Tesla Stock: Buy, Sell, or Hold?

If you believe Elon Musk, Tesla (NASDAQ: TSLA) is not an automaker anymore, it's an artificial intelligence (AI) and robotics company. That makes it much harder to assess the potential and value of the stock because there's very little in AI or robotics revenue at Tesla today.

Where is Tesla going, and should investors buy the stock? Let's break it down into components.

The EV business isn't what it once was

Tesla's business today is primarily selling electric vehicles (EVs) with an adjacent energy storage business. For the purpose of this article, I'm going to combine those two businesses and treat them as one.

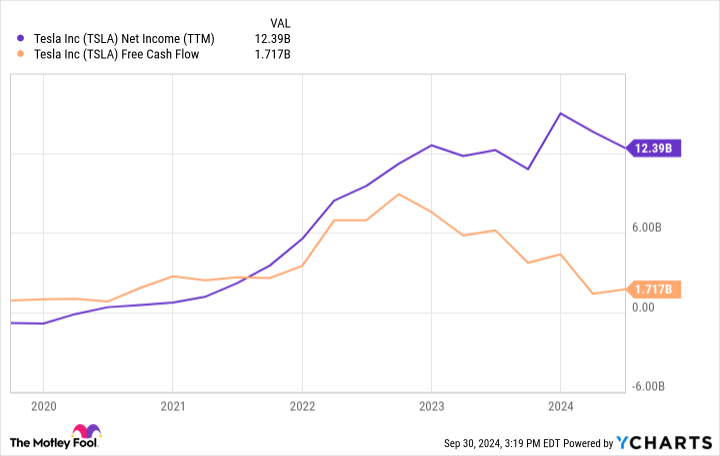

You can see that free cash flow is in decline and so is net income if you pull out the $5.9 billion benefit from deferred tax assets recorded in the fourth quarter of 2024.

The reason net income is declining is pretty simple. Tesla was able to raise prices -- and, in turn, its margins -- during the pandemic when the entire industry was in short supply, but it has had to cut prices over the past two years. That will show up in lower margins.

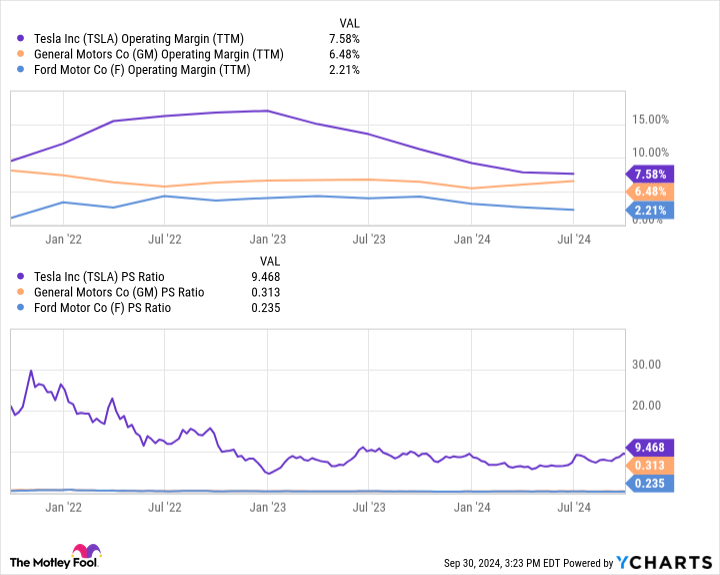

Margins are falling, and you can see below that they are now only slightly better than GM (NYSE: GM) and Ford (NYSE: F), despite the EV maker's stock trading for 30 times more on the basis of its price-to-sales ratio (P/S). And remember: Tesla's deliveries and revenue are falling, too.

So the market must be putting a lot of value on AI and robotics.

AI and Tesla's FSD strategy

We know Tesla has been selling Autopilot since 2014 and its Full Self-Driving (FSD) feature -- automated driving that requires human supervision -- since 2020. What we don't know is the adoption rate or anything about the option's margins. For now, it's folded into the auto business.

Third-party estimates have the rate of adoption at 2%, although Elon Musk said it was "much higher," without elaborating. If we assume the adoption rate is 5% on 2 million vehicles sold per year, it could add $120 million per year in incremental revenue at the current price of $99 per month. That's nice, but it doesn't move the needle much for an $832 billion company.

The vision is for FSD to ultimately lead to a fleet of autonomous vehicles. They would be owned by Tesla buyers, who would then pay Tesla for FSD and earn money when they make their cars available as robotaxis.

The reality is, FSD isn't able to legally drive a vehicle by itself anywhere in the world today, and it's likely to be years before Tesla gets a license to operate any kind of autonomous fleet. Even after that happens, the economics of this business model is unclear.

The market clearly likes the robotaxi idea, but I don't see how there's a clear path to cash flow given its FSD must be supervised today and doesn't have a path to full autonomy.

The robotics business

Robots are the other piece of the business that's extremely unclear. There's a humanoid robot under development, but what is market for such a product?

Again, investors are being asked to put a lot of value on a product that doesn't yet exist, with an unclear market fit.

Tesla's stock is not a buy today

Tesla is currently trading for 9 times sales and 73 times trailing earnings. Looking forward, the stock is trading for 93 times analyst estimates for next year's earnings.

That's an incredibly high multiple to pay for a company with a declining core and very high-risk new products in AI and robotics.

I don't think the risk is worth taking, and that's why I think the stock is a sell today.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Travis Hoium has positions in General Motors. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

Tesla Stock: Buy, Sell, or Hold? was originally published by The Motley Fool