Top Dividend Stocks To Watch In US July 2024

As the U.S. stock market experiences a robust phase, marked by significant gains in major indices and a positive response to corporate earnings and economic indicators, investors are keenly observing opportunities for stable returns. In this context, dividend stocks emerge as appealing options for those looking to benefit from consistent income streams amidst the current market dynamics.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 6.46% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.43% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 5.40% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.96% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.42% | ★★★★★★ |

OTC Markets Group (OTCPK:OTCM) | 4.62% | ★★★★★★ |

Financial Institutions (NasdaqGS:FISI) | 5.64% | ★★★★★☆ |

Citizens & Northern (NasdaqCM:CZNC) | 5.75% | ★★★★★☆ |

Franklin Financial Services (NasdaqCM:FRAF) | 4.62% | ★★★★★☆ |

Southside Bancshares (NasdaqGS:SBSI) | 4.91% | ★★★★★☆ |

Click here to see the full list of 188 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Burke & Herbert Financial Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Burke & Herbert Financial Services Corp., with a market cap of approximately $775.66 million, serves as the holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland.

Operations: Burke & Herbert Financial Services Corp. generates its revenue primarily through community banking, with earnings of $107.52 million.

Dividend Yield: 3.8%

Burke & Herbert Financial Services has seen a 28.6% undervaluation against its fair value, with a stable dividend yield of 3.84%, though lower than the top US market payers at 4.6%. Dividend reliability is supported by a decade of consistent growth and stability, underpinned by sufficient earnings with a payout ratio of 77.3%. However, recent financials show declining profit margins from 33% to 19%, and shareholder dilution within the last year raises concerns about future sustainability.

C&F Financial

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: C&F Financial Corporation serves as the holding company for Citizens and Farmers Bank, offering banking services to individuals and businesses, with a market capitalization of approximately $156.14 million.

Operations: C&F Financial Corporation generates revenue through three primary segments: Community Banking at $86.97 million, Consumer Finance at $17.69 million, and Mortgage Banking at $10.96 million.

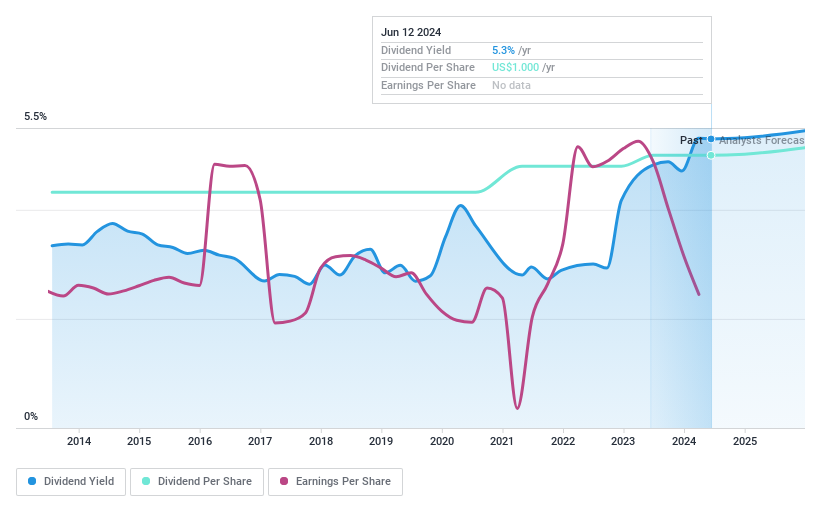

Dividend Yield: 3.5%

C&F Financial has demonstrated a stable dividend history with a recent declaration of US$0.44 per share, maintaining consistency despite being dropped from multiple Russell indexes on July 1, 2024. The company's dividends are well-supported by earnings, evidenced by a low payout ratio of 29%. However, its current yield of 3.55% trails the top quartile of U.S. dividend payers and recent financials indicate a downturn in net income and net interest income from the previous year.

Dime Community Bancshares

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dime Community Bancshares, Inc., serving as the holding company for Dime Community Bank, provides a range of commercial banking and financial services with a market capitalization of approximately $851.11 million.

Operations: Dime Community Bancshares generates revenue primarily through its community banking segment, which brought in $328.39 million.

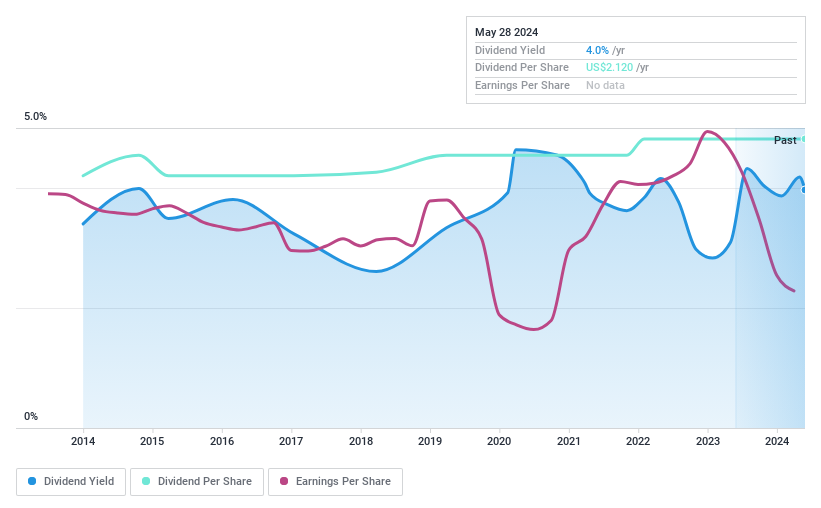

Dividend Yield: 4.3%

Dime Community Bancshares has been consistently paying dividends, with a recent quarterly payment of US$0.25 per share. Despite a reliable dividend history over the past decade, current profit margins have decreased to 20.7% from last year's 35.4%. The company is trading below its estimated fair value by 26.8%, suggesting potential undervaluation. Recent activities include issuing US$65 million in subordinated notes with an initial fixed rate of 9%, enhancing financial flexibility but increasing debt obligations.

Seize The Opportunity

Investigate our full lineup of 188 Top US Dividend Stocks right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:BHRB NasdaqGS:CFFI and NasdaqGS:DCOM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com