US Growth Companies With High Insider Ownership

As the major U.S. indexes gain momentum, driven by strong earnings reports from chipmakers and optimism around China's economic stimulus measures, investors are increasingly focused on identifying robust growth opportunities. In this favorable market environment, companies with high insider ownership often signal confidence in their long-term prospects, making them compelling candidates for growth-oriented portfolios.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

Hims & Hers Health (NYSE:HIMS) | 13.8% | 40.7% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 95% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

Underneath we present a selection of stocks filtered out by our screen.

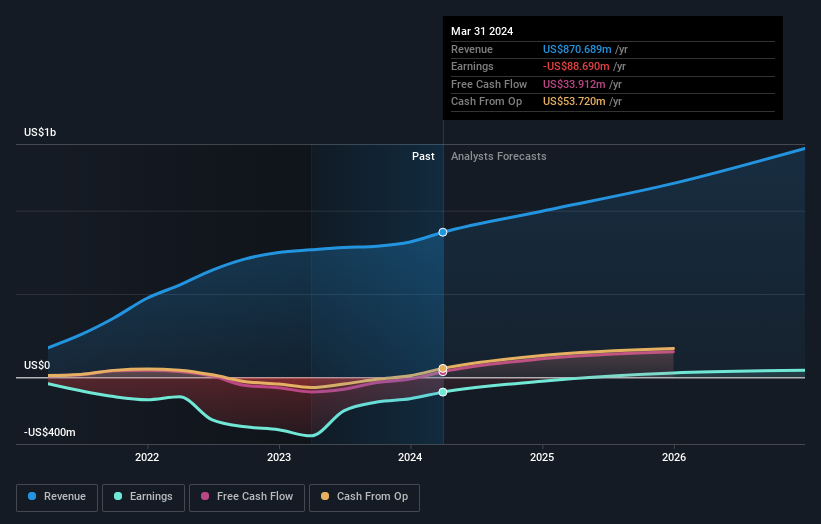

Pagaya Technologies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pagaya Technologies Ltd. is a technology company that uses data science and proprietary AI-powered technology to serve financial institutions and investors globally, with a market cap of $859.63 million.

Operations: Pagaya Technologies Ltd. generates revenue of $925.42 million from its Software & Programming segment.

Insider Ownership: 19.7%

Pagaya Technologies is a growth company with high insider ownership, forecasted to achieve profitability within three years and expected to see annual revenue growth of 15%, outpacing the US market. Despite recent shareholder dilution and a highly volatile share price, it trades at 67.5% below its estimated fair value. Recent executive changes aim to strengthen investor relations and risk management, while new partnerships and funding agreements bolster its financial position.

Taboola.com

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across Israel, the United States, the United Kingdom, Germany, and internationally with a market cap of $1.07 billion.

Operations: Advertising contributes $1.62 billion to the company's revenue segments.

Insider Ownership: 13.3%

Taboola.com, with significant insider ownership, is forecasted to achieve profitability within three years and expected to see annual revenue growth of 14%, outpacing the US market. Recent product innovations like Maximize Conversions have driven a 100% increase in campaign launches in Q2 2024. Despite substantial insider selling over the past three months, it trades at 78% below its estimated fair value and analysts project a potential price increase of 71.3%.

Dive into the specifics of Taboola.com here with our thorough growth forecast report.

Upon reviewing our latest valuation report, Taboola.com's share price might be too pessimistic.

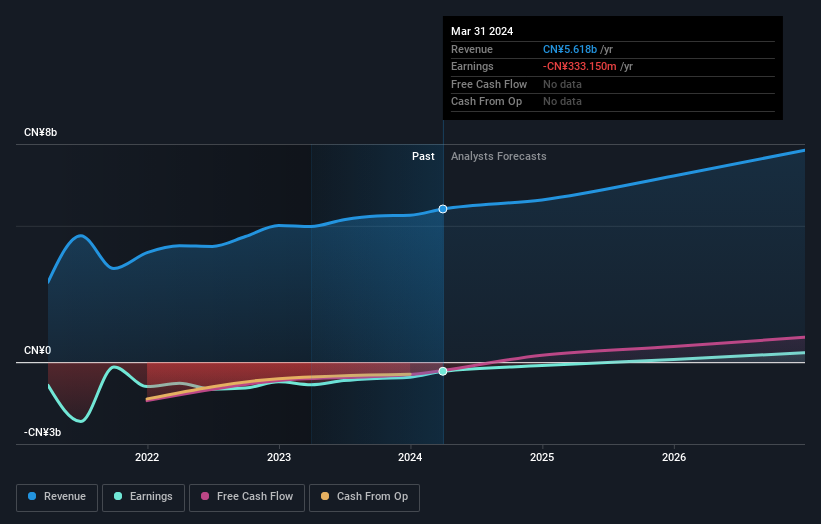

Youdao

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Youdao, Inc. is an internet technology company offering online services in content, community, communication, and commerce in China with a market cap of $388.44 million.

Operations: The company's revenue segments include Smart Devices (CN¥822.21 million), Learning Services (CN¥3.10 billion), and Online Marketing Services (CN¥1.81 billion).

Insider Ownership: 20.3%

Youdao, Inc. showcases high insider ownership and is expected to become profitable within three years. The company reported second-quarter revenue of CNY 1.32 billion, a year-over-year increase, while reducing its net loss significantly. Recent innovations include the Youdao Dictionary Pen X7 and other AI-driven educational tools, highlighting robust product development. Despite being dropped from the S&P Global BMI Index recently, it trades at 91% below its estimated fair value and has completed a significant share buyback program worth $33.8 million.

Make It Happen

Explore the 180 names from our Fast Growing US Companies With High Insider Ownership screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:PGY NasdaqGS:TBLA and NYSE:DAO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com