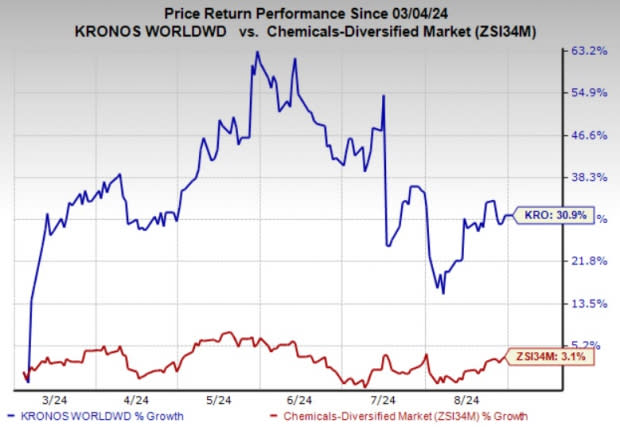

Kronos Worldwide's Shares Rally 31% in 6 Months: Here's Why

Kronos Worldwide, Inc.’s KRO shares have shot up 31% over the past six months. The rally has resulted in the stock outperforming its industry’s increase of 3.1% over the same time frame. KRO has also topped the S&P 500’s roughly 8.9% rise over the same period.

Let’s dive into the factors behind this Zacks Rank #2 (Buy) stock’s price appreciation.

Image Source: Zacks Investment Research

Higher TiO2 Demand, Cost Actions Drive KRO

KRO is well-placed to benefit from higher demand for TiO2 in major markets. Per the company, TiO2 consumption has increased at a compound annual growth rate of around 2% since 2000. Western Europe and North America account for roughly 14% and 15% of global TiO2 consumption, respectively. These regions are expected to continue to be the biggest consumers of TiO2. Markets for TiO2 are growing in South America, Eastern Europe, the Asia Pacific region and China.

Kronos Worldwide expects sales volumes in 2024 to exceed 2023 levels factoring in the recently experienced improved demand and expectations that demand will continue to improve this year.

KRO is also taking actions to reduce costs and align production and inventories to expected demand levels, which are expected to support its margins. It has increased its production rates in sync with current and expected near-term demand improvement. It expects its production rates for the balance of 2024 to be higher than the level witnessed in 2023.

The company’s internal cost initiatives are expected to continue to support margins in 2024. Reduced energy costs along with its cost-cutting initiatives and the realization of selling price increases are likely to result in improved margins on a year-over-year basis this year. KRO has undertaken TiO2 selling price hikes, which need to be sustained to attain margins in line with historical levels. KRO expects to report higher operating results on a year-over-year basis for full-year 2024 based on the expected improved demand, higher selling prices and reduced production costs.

Kronos Worldwide Inc Price and Consensus

Kronos Worldwide Inc price-consensus-chart | Kronos Worldwide Inc Quote

Stocks to Consider

Other top-ranked stocks in the Basic Materials space are Newmont Corporation NEM, Element Solutions Inc ESI and Eldorado Gold Corporation EGO, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Newmont’s current-year earnings is pegged at $2.82, indicating a rise of 75.2% from year-ago levels. The Zacks Consensus Estimate for NEM’s earnings has increased 16% in the past 60 days. The stock has rallied around 36% in the past year.

The consensus estimate for Element Solutions’ current-year earnings has increased by 0.7% in the past 60 days. ESI beat the consensus estimate in three of the last four quarters while delivering in-line results on the other occasion. In this timeframe, it delivered an earnings surprise of around 3.8%, on average.

The Zacks Consensus Estimate for Eldorado Gold’s current year earnings is pegged at $1.35 per share, indicating a year-over-year rise of 136.8%. EGO beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 430.3%. The company's shares have rallied roughly 80% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Newmont Corporation (NEM) : Free Stock Analysis Report

Kronos Worldwide Inc (KRO) : Free Stock Analysis Report

Eldorado Gold Corporation (EGO) : Free Stock Analysis Report