One chart tells the whole story of the election — and it's about to go haywire

If you want to know what markets think is happening in the US election, look no further than the Mexican peso.

And if you want to know which election outcome markets are worried about, look no further than the Mexican peso.

Between Donald Trump’s claims that he will build a wall along the US-Mexico border “and Mexico will pay for it,” and his general antagonism towards free trade and agreements like NAFTA, the peso has been a flashpoint for investor anxiety over the last year or so.

More restrictive trade between the US and international trading partners is seen as boosting the value of the dollar while harming other currencies. Mexico, as one of the US’ largest trading partners, is particularly vulnerable to any major shifts in current policies.

This chart, which comes to us from strategists at Credit Suisse, shows the tight relationship between the odds Democratic nominee Hillary Clinton wins the White House and the strength of the peso.

A Trump victory is seen as negative to the value of the peso while a Clinton victory would, in the market’s view, be positive.

But as Credit Suisse analysts Shahab Jalinoos and Alvise Marino note, action in the peso looks set to get frantic after the election. Especially if Trump wins.

“We first mentioned ‘Trumpxit’ risk back in Q1 this year (the stylized tail risk that the US economy under Trump moves to disconnect from the global economy in the same manner as the UK is seeking to do from the EU now),” they write.

“At the time, we flagged MXN as the ultimate market indicator of the probability of a Trump victory, seeing it as the ‘canary in the coal mine’.”

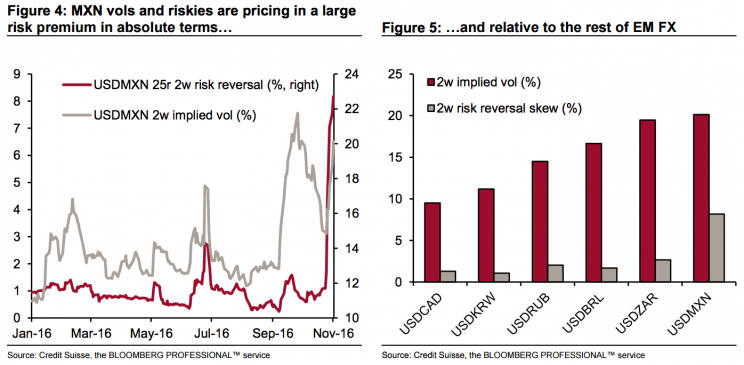

And as these charts show, right now the options market is indicating a massive range of potential future prices for the peso relative both to the dollar and other currency peers.

“We think realized volatility is likely to remain very high in the coming week, and likely in the days following the election too. Judging by price action in vol markets, we are not alone in having this view,” they write.

Market pricing also indicates that a Trump victory would be a far more volatile event than a Clinton win next Tuesday.

“MXN implied vols are trading at extreme levels relative to the rest of EM FX, and more importantly the market has made it very clear which election outcome would generate more realized volatility, as suggested by the extreme bid for USDMXN calls over puts implied by the risk reversal skew,” they write. (Emphasis added.)

In plain(er) English, this means investors have made more offers on futures contracts to buy a weaker peso (via a higher-priced USDMXN pair) than sell a weaker peso, indicating a larger appetite for hedging against a Trump win than a Clinton win.

A Clinton administration likely ushers in similar economic policies to those pursued by President Obama over the last eight years. Trump is more of a wild card.

Or as we wrote Tuesday, the market doesn’t really care who wins the election — unless it’s Donald Trump.

—

Myles Udland is a writer at Yahoo Finance.

Read more form Myles here: