Top German Dividend Stocks For October 2024

As of October 2024, the German market has been influenced by escalating Middle East tensions and a cautious investor sentiment, leading to a decline in major indices such as the DAX. Despite these challenges, dividend stocks remain an attractive option for investors seeking steady income streams, particularly in uncertain economic climates.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Edel SE KGaA (XTRA:EDL) | 6.73% | ★★★★★★ |

MLP (XTRA:MLP) | 5.01% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 5.53% | ★★★★★☆ |

OVB Holding (XTRA:O4B) | 4.71% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.52% | ★★★★★☆ |

Allianz (XTRA:ALV) | 4.70% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.33% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 9.30% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.28% | ★★★★★☆ |

MVV Energie (XTRA:MVV1) | 3.69% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top German Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

SIMONA

Simply Wall St Dividend Rating: ★★★★☆☆

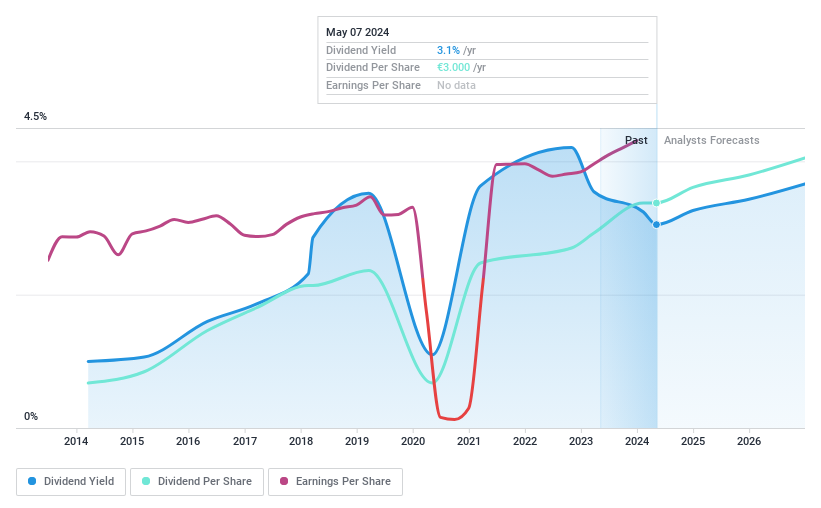

Overview: SIMONA Aktiengesellschaft is a company that develops, manufactures, and markets semi-finished thermoplastics, pipes, fittings, and profiles globally with a market cap of €384 million.

Operations: SIMONA generates revenue of €578.85 million from its segments, which include semi-finished plastics, pipes, fittings, and finished parts.

Dividend Yield: 3%

SIMONA's dividend sustainability is supported by a low payout ratio of 35.7% and cash payout ratio of 35%, indicating dividends are well-covered by earnings and cash flows. However, its 3.01% yield is below the top quartile in Germany, and dividends have been volatile over the past decade despite some growth. Recent earnings show improvement with net income rising to €13.24 million for H1 2024, suggesting potential stability in future payouts.

Click here to discover the nuances of SIMONA with our detailed analytical dividend report.

Upon reviewing our latest valuation report, SIMONA's share price might be too pessimistic.

Heidelberg Materials

Simply Wall St Dividend Rating: ★★★★☆☆

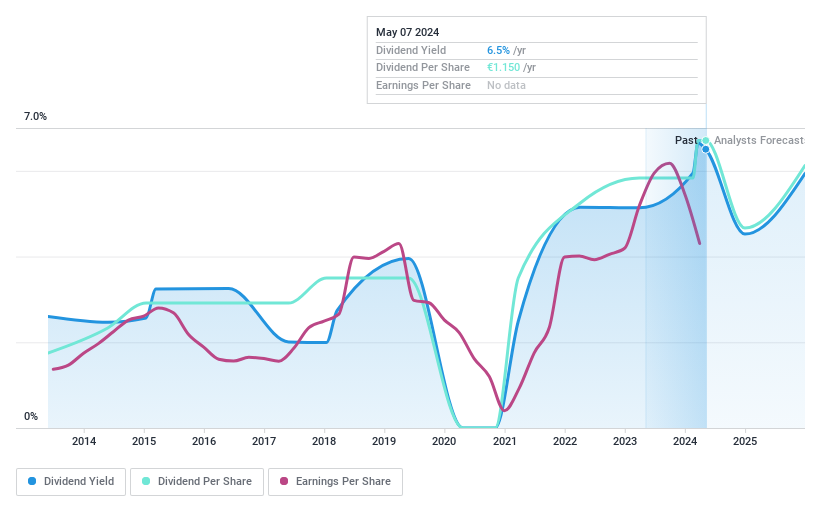

Overview: Heidelberg Materials AG is a global producer and distributor of cement, aggregates, ready-mixed concrete, and asphalt with a market cap of €17.72 billion.

Operations: Heidelberg Materials AG generates revenue from its primary segments, including €10.90 billion from cement, €4.92 billion from aggregates, and €5.71 billion from ready-mixed concrete and asphalt.

Dividend Yield: 3%

Heidelberg Materials' dividend yield of 3.03% is below the top quartile in Germany, with a history of volatility over the past decade. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios at 29.6% and 27.2%, respectively. The company recently completed a €154.5 million share buyback, which might indicate confidence in its financial position despite a decline in half-year earnings to €574.3 million from €718.7 million last year.

Wacker Neuson

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wacker Neuson SE manufactures and distributes light and compact equipment in Germany, Austria, the United States, and internationally, with a market cap of approximately €1.01 billion.

Operations: Wacker Neuson's revenue is derived from its Services segment (€502.60 million), Light Equipment (€480.20 million), and Compact Equipment (€1.53 billion).

Dividend Yield: 7.8%

Wacker Neuson's dividend yield of 7.76% ranks in the top quartile in Germany, but its dividends are not well-covered by free cash flows, reflecting a high cash payout ratio of 418.3%. Despite past volatility and a decrease in profit margins from 8% to 4.6%, dividends remain covered by earnings with a payout ratio of 68.3%. The stock trades at a favorable price-to-earnings ratio of 8.8x compared to the market average of 16.7x.

Get an in-depth perspective on Wacker Neuson's performance by reading our dividend report here.

Our valuation report unveils the possibility Wacker Neuson's shares may be trading at a discount.

Summing It All Up

Explore the 34 names from our Top German Dividend Stocks screener here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DB:SIM0 XTRA:HEI and XTRA:WAC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com