SAP Reportedly Faces Expanded DOJ Probe for Alleged Price Fixing

SAP SE SAP is facing an intensified investigation by U.S. prosecutors for possible price-fixing alongside Carahsoft Technology Corp. The investigation now includes their work with almost 100 government agencies, as revealed in a Bloomberg report.

Citing federal court records filed in Baltimore, Bloomberg added the Justice Department has issued a legal demand to Carahsoft for documents related to its dealings with 94 civilian government agencies relating to SAP products. Earlier, Carahsoft refused to provide records pertaining to the Department of Agriculture, Department of Labor, Office of Personnel Management and the Centers for Disease Control and Prevention in June 2022. The broader scope of the civil case became public through a lawsuit filed by prosecutors against Carahsoft in 2023, focusing on how the company mishandled the government's request for documents from the previous year, added Bloomberg.

A SAP spokesperson was quoted by Bloomberg stating that both the company and its U.S.-based unit, SAP National Security Services, Inc., received document demands from the Justice Department in August 2022 and have been fully cooperating in the ongoing civil investigation.

SAP SE Price and Consensus

SAP SE price-consensus-chart | SAP SE Quote

SAP and Carahsoft Technologies have been under investigation by U.S. officials for allegedly colluding to overcharge U.S. government agencies. The investigation stems from concerns that since 2022, SAP may have conspired with Carahsoft to fix prices on sales to military and various U.S. government entities, per an earlier Bloomberg report.

As part of this inquiry, the FBI and military investigators have conducted raids on Carahsoft’s offices in Virginia. The Department of Justice’s (“DOJ”) focus is primarily on the potential manipulation of the market for more than $2 billion in SAP technology purchased by the U.S. government in the past decade.

Furthermore, the probe is examining the involvement of a segment of Accenture and other software resellers in this potential price-fixing scheme. In this context, Accenture stated in regulatory filings that Accenture Federal Services made a voluntary disclosure to the U.S. government, which has prompted a civil and criminal investigation into whether one or more employees submitted inaccurate information regarding the company’s offerings, as reported by Bloomberg.

Headquartered in Walldorf, Germany, SAP is one of the largest independent software vendors in the world and the leading provider of enterprise resource planning (ERP) software. SAP’s performance is cushioned by momentum in its cloud business, especially rising demand for the Rise with SAP and Grow with SAP solutions.

SAP reported total revenues of €8.288 billion ($8.921 billion) on a non-IFRS basis, bolstered by solid growth in its cloud business. This figure represents a 10% increase year over year in both nominal and constant currencies for the most recent quarter. However, weakness in the software license and support business segment and rising costs due to the ongoing restructuring program are likely to weigh on SAP’s performance.

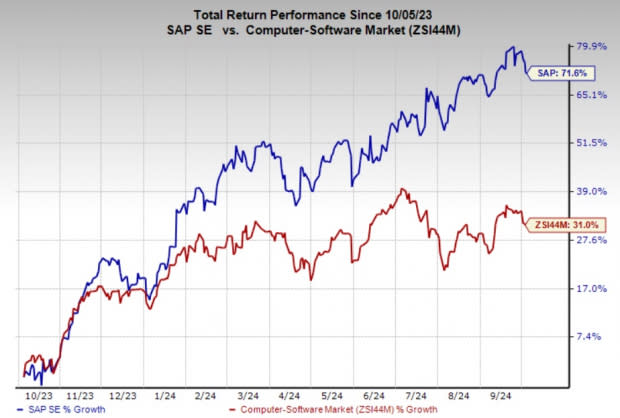

Image Source: Zacks Investment Research

This expansion of the probe underscores the serious legal risks both companies are facing. Following the development, SAP's shares declined 1.9% in the last trading session and closed at $220.47. Shares of the company have gained 71.6% in the past year compared with the sub-industry's growth of 31%.

SAP’s Zacks Rank

SAP currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks from the broader technology space are Seagate Technology Holdings plc STX, OptimizeRx Corporation OPRX and SS&C Technologies Holdings, Inc. SSNC. Both STX & OPRX presently sport a Zacks Rank #1 (Strong Buy), whereas SSNC carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Seagate Technology delivered an earnings surprise of 80.9%, on average, in three of the trailing four quarters. In the last reported quarter, STX pulled off an earnings surprise of 40%. The Zacks Consensus Estimate for its earnings has increased 18% to $7.41 in the past 60 days.

OptimizeRx delivered an earnings surprise of 159.5%, on average, in three of the trailing four quarters. In the last reported quarter, OPRX pulled off an earnings surprise of 128.6%. The Zacks Consensus Estimate for its earnings has increased 38.5% to 36 cents in the past 60 days.

SS&C Technologies Holdings delivered an earnings surprise of 3.1%, on average, in the trailing four quarters. In the last reported quarter, SSNC pulled off an earnings surprise of 4.9%. The Zacks Consensus Estimate for its earnings is pegged at $5.18.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

SAP SE (SAP) : Free Stock Analysis Report

OptimizeRx Corp. (OPRX) : Free Stock Analysis Report

SS&C Technologies Holdings, Inc. (SSNC) : Free Stock Analysis Report