Reflecting On Industrial Distributors Stocks’ Q2 Earnings: GMS (NYSE:GMS)

As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the industrial distributors industry, including GMS (NYSE:GMS) and its peers.

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Distributors that boast a reliable selection of products–everything from hardhats and fasteners for jet engines to ceiling systems–and quickly deliver goods to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to better interact with customers. Additionally, distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

The 29 industrial distributors stocks we track reported a slower Q2. As a group, revenues were in line with analysts’ consensus estimates.

Inflation progressed towards the Fed's 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

industrial distributors stocks have held steady amidst all this with average share prices relatively unchanged since the latest earnings results.

GMS (NYSE:GMS)

Founded in 1971, GMS (NYSE:GMS) distributes specialty building materials including wallboard, ceilings, and insulation products, to the construction industry.

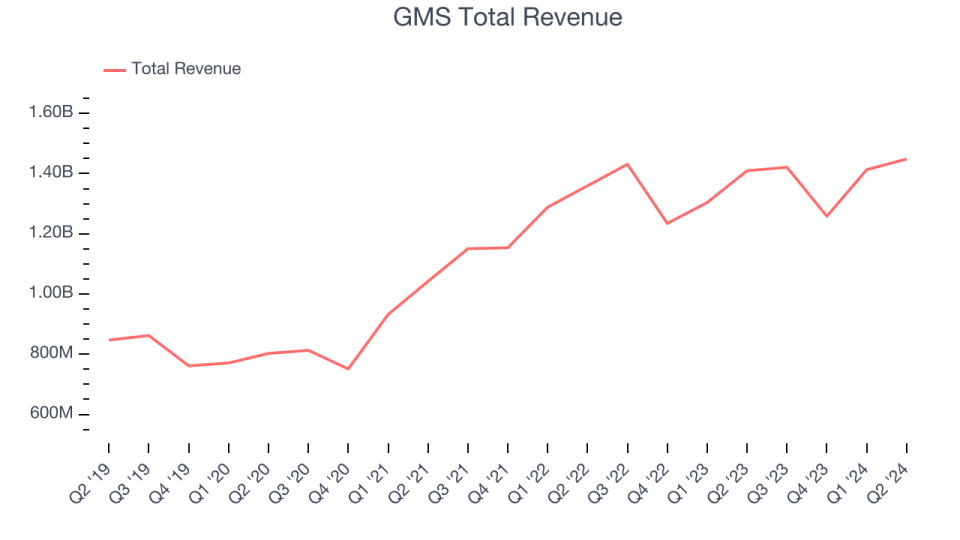

GMS reported revenues of $1.45 billion, up 2.8% year on year. This print fell short of analysts’ expectations by 2.5%. Overall, it was a disappointing quarter for the company with a miss of analysts’ earnings estimates.

“During our first quarter of fiscal 2025, the GMS team delivered net sales of $1.4 billion, net income of $57.2 million and Adjusted EBITDA of $145.9 million amid what has quickly become a more challenging market environment,” said John C. Turner, Jr., President and CEO of GMS.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $90.76.

Read our full report on GMS here, it’s free.

Best Q2: Rush Enterprises (NASDAQ:RUSHA)

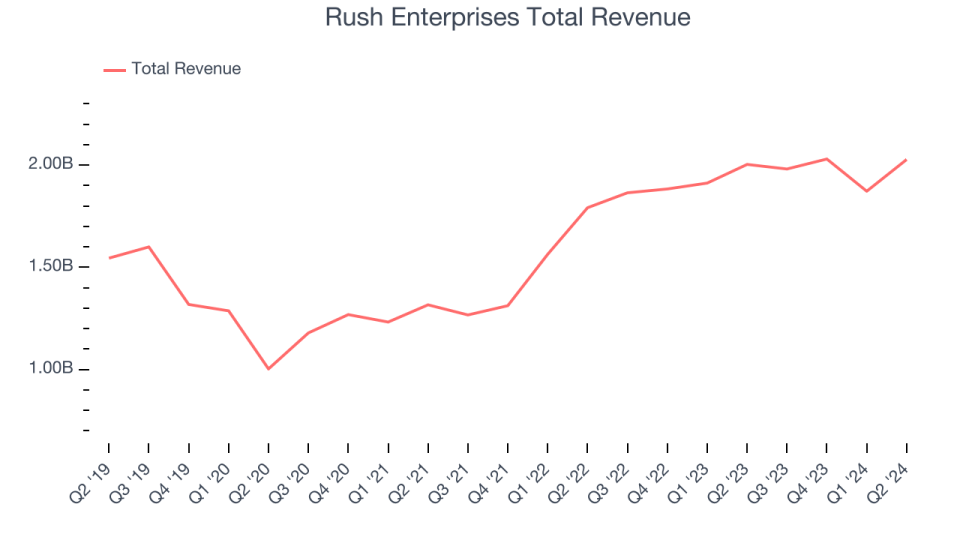

Headquartered in Texas, Rush Enterprises (NASDAQ:RUSH.A) provides truck-related services and solutions, including sales, leasing, parts, and maintenance for commercial vehicles.

Rush Enterprises reported revenues of $2.03 billion, up 1.2% year on year, outperforming analysts’ expectations by 8.8%. The business had an exceptional quarter with an impressive beat of analysts’ earnings estimates.

The market seems content with the results as the stock is up 3.2% since reporting. It currently trades at $52.64.

Is now the time to buy Rush Enterprises? Access our full analysis of the earnings results here, it’s free.

Hudson Technologies (NASDAQ:HDSN)

Founded in 1991, Hudson Technologies (NASDAQ:HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Hudson Technologies reported revenues of $75.28 million, down 16.8% year on year, falling short of analysts’ expectations by 4.9%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations and a miss of analysts’ earnings estimates.

Hudson Technologies delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 9.8% since the results and currently trades at $8.27.

Read our full analysis of Hudson Technologies’s results here.

Fastenal (NASDAQ:FAST)

Founded in 1967, Fastenal (NASDAQ:FAST) provides industrial and construction supplies, including fasteners, tools, safety products, and many other product categories to businesses globally.

Fastenal reported revenues of $1.92 billion, up 1.8% year on year. This number was in line with analysts’ expectations. Aside from that, it was a mixed quarter as it also recorded a narrow beat of analysts’ earnings estimates but a miss of analysts’ operating margin estimates.

The stock is up 10.6% since reporting and currently trades at $71.

Read our full, actionable report on Fastenal here, it’s free.

United Rentals (NYSE:URI)

Owning the largest rental fleet in the world, United Rentals (NYSE:URI) provides equipment rental and related services to construction, industrial, and infrastructure industries.

United Rentals reported revenues of $3.77 billion, up 6.2% year on year. This print met analysts’ expectations. Zooming out, it was a disappointing quarter as it also logged an impressive beat of analysts’ operating margin estimates but a miss of analysts’ organic revenue estimates.

The stock is up 13.7% since reporting and currently trades at $814.

Read our full, actionable report on United Rentals here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.