Why rich Americans believe they pay enough taxes, in 2 charts

The highest-income earners are frequently the target of criticism from middle-class America and progressive politicians who accuse the wealthy of not paying their fair share of taxes.

Two charts from Deutsche Bank illustrate a common retort from those high-income earners.

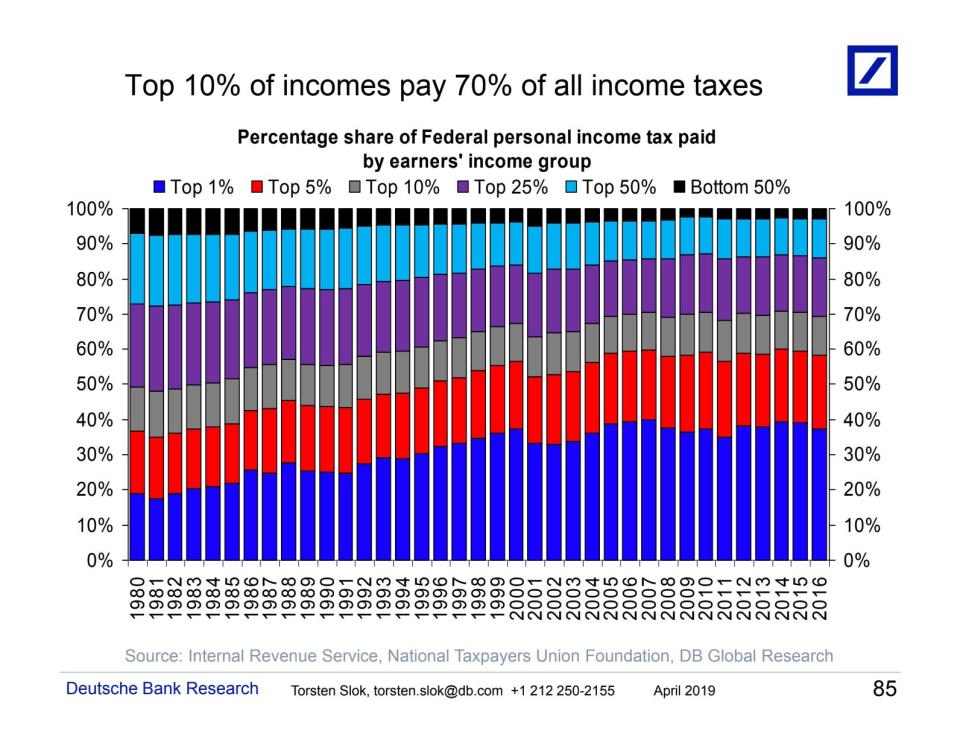

In the first chart below, the top 10% of incomes (blue, red, and gray) is shown to have paid 70% of all income taxes in 2016. The top 1% paid more than 35%, the top 5% contributed nearly 60% before adding the top 6-10%.

“This isn’t necessarily something that’s surprising to folks who follow tax,” Joe Rosenberg, a senior research associate at the Tax Policy Center, told Yahoo Finance. “If you look at the individual income tax … there’s a large number of taxpayers that pay relatively low rates, some even negative effective tax rates from refundable credits. And, the bulk of the income tax share is paid by high income taxpayers.”

In 2016, a single individual who made over $190,150 paid an average 33% rate on their federal income taxes. The highest bracket paid 39.6%. Those rates remain relatively unchanged under the new tax law passed in late 2017.

“The underlying distribution of income is fairly skewed, so that high-income earners earn and report a disproportionate share of total income,” Rosenberg explained. “Combined with the fact that policy changes again have made the income tax at the federal level fairly progressive, so the share of income taxes is even larger than their share of income.”

‘Somewhat of a misinterpretation’

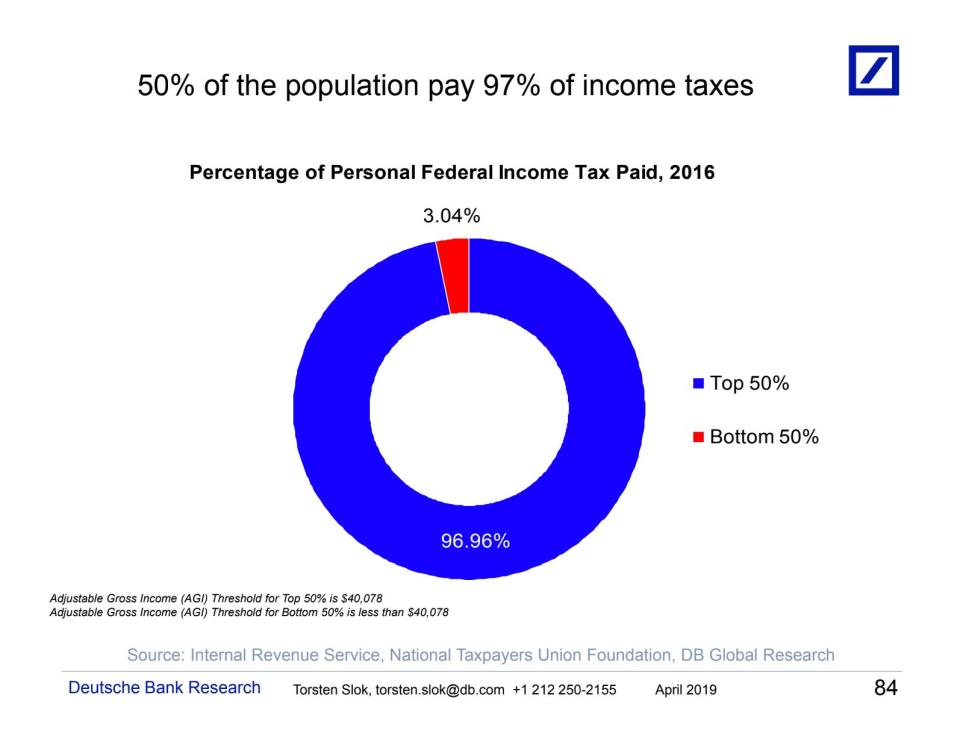

The second chart put it another way, highlighting how 50% of the population paid 97% of income taxes in 2016.

“I think the general consensus is that the rich don’t pay enough of federal taxes,” G.W. Hoagland, senior vice president at the Bipartisan Policy Center, told Yahoo Finance. The charts indicate, however, that the consensus is “somewhat of a misinterpretation of the actual tax laws.”

Yahoo Finance previously reported on survey findings from Politico and Morning Consult that indicated that 76% of registered voters think wealthy Americans should pay more taxes.

And those survey respondents aren’t the only ones — Democratic politicians like Sen. Elizabeth Warren and Rep. Alexandria Ocasio-Cortez have proposed wealth taxes. Presidential candidate Warren floated the idea of a 2%-3% annual tax on a household’s net worth if the wealth exceeds $50 million. Ocasio-Cortez’s proposal suggests taxing the highest tax bracket at a 70% rate in order to fund environmental projects.

“For any policy, there’s going to be pros and cons and benefits and costs,” Rosenberg said. “There may be more effective policies than simply just raising marginal tax rates, but those all have the flavor. You could think of different policies that accomplish a similar goal, in terms of increasing the amount of tax paid by very high income taxpayers.”

“With a 70% federal tax and with average taxes out there in the states … you’re getting very high marginal tax rates that I think would be very difficult to maintain,” Hoagland said.

Some of the wealthy will say they pay enough in taxes, but some won’t, according to Hoagland. “It probably depends a little bit on their political affiliation,” he said. “If there are those in that higher income bracket, that 10%, who feel we should have Medicare for All, then they’ll be the ones who will have to also admit they’ll have to pay more taxes.”

Some high-profile billionaires have come out in favor of increasing taxes on the wealthy, including legendary investor Warren Buffett. In a 2011 op-ed for the New York Times, he wrote: “My friends and I have been coddled long enough by a billionaire-friendly Congress. It’s time for our government to get serious about shared sacrifice.”

Hoagland acknowledged that the argument made some sense — to a point.

“If there are those in those upper income brackets who feel the federal deficit we’re running is inappropriate and is a burden on future generations, then they too will say we should be paying a larger share of our income,” he said. “But, at what point does it become a disincentive for work in that income bracket? That’s been the argument going back for years.”

READ MORE:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.