Itau Unibanco (ITUB) Announces Merger Proposal With Hipercard

Itaú Unibanco Holding S.A. ITUB has announced a corporate internal restructuring plan. This will include the merger of its wholly-owned subsidiary, Hipercard Banco Múltiplo S.A. (“Hipercard”), subject to approval from the Central Bank of Brazil. The cost associated with executing and implementing the transaction is estimated to be approximately R$180,000 ($34,843).

As part of the effort, all activities currently managed by Hipercard, including the administration of bank cards, will be transferred to Itaú Unibanco. The primary purpose of this merger is to achieve greater synergy among the companies and activities of the ITUB conglomerate. This will help streamline costs and enhance efficiency.

Following the completion of the transaction, Hipercard will be dissolved as an entity and its assets will be taken over by ITUB. This will lead to a reduction in maintenance costs, rationalization in administrative and commercial activities and an improvement in the overall corporate structure.

Itaú Unibanco will take over Hipercard’s equity worth R$2.68 billion ($518 million). The merger will not result in any increase in capital or the issuance of new shares of ITUB. There will be no exchange ratio. Also, rules relating to withdrawal rights for dissenting shareholders will not apply. Overall, the transaction will not have any financial impact on Itaú Unibanco.

This strategic move highlights ITUB’s ability to adapt to the trends of the rapidly evolving market and strengthen its competitive placement. Through such efforts, the company is well-poised to improve its market leadership and drive sustainable growth in the long run.

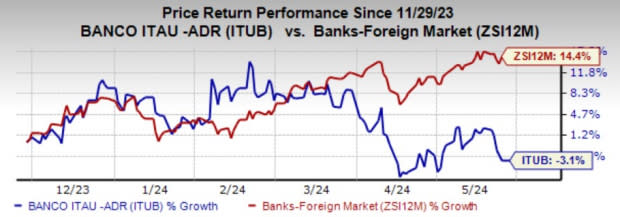

Over the past six months, the company’s shares on the NYSE have lost 3.1% against the industry’s growth of 14.4%.

Image Source: Zacks Investment Research

At present, ITUB carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked foreign finance stocks are Bancolombia S.A. CIB and Banco Macro S.A. BMA.

Bancolombia S.A.’s current-year earnings have been revised upward marginally over the past 30 days. Shares of CIB have gained 26.4% over the past six months. The stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Banco Macro’s current-year earnings have been revised 29.6% upward over the past 30 days. Over the past three months, shares of BMA have gained 46.5%. The stock currently flaunts a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Itau Unibanco Holding S.A. (ITUB) : Free Stock Analysis Report

Macro Bank Inc. (BMA) : Free Stock Analysis Report

BanColombia S.A. (CIB) : Free Stock Analysis Report