Top US Growth Companies With High Insider Ownership In September 2024

As the U.S. stock market wraps up its best week of 2024, driven by strong performances in major indices like the S&P 500 and Nasdaq Composite, investors are keenly watching for the Federal Reserve's upcoming decision on interest rates. In this bullish environment, growth companies with high insider ownership often stand out as attractive options due to their potential for robust performance and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 27.1% |

Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 94.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

We'll examine a selection from our screener results.

PDF Solutions

Simply Wall St Growth Rating: ★★★★★☆

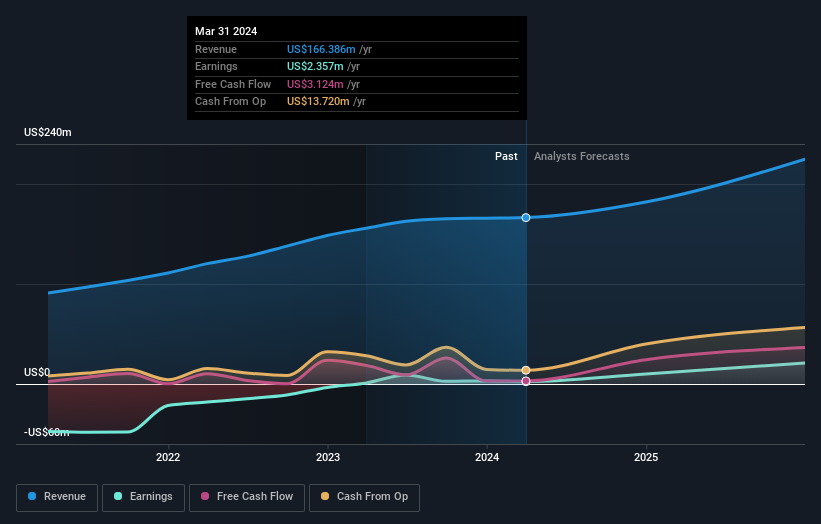

Overview: PDF Solutions, Inc. offers proprietary software, physical intellectual property products for integrated circuit designs, electrical measurement hardware tools, methodologies, and professional services globally with a market cap of $1.14 billion.

Operations: Revenue from the Software & Programming segment amounted to $166.45 million.

Insider Ownership: 17.5%

Earnings Growth Forecast: 136.5% p.a.

PDF Solutions, Inc. demonstrates strong growth potential with revenue forecasted to grow faster than both the market and its historical performance, at 21% per year. Despite a recent dip in net income for Q2 2024 (US$1.71 million compared to US$6.84 million a year ago), the company maintains positive momentum by reiterating revenue guidance with an expected 20% growth in H2 2024. Insider ownership remains significant, aligning management interests with shareholders and supporting long-term value creation.

Fiverr International

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fiverr International Ltd. operates a global online marketplace with a market cap of $893.09 million (NYSE:FVRR).

Operations: Fiverr generates $372.22 million in revenue from its Internet Software & Services segment.

Insider Ownership: 13.9%

Earnings Growth Forecast: 42.9% p.a.

Fiverr International has shown strong growth potential, with earnings forecasted to grow significantly at 42.9% per year, outpacing the US market. Recent buyback activity saw the company repurchase 4.45 million shares for $100 million, indicating confidence in its value. Q2 2024 results revealed a substantial increase in net income to $3.27 million from $0.227 million a year ago. Insider ownership remains high, aligning management interests with shareholders and supporting long-term growth prospects.

Genius Sports

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genius Sports Limited develops and sells technology-driven products and services to the sports, sports betting, and sports media industries, with a market cap of approximately $1.62 billion.

Operations: The company's revenue segments include $444.07 million from Data Processing.

Insider Ownership: 11.9%

Earnings Growth Forecast: 76.3% p.a.

Genius Sports has high insider ownership and is forecasted to grow earnings by 76.32% annually, outpacing the US market. Despite recent net losses, revenue is expected to reach US$510 million in 2024. The launch of GeniusIQ highlights its innovative edge in sports data and AI, enhancing fan engagement and team performance. Recent board changes bring seasoned expertise, bolstering strategic direction. Analysts predict a 21.1% stock price rise, supporting its growth trajectory despite current undervaluation at 59.1%.

Summing It All Up

Embark on your investment journey to our 177 Fast Growing US Companies With High Insider Ownership selection here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:PDFS NYSE:FVRR and NYSE:GENI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com