Q2 Earnings Beat Sparks Rally in PLAY Stock, Revenues Trail

Dave & Buster's Entertainment, Inc. PLAY reported mixed second-quarter fiscal 2024 results, with earnings beating the Zacks Consensus Estimate and revenues missing the same. The top and the bottom line increased on a year-over-year basis.

During the quarter, the company reported strong performance from the remodeled locations. Also, it recorded a positive reception of the new menu, which is driving improvements in food and beverage performance and guest satisfaction. Pricing tests for games and food and beverage offerings have bolstered revenues and margins, with further gains anticipated as optimization continues.

The special events segment experienced substantial growth, with same-store sales increasing significantly both for the second quarter and year to date. Forward bookings for fiscal 2024 are also well ahead of last year. Despite some difficulties with same-store sales in a challenging environment, Dave & Buster's remains focused on its medium-term objectives and anticipates its strategic initiatives to drive growth in same-store sales, revenues, EBITDA and cash flow in upcoming periods.

Following the release of the results, the company's shares jumped 12.2% during after-hours trading on Tuesday.

Earnings & Revenues in Detail

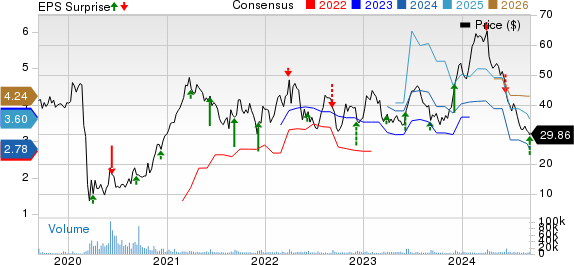

Dave & Buster's Entertainment, Inc. Price, Consensus and EPS Surprise

Dave & Buster's Entertainment, Inc. price-consensus-eps-surprise-chart | Dave & Buster's Entertainment, Inc. Quote

During the fiscal second quarter, the company reported adjusted earnings per share (EPS) of $1.12, beating the Zacks Consensus Estimate of 87 cents. In the year-ago quarter, it reported an adjusted EPS of 94 cents.

Quarterly revenues of $557.1 million missed the consensus mark of $562 million. The top line increased 2.8% from $542.1 million reported in the prior-year quarter.

Food and Beverage revenues (32.6% of total revenues in the reported quarter) inched up 0.6% year over year to $181.4 million. Entertainment revenues (67.4%) increased 4.1% year over year to $375.7 million.

Comps Details

During the quarter under discussion, comparable store sales (including Main Event branded stores) declined 6.3% year over year.

Operating Highlights

During the fiscal second quarter, operating income amounted to $84.5 million compared with $77.1 million in the prior-year quarter. The operating margin was 15.1% compared with 14.3% in the year-ago quarter. Our estimate for the metric was 14.1%.

Adjusted EBITDA came in at $151.6 million compared with $140.3 million in the year-earlier quarter. Our estimate for the metric was $138.2 million.

Balance Sheet

As of Aug. 6, 2024, cash and cash equivalents were $13.1 million compared with $37.3 million as of Feb. 4, 2024.

As of Aug. 6, 2024, the company repurchased 1.2 million shares for an aggregate cost of $60 million. As of the same date, the company had $140 million available for the buyback program.

At the fiscal second-quarter end, net long-term debt totaled approximately $1.29 billion compared with $1.28 billion as of Feb. 4, 2024.

Zacks Rank & Key Picks

Dave & Buster currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Zacks Retail-Wholesale sector include Texas Roadhouse, Inc. TXRH, Potbelly Corporation PBPB and El Pollo Loco Holdings, Inc. LOCO. TXRH currently sports a Zacks Rank #1 (Strong Buy) while PBPB and LOCO carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Texas Roadhouse has a trailing four-quarter earnings surprise of 0.4%, on average. TXRH’s shares have risen 59.1% in the past year. The Zacks Consensus Estimate for TXRH’s 2024 sales and EPS indicates 15.6% and 39.2% growth, respectively, from the year-earlier actuals.

Potbelly Corporation has a trailing four-quarter earnings surprise of 77.5%, on average. The stock has declined 27.6% so far this year. The Zacks Consensus Estimate for PBPB’s 2025 sales and EPS implies a rise of 4.2% and 30%, respectively, from the year-ago levels.

El Pollo Loco Holdings has a trailing four-quarter earnings surprise of 21.6%, on average. LOCO’s shares have risen 43% in the past year. The Zacks Consensus Estimate for LOCO’s 2025 sales and EPS indicates 3.8% and 11.7% growth, respectively, from the prior-year figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Roadhouse, Inc. (TXRH) : Free Stock Analysis Report

Potbelly Corporation (PBPB) : Free Stock Analysis Report

El Pollo Loco Holdings, Inc. (LOCO) : Free Stock Analysis Report

Dave & Buster's Entertainment, Inc. (PLAY) : Free Stock Analysis Report