Samsara Inks Partnership With Esri: How You Should Play IOT Stock?

Samsara IOT inked a new partnership with Esri on Monday, a well-known provider of geographic information system (GIS) technology. This collaboration seeks to improve fleet management and offer real-time reporting capabilities for government agencies.

This partnership enables customers to utilize telematics data from Samsara — such as location, utilization and maintenance — within Esri’s ArcGIS Velocity, a software-as-a-service IoT application designed for processing, visualizing and analyzing real-time data.

The integration between Samsara and Esri’s ArcGIS Velocity helps public sector organizations enhance citizen services, boost efficiency and improve community safety.

By integrating telematics insights from ArcGIS Velocity, these organizations gain a complete view of fleet operations, breaking down data silos and increasing real-time visibility.

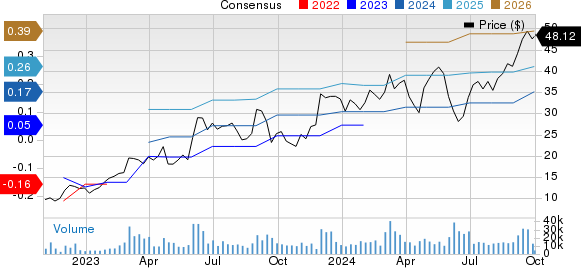

Samsara Inc. Price and Consensus

Samsara Inc. price-consensus-chart | Samsara Inc. Quote

Will IOT Benefit From a Robust Portfolio?

Samsara’s shares have rallied 44.2% in the year-to-date period compared with the Zacks Computer & Technology sector’s rise of 23.7% and the Zacks Internet - Software industry’s return of 21.2%.

Samsara's shares are experiencing an uptick driven by a strong portfolio, an expanding clientele and a robust partner base. The collaboration with Esri is expected to boost growth prospects further.

In the second quarter of fiscal 2025, IOT demonstrated momentum in customer acquisition by adding 169 customers, generating more than $100,000 in Annual Recurring Revenue (ARR).

IOT is witnessing robust growth fueled by the ongoing wave of digitization, utilizing its advanced AI solutions to serve a range of industries, including construction, food and beverage, transportation, warehousing and agriculture.

In August, Samsara’s advanced AI solutions bolstered fleet safety for Lanes Group, achieving a 72% increase in driver safety scores, a 92% drop in mobile phone usage, and a £3,000 reduction in average claim value in just eight months.

Samsara has further broadened its customer base by teaming up with AT&T T to enhance its services for public safety clients.

In June, Samsara unveiled new products and solutions at its Beyond conference, including a FirstNet Trusted Vehicle Gateway designed to enhance public safety communications via AT&T’s network.

Samsara has also seen impressive growth and adoption of its video-based safety, vehicle telematics and equipment monitoring products.

In second-quarter fiscal 2025, Samsara’s Video-Based Safety and Vehicle Telematics apps each exceeded $500 million in ARR, while Equipment Monitoring and other products surpassed $150 million, all achieving more than 30% year over year growth.

Samsara enabled United Natural Foods UNFI to enhance sustainability and safety across its extensive operations, including fleet management, through its innovative solutions.

In April, Samsara announced that United Natural Foods selected its solutions — including Vehicle Telematics, Asset Gateways, Environmental Monitors and Video-Based Safety — to advance sustainability and safety initiatives.

IOT’s Q3 View Positive

For the third quarter of fiscal 2025, Samsara projects revenues between $309 million and $311 million, indicating year-over-year growth of 30-31%. Non-GAAP earnings are expected to range from 3 to 4 cents per share.

The Zacks Consensus Estimate for third-quarter fiscal 2025 revenues is currently pegged at $310.65 million, suggesting 30.78% growth year over year.

The consensus mark for earnings is currently pegged at 4 cents, increased by a penny in the past 30 days.

Zacks Rank & Valuation

Samsara stock is not so cheap, as the Value Score of F suggests a stretched valuation at this moment.

IOT currently carries Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point in the stock.

A Top-Ranked Stock to Buy

Alps Electric APELY is a better-ranked stock in the broader sector, sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

APELY’s shares have returned 26.3% year to date. The long-term earnings growth rate for Alps Electric is currently pegged at 40.52%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AT&T Inc. (T) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

Alps Electric (APELY) : Free Stock Analysis Report

Samsara Inc. (IOT) : Free Stock Analysis Report