Q2 Rundown: Avis Budget Group (NASDAQ:CAR) Vs Other Ground Transportation Stocks

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Avis Budget Group (NASDAQ:CAR) and the best and worst performers in the ground transportation industry.

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 16 ground transportation stocks we track reported a slower Q2; on average, revenues missed analyst consensus estimates by 1%. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and while some of the ground transportation stocks have fared somewhat better than others, they collectively declined, with share prices falling 4.4% on average since the previous earnings results.

Slowest Q2: Avis Budget Group (NASDAQ:CAR)

The parent company of brands such as Zipcar and Budget Truck Rental, Avis (NASDAQ:CAR) is a provider of car rental and mobility solutions.

Avis Budget Group reported revenues of $3.05 billion, down 2.4% year on year, falling short of analysts' expectations by 2.8%. Overall, it was a weak quarter for the company with a miss of analysts' earnings and volume estimates.

“As the second quarter progressed, demand elevated with pricing and vehicle utilization sequentially improving. June pricing finished down slightly and vehicle utilization up a point in the Americas compared to June 2023,” said Joe Ferraro, Avis Budget Group Chief Executive Officer.

The stock is up 4.1% since reporting and currently trades at $87.40.

Read our full report on Avis Budget Group here, it's free.

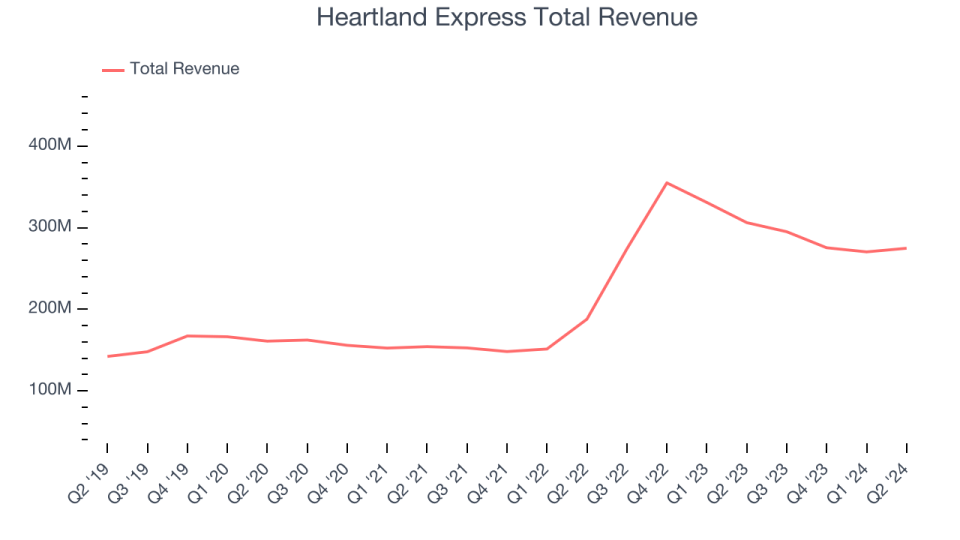

Best Q2: Heartland Express (NASDAQ:HTLD)

Founded by the son of a trucker, Heartland Express (NASDAQ:HTLD) offers full-truckload deliveries across the United States and Mexico.

Heartland Express reported revenues of $274.8 million, down 10.3% year on year, in line with analysts' expectations. It was a very strong quarter for the company with an impressive beat of analysts' earnings estimates.

Although it had a great quarter compared its peers, the market seems unhappy with the results as the stock is down 3.1% since reporting. It currently trades at $12.07.

Is now the time to buy Heartland Express? Access our full analysis of the earnings results here, it's free.

U-Haul (NYSE:UHAL)

Founded by a husband and wife, U-Haul (NYSE:UHAL) offers truck and trailer rentals and self storage units.

U-Haul reported revenues of $1.55 billion, flat year on year, in line with analysts' expectations. It was a weak quarter for the company with a miss of analysts' earnings estimates.

Interestingly, the stock is up 6.8% since the results and currently trades at $67.57.

Read our full analysis of U-Haul's results here.

ArcBest (NASDAQ:ARCB)

Historically owning furniture, banking, and other subsidiaries, ArcBest (NASDAQ:ARCB) offers full-truckload, less-than-truckload, and intermodal deliveries of freight.

ArcBest reported revenues of $1.08 billion, down 2.3% year on year, surpassing analysts' expectations by 1.9%. Taking a step back, it was a mixed quarter for the company with a narrow beat of analysts' volume estimates but a miss of analysts' earnings estimates.

ArcBest scored the biggest analyst estimates beat among its peers. The stock is down 12.2% since reporting and currently trades at $106.78.

Read our full, actionable report on ArcBest here, it's free.

Hertz (NASDAQ:HTZ)

Started with a dozen Model T Fords, Hertz (NASDAQ:HTZ) is a global car rental company providing vehicle rental services to leisure and business travelers.

Hertz reported revenues of $2.35 billion, down 3.4% year on year, falling short of analysts' expectations by 4.3%. Overall, it was a weak quarter for the company with a miss of analysts' earnings and volume estimates.

Hertz had the weakest performance against analyst estimates among its peers. The stock is down 13.7% since reporting and currently trades at $3.53.

Read our full, actionable report on Hertz here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.