Is Tilray Brands Stock a Buy?

The global cannabis market, while currently out of favor with many investors, is projected to experience explosive growth in the coming years. Industry analysts forecast the market could reach $444 billion by 2030, representing a compound annual growth rate (CAGR) of 34.03% from 2023. This potential for rapid expansion might pique the interest of contrarian growth investors willing to weather near-term volatility for possible long-term gains.

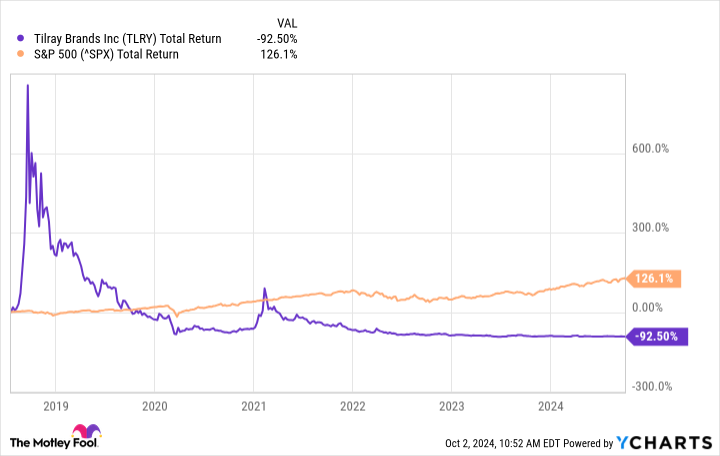

One company that stands out in this space is Tilray Brands (NASDAQ: TLRY). Once a high-flying darling of the cannabis industry, Tilray has seen its stock price plummet a staggering 92% since its 2018 initial public offering (IPO), significantly underperforming the S&P 500 over this period. This dramatic fall from grace has left many investors wary, but for those with a contrarian mindset, Tilray's current position could present an intriguing opportunity.

The company has undergone significant changes since its early days, diversifying its business model and making strategic acquisitions. Could Tilray capitalize on the anticipated growth in the cannabis market? Let's take a closer look at this embattled marijuana stock and its potential for a turnaround.

A diversified consumer goods powerhouse

Tilray Brands is evolving beyond its roots as a pure-play cannabis company. Through strategic acquisitions, Tilray has built a diverse portfolio spanning cannabis, craft beer, spirits, and wellness products.

The company's recent purchase of four craft breweries from Molson Coors strengthens its position as the fifth-largest craft brewer in the United States. This move expands Tilray's distribution network and adds popular brands to its lineup. In the cannabis space, Tilray holds the No. 1 market share in Canada's recreational market and leads in European medical cannabis.

The company's fiscal 2024 results showed promise, with net revenue growing 26% year over year to $789 million. The company also reduced its convertible debt by about $300 million. These efforts demonstrate management's commitment to growth and financial discipline.

Growing pains in an emerging market

Despite its diversification efforts, Tilray's core cannabis business is facing headwinds. The Canadian market remains crowded, limiting pricing power. While international medical markets offer higher margins, they require navigating complex regulations.

Tilray's alcohol division shows potential, but synergies between its various product lines have yet to materialize. The company's limited U.S. THC exposure also raises questions about its ability to capitalize on potential federal legalization.

Navigating the road to recovery

Tilray's strategy of becoming a global consumer packaged-goods company is ambitious. Its recent acquisitions and debt-reduction efforts show promise. However, the path to profitability remains challenging in the competitive cannabis landscape.

Investors should closely monitor Tilray's progress in integrating its acquisitions, expanding distribution, and improving margins across its product lines. The company's ability to leverage its diverse brand portfolio and create meaningful synergies will be crucial to its long-term success.

Is Tilray a buy for contrarian investors?

For contrarian investors with a high-risk tolerance and a long-term horizon, Tilray could present an intriguing opportunity. The company's diversification strategy, market leadership in key segments, and potential for growth in the expanding global cannabis market are compelling factors.

However, this investment comes with substantial risks. Tilray faces ongoing challenges in the crowded Canadian market, uncertain regulatory landscapes, and the need to prove it can generate meaningful synergies across its diverse product lines. The company's path to consistent profitability remains unclear.

Ultimately, whether Tilray is a buy depends on your risk appetite and belief in the company's ability to execute its ambitious strategy. Those who see potential in the cannabis industry's long-term growth and believe in Tilray's management team might find the current valuation attractive. However, more conservative investors may want to wait for clearer signs of sustainable profitability and successful integration of the company's acquisitions before considering a position.

As with any high-risk investment, a position in Tilray should be part of a well-diversified portfolio. Contrarian investors interested in the stock should be prepared for continued volatility and the possibility of further downside in the near term, even if they believe in the long-term potential of the company and the broader cannabis industry.

Should you invest $1,000 in Tilray Brands right now?

Before you buy stock in Tilray Brands, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tilray Brands wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

George Budwell has no position in any of the stocks mentioned. The Motley Fool recommends Tilray Brands. The Motley Fool has a disclosure policy.

Is Tilray Brands Stock a Buy? was originally published by The Motley Fool