Neuberger Berman Group LLC Adjusts Stake in Exponent Inc

Overview of Recent Transaction

On September 30, 2024, Neuberger Berman Group LLC executed a significant transaction involving the shares of Exponent Inc (NASDAQ:EXPO), a renowned engineering and scientific consulting firm. The firm reduced its holdings by 68,141 shares, which adjusted its total ownership to 2,392,635 shares. This move, priced at $115.28 per share, reflects a subtle yet strategic portfolio adjustment, impacting the firm's stake by a mere -0.01%.

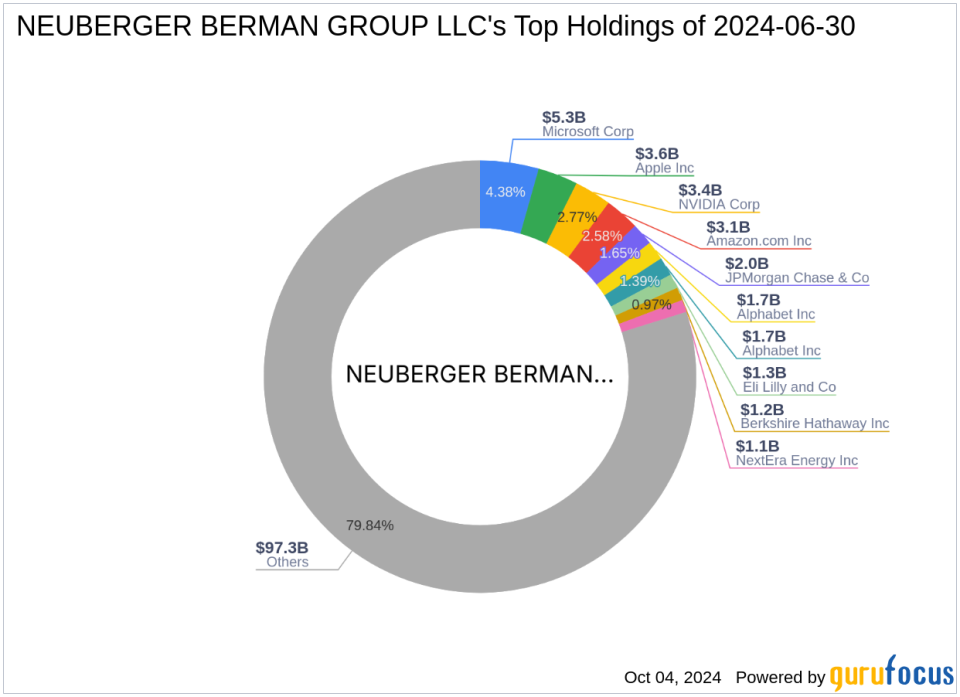

Profile of Neuberger Berman Group LLC

Neuberger Berman Group LLC, based at 1290 Avenue of the Americas, New York, NY, is a prominent player in the investment field. With a robust portfolio management strategy, the firm oversees an equity of approximately $121.8 billion across various sectors, with a strong emphasis on Technology and Financial Services. Their investment philosophy focuses on long-term growth and value creation, leveraging deep market insights and a proactive management approach.

Introduction to Exponent Inc

Exponent Inc, trading under the symbol EXPO, has been a key player in the consulting industry since its IPO in 1985. The company specializes in providing expert engineering and scientific advice across two main segments: Engineering and Other Scientific, and Environmental and Health. Predominantly serving the American market, Exponent Inc has built a reputation for its rigorous analytical services and problem-solving capabilities.

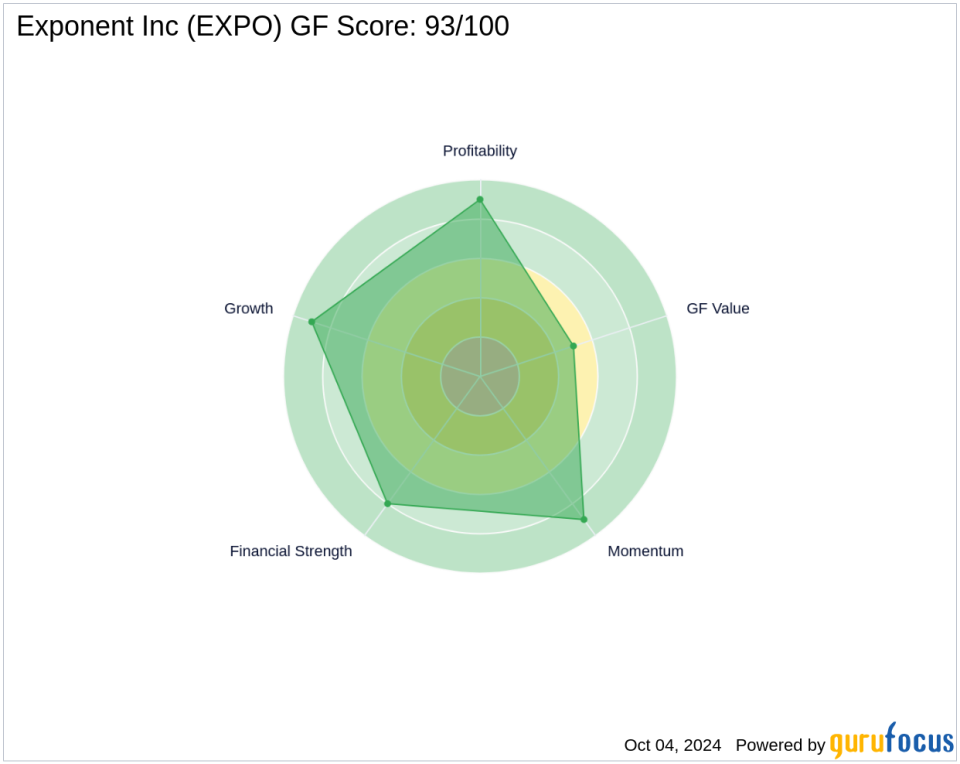

Financial and Market Analysis of Exponent Inc

Currently, Exponent Inc holds a market capitalization of $5.76 billion, with a stock price of $113.56. The stock is considered modestly overvalued with a GF Value of $101.88 and a price to GF Value ratio of 1.11. Despite this, Exponent maintains a strong GF Score of 93/100, indicating high potential for future performance. The company's financial strength and profitability are underscored by a PE Ratio of 55.40, reflecting its robust earnings capacity.

Impact of the Trade on Neuberger Berman Group LLCs Portfolio

The recent transaction slightly altered Neuberger Berman Group LLCs exposure to Exponent Inc, with the firm's position in the company now standing at 4.72%. This adjustment represents a strategic shift within their portfolio, which continues to prioritize high-value, high-growth stocks.

Sector and Market Considerations

Neuberger Berman Group LLCs top sectors include Technology and Financial Services, aligning well with Exponents business model, which leverages technological and scientific expertise to deliver consulting solutions. This synergy suggests a calculated compatibility in the firm's investment strategy.

Comparative Analysis

When compared to industry standards, Exponent Incs robust GF Score and financial metrics position it favorably against peers. The companys strong Profitability Rank and Growth Rank further bolster its standing in a competitive market.

Conclusion

In conclusion, Neuberger Berman Group LLCs recent reduction in Exponent Inc shares appears to be a minor portfolio adjustment rather than a shift in investment strategy. This move aligns with the firm's ongoing strategy to optimize its investment allocations and maintain a balanced approach towards high-growth potential and value creation in its holdings.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.