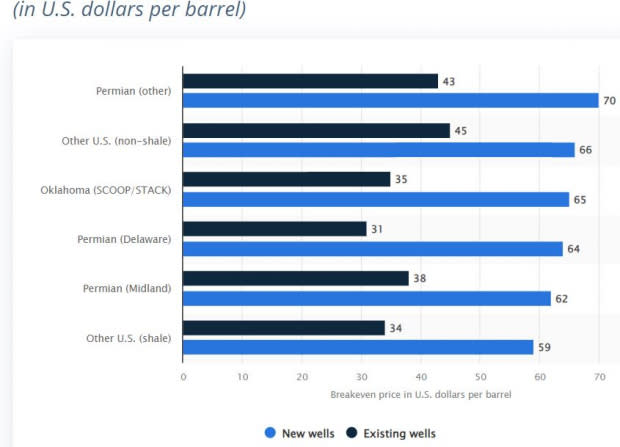

The West Texas Intermediate (WTI) crude price is trading close to $70 per barrel, which remains favorable for exploration and production activities. Despite a slowdown in drilling due to upstream companies focusing on stockholder returns over increasing output, the handsome oil pricing environment benefits upstream energy companies. This is because the breakeven WTI price for U.S. oil and gas producers is significantly lower for existing wells across all shale plays in the United States, as shown in the image below. Additionally, for most new wells, the average breakeven WTI price remains below the current market price.

Breakeven WTI Price for U.S. Producers

Image Source: Statista

The increasing rig count in U.S. oil and gas resources, driven by handsome crude prices, indicates profitable opportunities for companies in the oil and gas exploration and production space. As global consumption continues to exceed production and oil inventories dwindle, the crude pricing outlook is expected to remain advantageous.

Thus, EOG Resources and Matador Resources stand out as companies to watch, as they are well-positioned to benefit from a supportive commodity pricing environment.

In the United States, EOG Resources is one of the foremost explorers and producers of oil and gas, with its crude reserves spanning across the United States and Trinidad. The company, carrying a Zacks Rank #3 (Hold), possesses an extensive inventory of high-quality drilling wells in low-cost, premium resources, ensuring a strong business outlook. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Matador Resources recently entered into a $1.91 billion agreement to expand its footprint in the prolific Delaware Basin. With the deal expected to close in the late third quarter of 2024, the #3 Ranked company is projected to have more than 190,000 net acres in the Delaware Basin on a pro forma basis. Consequently, the company estimates that its production will exceed 180,000 barrels of oil equivalent per day, positioning it for significant growth and enhanced operational scale.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report