September 2024 US Growth Companies With High Insider Ownership

As the S&P 500 and Dow Jones Industrial Average reach record highs, driven by Nvidia's surge and China's new stimulus plan, investor optimism is palpable. In this buoyant market environment, identifying growth companies with high insider ownership can be particularly rewarding as such stocks often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

Hims & Hers Health (NYSE:HIMS) | 13.8% | 40.7% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 95% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

Here's a peek at a few of the choices from the screener.

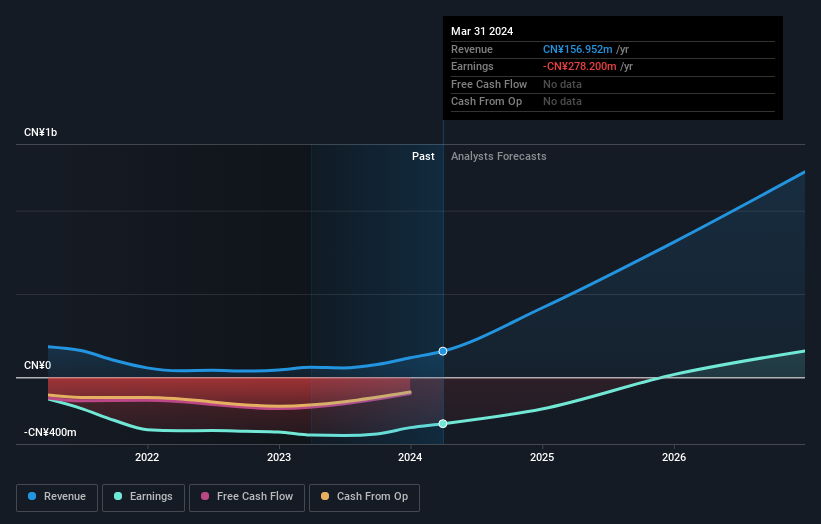

EHang Holdings

Simply Wall St Growth Rating: ★★★★★★

Overview: EHang Holdings Limited is an autonomous aerial vehicle technology platform company operating in China, East Asia, West Asia, Europe, and internationally with a market cap of $744.87 million.

Operations: The company generates revenue primarily from its Aerospace & Defense segment, which amounted to CN¥248.97 million.

Insider Ownership: 32.8%

Earnings Growth Forecast: 81.4% p.a.

EHang Holdings, a growth company with high insider ownership, recently obtained an Experimental Flight Authorization Certificate in Brazil for its EH216-S pilotless eVTOL aircraft. The company reported significant revenue growth from CNY 10.01 million to CNY 102.02 million year-over-year for Q2 2024 while reducing net losses. Forecasts indicate continued strong revenue growth at 38% annually and profitability within three years, bolstered by strategic partnerships and international regulatory advancements.

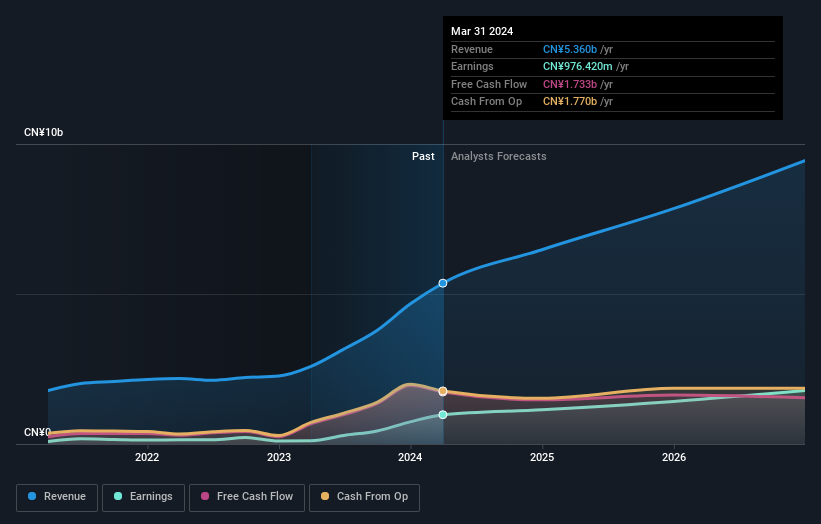

Atour Lifestyle Holdings

Simply Wall St Growth Rating: ★★★★★★

Overview: Atour Lifestyle Holdings Limited, with a market cap of $2.93 billion, develops lifestyle brands centered around hotel offerings in the People’s Republic of China through its subsidiaries.

Operations: Atour Lifestyle Holdings generates revenue primarily from its Atour Group segment, which amounted to CN¥6.06 billion.

Insider Ownership: 26%

Earnings Growth Forecast: 23.2% p.a.

Atour Lifestyle Holdings, with substantial insider ownership, reported strong financial performance for Q2 2024. Revenue surged to CNY 1.80 billion from CNY 1.09 billion year-over-year, and net income increased to CNY 303.65 million from CNY 238.19 million. Forecasts predict annual revenue growth of over 20% and earnings growth of over 23%, outpacing the US market average. Analysts expect the stock price to rise by approximately 21%.

TAL Education Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: TAL Education Group offers K-12 after-school tutoring services in the People's Republic of China and has a market cap of approximately $4.89 billion.

Operations: The company generates revenue primarily from its after-school tutoring services, amounting to approximately $1.63 billion.

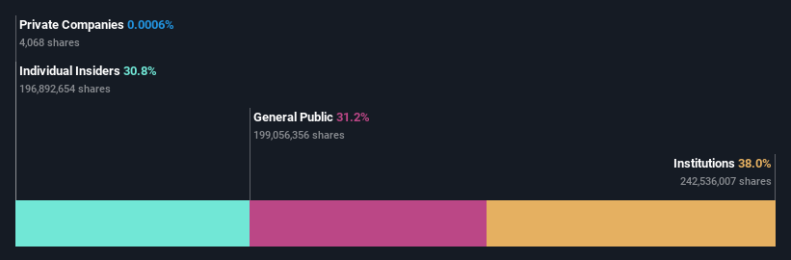

Insider Ownership: 31.7%

Earnings Growth Forecast: 32.9% p.a.

TAL Education Group, with significant insider ownership, has shown strong financial performance. For Q1 2024, sales increased to US$414.19 million from US$275.44 million year-over-year, and net income reached US$11.4 million compared to a net loss of US$45.04 million previously. Revenue is forecast to grow at 20.4% annually, outpacing the market average of 8.7%. Despite trading at 58.5% below its estimated fair value, its Return on Equity is projected to be low at 6.2% in three years.

Next Steps

Click this link to deep-dive into the 179 companies within our Fast Growing US Companies With High Insider Ownership screener.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:EH NasdaqGS:ATAT and NYSE:TAL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com