Q2 Earnings Outperformers: Desktop Metal (NYSE:DM) And The Rest Of The Custom Parts Manufacturing Stocks

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Desktop Metal (NYSE:DM) and its peers.

Onshoring and inventory management–themes that grew in focus after COVID wreaked havoc on global supply chains–are tailwinds for companies that combine economies of scale with reliable service. Many in the space have adopted 3D printing to efficiently address the need for bespoke parts and components, but all companies are still at the whim of economic cycles. For example, consumer spending and interest rates can greatly impact the industrial production that drives demand for these companies’ offerings.

The 4 custom parts manufacturing stocks we track reported a softer Q2. As a group, revenues missed analysts’ consensus estimates by 5.1% while next quarter’s revenue guidance was 6.7% below.

After much suspense, the Federal Reserve cut its policy rate by 50bps (half a percent) in September 2024. This marks the central bank’s first easing of monetary policy since 2020 and the end of its most pointed inflation-busting campaign since the 1980s. Inflation had begun to run hot in 2021 post-COVID due to a confluence of factors such as supply chain disruptions, labor shortages, and stimulus spending. While CPI (inflation) readings have been supportive lately, employment measures have prompted some concern. Going forward, the markets will debate whether this rate cut (and more potential ones in 2024 and 2025) is perfect timing to support the economy or a bit too late for a macro that has already cooled too much.

Luckily, custom parts manufacturing stocks have performed well with share prices up 16.6% on average since the latest earnings results.

Weakest Q2: Desktop Metal (NYSE:DM)

Originating from a research lab at MIT, Desktop Metal (NYSE:DM) offers 3D printers, production materials, and software to many industries.

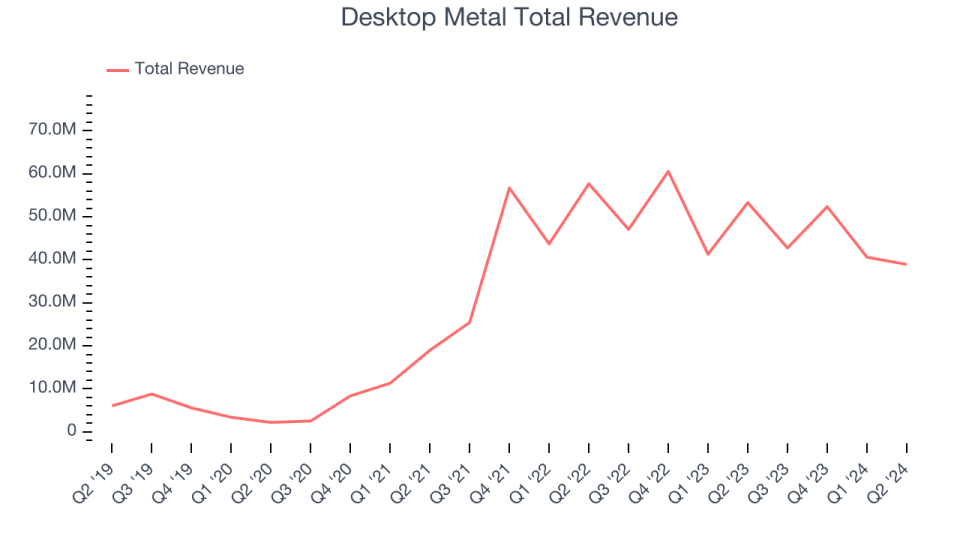

Desktop Metal reported revenues of $38.93 million, down 26.9% year on year. This print fell short of analysts’ expectations by 14.4%. Overall, it was a disappointing quarter for the company with a miss of analysts’ earnings estimates.

“Since the beginning of 2022, Desktop Metal has worked tirelessly to align our cost structure with macroeconomic realities, making hard decisions about the business. By the end of Q1 we had delivered nine quarters of non-GAAP opex reduction and brought our cash burn down dramatically. I am proud of the progress we have shown,” said Ric Fulop, Founder and CEO of Desktop Metal.

Desktop Metal delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 4.5% since reporting and currently trades at $4.69.

Read our full report on Desktop Metal here, it’s free.

Best Q2: Proto Labs (NYSE:PRLB)

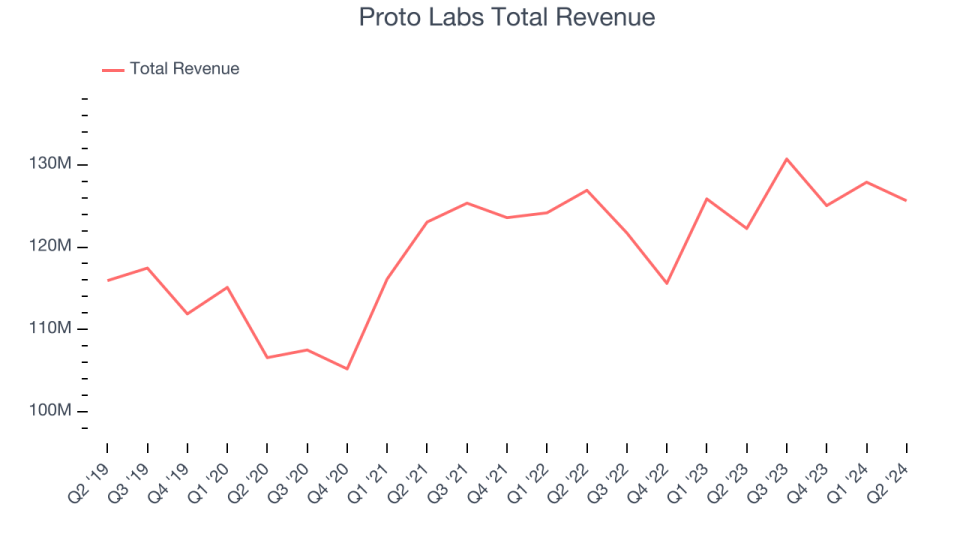

Pioneering the concept of online quoting and manufacturing for custom prototypes and low-volume production parts, Proto Labs (NYSE:PRLB) offers injection molding, 3D printing, and sheet metal fabrication for manufacturers in various industries.

Proto Labs reported revenues of $125.6 million, up 2.8% year on year, in line with analysts’ expectations. The business performed better than its peers, but overall, it was a mixed quarter with strong earnings guidance for the next quarter but revenue guidance for next quarter missing analysts’ expectations.

Proto Labs achieved the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 11% since reporting. It currently trades at $29.84.

Is now the time to buy Proto Labs? Access our full analysis of the earnings results here, it’s free.

Stratasys (NASDAQ:SSYS)

Born from the Founder’s idea of making a toy frog with a glue gun, Stratasys (NASDAQ:SSYS) offers 3D printers and related materials, software, and services to many industries.

Stratasys reported revenues of $138 million, down 13.6% year on year, falling short of analysts’ expectations by 5.7%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Stratasys delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 5.5% since the results and currently trades at $8.11.

Read our full analysis of Stratasys’s results here.

Markforged (NYSE:MKFG)

Beginning as a start-up at SolidWorks World–an annual design and engineering conference, Markforged (NYSE:MKFG) offers 3D printers and softwares to manufacturers of various industries.

Markforged reported revenues of $21.69 million, down 14.8% year on year. This number met analysts’ expectations. Taking a step back, it was a disappointing quarter as it recorded full-year revenue guidance missing analysts’ expectations.

Markforged delivered the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is up 76.3% since reporting and currently trades at $4.76.

Read our full, actionable report on Markforged here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.