Is Joby Aviation Stock Ready for Takeoff?

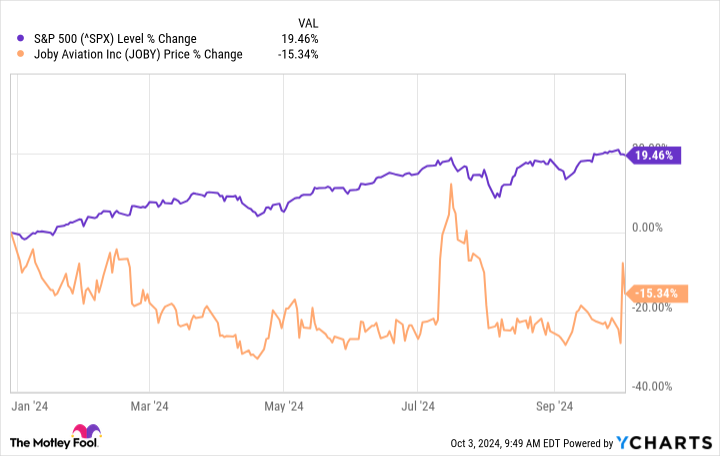

The benchmark S&P 500 is on track to produce a whopping 20% gain for 2024, but companies developing electric vertical take-off and landing (eVTOL) aircraft have floundered. The stocks of the biggest and most visible players in this emerging field of aviation technology have averaged a return of negative 22.2% this year.

This stark contrast between the broader market's performance and the struggles of eVTOL companies raises questions for investors. Are these innovative aviation technology firms experiencing growing pains, or do they represent a buying opportunity for those with a long-term outlook?

One company at the forefront of this nascent industry is Joby Aviation (NYSE: JOBY). With its ambitious plans and recent high-profile investment (see below), Joby stands out as a potential leader in the urban air mobility revolution. Below is a closer look at the company's recent developments and an assessment of whether this eVTOL pioneer might be poised for liftoff.

A Toyota-backed front-runner

Joby Aviation recently secured a game-changing $500 million investment from Toyota Motor Corporation (NYSE: TM). This deal brings Toyota's total investment in Joby to $894 million. Toyota will own over 20% of Joby after the second tranche is invested in 2025.

The partnership goes beyond financial backing. Toyota is sharing its renowned production expertise with Joby as engineers from both companies are working side-by-side in California. This collaboration aims to leverage Toyota's manufacturing prowess to scale Joby's production capabilities efficiently.

Joby is making steady progress toward commercialization and recently rolled out its third aircraft off its pilot production line. It has also broken ground on an expanded manufacturing facility in California. The company aims to reach a production capacity of one eVTOL aircraft per month by the end of 2024, a crucial milestone in its journey to market.

Global expansion and regulatory milestones

Joby is not limiting its ambitions to the United States. The company has taken steps to become a certified air-taxi operator in the United Arab Emirates and has signed agreements with Dubai's Road and Transport Authority and various Abu Dhabi government departments. These partnerships pave the way for Joby to establish and scale air-taxi services in the UAE, positioning the company for global expansion.

In the U.S., the company has already obtained its Part 135 Air Carrier Certificate from the Federal Aviation Administration, which is a crucial step toward commercial operations. As a result, the company has operated traditional aircraft for over two years, refining its intended air-taxi operations and gathering valuable operational experience.

Certification progress and financial position

Joby reports that the fourth of five stages in the type certification process is now 37% complete on their side. The company expects progress to accelerate in the remainder of 2024. This certification is critical for Joby to begin commercial air-taxi services with its eVTOL aircraft.

On the financial front, Joby maintains a strong balance sheet with $825 million in cash and short-term investments as of the second quarter of 2024. This substantial cash reserve gives the company a healthy runway to continue its development and certification efforts.

The eVTOL market potential

Morgan Stanley projects the global urban air mobility market to reach $1 trillion by 2040 and $9 trillion by 2050. While this represents a decrease from earlier estimates, it still suggests immense potential for eVTOL technology. The long-term outlook for urban air mobility remains promising, with potential applications ranging from air taxis to cargo transport and emergency services.

However, investors should temper their excitement with patience, according to the investment bank. Regulatory hurdles and certification processes may slow initial adoption. In fact, Morgan Stanley's report suggests widespread commercial introduction may be closer to 2040 than 2030. This timeline reflects the complex challenges of integrating a new form of air transportation into existing urban infrastructure and airspace management systems.

The road ahead for Joby Aviation

While Joby's stock has badly underperformed the S&P 500 in 2024 (see graph below), the long-term potential remains substantial. Joby Aviation's strong partnerships, global expansion efforts, and certification progress position it as a leading contender in the eVTOL space.

The company's innovative aircraft design, which promises to be fast, quiet, and environmentally friendly, could revolutionize urban transportation. Joby's eVTOL is designed to carry a pilot and four passengers at speeds of up to 200 miles per hour, with a journey from Dubai International Airport to Palm Jumeirah, Dubai expected to take just 10 minutes, compared to the typical 45-minute car ride.

What's the bottom line? Investors should carefully consider the risks and potential rewards of this emerging technology. The development of eVTOL aircraft may require decades to reach high-volume commercialization, but the eventual impact on urban transportation could be transformative.

As Joby continues to make progress on its certification and production goals, it may offer an intriguing opportunity for investors willing to weather near-term volatility for the potential of long-term growth in a revolutionary industry. In other words, this small-cap growth stock should appeal to aggressive investors on the hunt for unusual growth opportunities.

Should you invest $1,000 in Joby Aviation right now?

Before you buy stock in Joby Aviation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Joby Aviation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

George Budwell has positions in Joby Aviation and Toyota Motor. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is Joby Aviation Stock Ready for Takeoff? was originally published by The Motley Fool