Interactive Brokers Allows Clients to Trade Stocks on Bursa Malaysia

Interactive Brokers Group, Inc.’s IBKR clients are now allowed to trade stocks on one of the largest stock exchanges in Southeast Asia, Bursa Malaysia. The brokerage firm’s clients will be able to trade Malaysian Ringgit-denominated equities and exchange traded funds (ETFs), along with global stocks, options, futures, currencies, bonds and funds from a single unified platform.

By providing access to Malaysia-denominated equity products, IBKR will be able to expand the breadth of global investment products available on the Interactive Brokers platform and offer its clients new investment opportunities across Malaysia’s economy.

IBKR has decided to coordinate the necessary forex trade using an automatic FX conversion between the base currency selected in a client’s account and the Malaysian Ringgit, using a conversion rate determined based on the prevailing foreign exchange market rates. This will help streamline trading as it will eliminate the need for pre-trade currency conversions.

David Friedland, the head of APAC at IBKR, stated, “Interactive Brokers offers clients worldwide superior market and product access, allowing them to create diversified portfolios across geographies and asset classes. Introducing stocks on the Bursa Malaysia allows our clients to add exposure to Malaysian equities with the benefit of having Interactive Brokers manage the cost associated with currency conversion.”

Other Moves by IBKR to Expand Scope of Trading

Interactive Brokers has been aiming to boost its offerings and expand its global footprint.

In June 2024, the company announced that its wholly-owned subsidiary, ForecastEx LLC, obtained the requisite approvals from the Commodity Futures Trading Commission to operate as a contract market and derivative clearing organization, thus becoming the first Futures Commission Merchant to become a member of this exchange.

In May 2024, IBKR launched crypto trading in the U.K., expanding its scope of digital asset exposure. Moreover, with the launch of IBKR GlobalTrader, investors globally can trade stocks through mobile applications. IBKR is one of the first brokers to introduce Overnight Trading on U.S. stocks and ETFs nearly 24 hours a day, five days a week.

The launch of IBKR Lite has enabled investors to trade commission free and is, thus, expected to improve the company’s market share. Also, the launch of Impact Dashboard, an innovative sustainable investing tool, has made IBKR the first major brokerage firm to allow investors to easily align their portfolios with their values.

Along with these expansion efforts, Interactive Brokers has mainly been focusing on developing proprietary software to automate broker-dealer functions, which has resulted in a steady improvement in the company’s revenues. IBKR’s total net revenues witnessed a compound annual growth rate of 17.9% over the last five years (2018-2023), with the uptrend continuing in the first quarter of 2024. We anticipate GAAP revenues to increase 11.7% in 2024.

IBKR’s Price Performance & Zacks Rank

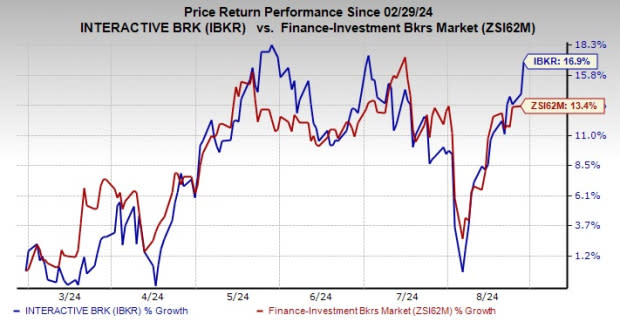

Over the past six months, IBKR shares have gained 16.9% compared with the industry’s growth of 13.4%.

Image Source: Zacks Investment Research

Currently, Interactive Brokers sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Like IBKR, Other Finance Firms Expand Asia Footprint

Earlier this month, Mitsubishi UFJ Financial Group, Inc. MUFG and its consolidated subsidiary — MUFG Bank — announced that they were investing in Globe Fintech Innovations, Inc. (“Mynt”), the firm that manages GCash. It was reported that MUFG would invest $393 million in Mynt to extend its foothold in Asia’s booming digital financial market.

Globe Fintech Innovations operates the Philippine mobile wallet GCash, specializing in QR code-based mobile payments with a user base of more than 60 million. With a valuation of $5 billion, the company is considered a ‘unicorn.’

MUFG's strategic investment in Mynt intends to accelerate growth in the Asia Pacific. The company aims to expand its customer base and promote financial inclusion by integrating Mynt into various online and offline channels.

Another foreign bank HSBC Holdings plc HSBC has been undertaking measures to bolster its performance with a special focus on building operations across Asia. HSBC intends to position itself as a top bank for high-net-worth and ultra-high-net-worth clients in the region.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

Mitsubishi UFJ Financial Group, Inc. (MUFG) : Free Stock Analysis Report