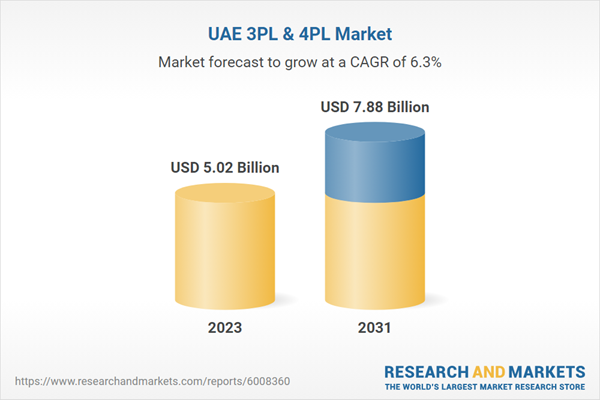

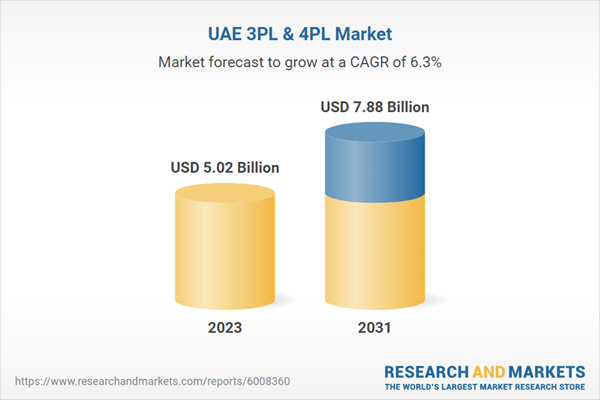

UAE 3PL & 4PL Market Opportunity Analysis and Forecasts 2024-2031 with Aramex, DHL, and FedEx Dominating the $7.88 Billion Industry

UAE 3PL & 4PL Market

Dublin, Oct. 07, 2024 (GLOBE NEWSWIRE) -- The "UAE 3PL & 4PL Market, By Services, By Customer Type, By Mode of Transport, By End Use, By Region - Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024-2031" report has been added to ResearchAndMarkets.com's offering.

The UAE 3PL & 4PL market is projected to grow from USD 5.03 billion in 2023 to USD 7.88 billion by 2031, reflecting a CAGR of 5.8%.

As a major logistics hub in the Middle East, the UAE plays a pivotal role in connecting global markets, particularly with Europe, Asia, and Africa. The demand for 3PL services is rising as businesses seek to outsource their logistics operations to improve efficiency and reduce costs. 4PL providers, which offer end-to-end supply chain management solutions, are also gaining popularity due to the increasing complexity of global supply chains.

The 3PL & 4PL market is characterized by a vigorous competitive landscape, with prominent entities like Aramex, DHL Supply Chain, DSV Solutions PJSC, FedEx Supply Chain, Kuehne+Nagel, Maersk, CMA CGM group, DP World and Other Players. at the forefront, collectively accounting for more than 40% of the overall market share. This competitive milieu is fueled by their intensive efforts in research and development as well as strategic partnerships and collaborations, underscoring their commitment to solidifying market presence and diversifying their offerings.

The primary competitive factors include pricing, product caliber, and technological innovation. As the 3PL & 4PL industry continues to expand, the competitive fervor among these key players is anticipated to intensify. The impetus for ongoing innovation and alignment with evolving customer preferences and stringent regulations is high. The industry's fluidity anticipates an uptick in novel innovations and strategic growth tactics from these leading corporations, which in turn propels the sector's comprehensive growth and transformation.

Government initiatives, such as investments in infrastructure and logistics technology, are further fueling the market. Additionally, the growth of e-commerce, retail, and manufacturing sectors in the UAE has led to a surge in demand for advanced logistics services. The market is expected to witness continued expansion, with an increasing focus on innovation, automation, and sustainability in logistics operations.

Growth Influencers:

The UAE is undergoing a significant transformation in its logistics and warehousing sector, propelled by strategic initiatives and technological advancements. The government actively promotes trade and economic diversification through initiatives like EXPO 2020, free trade agreements, and updated foreign ownership regulations. The establishment of free zones near key transportation hubs aims to attract foreign investment and bolster manufacturing.

Technological innovations, including the Dubai IoT Strategy, Blockchain Strategy, and the UAE National AI Programme, are set to enhance the logistics landscape, with initiatives like drone delivery and Smart Dubai 2021 driving efficiency. The Abu Dhabi Advanced Trade and Logistics Platform (ATLP) is a pioneering project that integrates public and private sector services, streamlining trade facilitation.

China remains a vital trading partner, with bilateral trade projected to exceed $70 billion, supported by enhanced port infrastructure at Khalifa and Jebel Ali. The growth of 3PL and 4PL alliances is critical in this landscape, facilitating exports and expanding market access. With a robust GDP growth rate of 7.4% in 2022, the UAE's logistics sector is increasingly essential for supporting its diversified economy.

Report Insights:

The transportation segment is the largest in the market, fueled by the UAE's advanced infrastructure and increased trade volumes from free trade agreements.

The rise of e-commerce and consumer demand for online shopping is driving the growth of the B2C segment, necessitating efficient logistics for last-mile deliveries.

Major players like Aramex, DHL, and FedEx dominate the market, collectively holding over 40% of the market share, driving innovation and competitive pricing.

Questions to be Answered:

What is the estimated growth rate of the 3PL & 4PL market?

What are the key drivers and potential restraints?

Which market segments are expected to witness significant growth?

Who are the leading players in the market?

Key Attributes:

Report Attribute | Details |

No. of Pages | 210 |

Forecast Period | 2023 - 2031 |

Estimated Market Value (USD) in 2023 | $5.02 Billion |

Forecasted Market Value (USD) by 2031 | $7.88 Billion |

Compound Annual Growth Rate | 6.3% |

Regions Covered | United Arab Emirates |

Companies Featured

Agility

Aramex

AZ Logistic

DB Schenker

DHL Supply Chain

DSV Solutions PJSC

FedEx Supply Chain

GAC Logistics

Global Shipping & Logistics (GSL)

Hellmann Worldwide Logistics

HND Logistics

Kuehne+Nagel

Logisti

Maersk

RSA Logistics

Safe Arrival

SAG Logistic

STS Group

Swift Freight

Time Global Shipping

Total Freight International (TFI)

Verks Global Logistics (VGL)

Segment Overview:

By Services

Procurement

Contract Software/ Systems

Storage

Public warehousing

Contract warehousing

Specialist storage

High-security storage

Value-Added Warehousing

Order fulfilment

Dedicated Contract Carriage (DCC)

Transportation

Domestic Transportation Management

International Transportation Management

Drayage

Cross-Docking

Intermodal Transport

Drop Deck and Lowboy Transport

Other

Other Services

Freight Forwarding

Reverse Logistics

Environmentally Controlled Freight

Consolidation and Deconsolidation

By Customer Type

B2B

LSP (Logistics Service Providers)

Carriers

CEP (Courier/Express/Parcel)

B2C

CEP (Courier/Express/Parcel)

By Mode of Transport

Railways

Waterways

Roadways

LTL

FTL

Express

Airways

By End Use

Industrial

Automotive

Heavy Industry

Agriculture

Food & Beverage

Paper & Pulp

Chemicals

Others

Commercial

Post & parcel

Retail

Ecommerce

Packers & Movers

Enterprises

Consumers

Relocation & Shifting

Vehicle Movement

For more information about this report visit https://www.researchandmarkets.com/r/3zpm6b

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900