Infosys And 2 Other High Growth Tech Stocks Shaping India's Future

Over the last 7 days, the Indian market has remained flat, yet it has seen a significant increase of 40% over the past year with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying high growth tech stocks like Infosys and others that are shaping India's future involves looking for companies with strong innovation capabilities and robust financial health to capitalize on these promising market conditions.

Top 10 High Growth Tech Companies In India

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Tips Music | 24.98% | 24.59% | ★★★★★★ |

Newgen Software Technologies | 21.66% | 21.71% | ★★★★★★ |

Coforge | 15.67% | 23.39% | ★★★★★☆ |

C. E. Info Systems | 29.31% | 26.39% | ★★★★★★ |

Firstsource Solutions | 12.35% | 20.03% | ★★★★★☆ |

Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

GFL | 44.50% | 49.42% | ★★★★★☆ |

Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Firstsource Solutions

Simply Wall St Growth Rating: ★★★★★☆

Overview: Firstsource Solutions Limited offers tech-enabled business process services across various regions including India, the United Kingdom, the United States, and several other countries, with a market capitalization of ₹233.40 billion.

Operations: Firstsource Solutions Limited generates revenue primarily from four segments: Banking and Financial Services (₹25.11 billion), Healthcare (₹22.27 billion), Communication, Media and Technology (₹14.76 billion), and Diverse Industries (₹3.75 billion). The company's operations span multiple regions, leveraging tech-enabled solutions to deliver business process services globally.

Firstsource Solutions has been actively expanding its operational footprint and technological capabilities, as evidenced by its recent establishment of a new headquarters in Australia, expected to create over 400 jobs. This move aligns with the company's strategy to leverage cutting-edge technologies like Microsoft Azure OpenAI Service for digital transformation services, enhancing client operations globally. Financially, Firstsource is poised for robust growth with a projected annual revenue increase of 12.4% and earnings growth of 20%, outpacing the Indian market averages of 10.2% and 17.4%, respectively. These initiatives underscore Firstsource’s commitment to integrating advanced AI solutions into its offerings, promising improved efficiency and personalized client experiences in diverse industries.

Nazara Technologies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nazara Technologies Limited, with a market cap of ₹68.68 billion, operates a gaming and sports media platform across India and various international markets including Africa, the Middle East, the Asia Pacific, and the United States.

Operations: Nazara Technologies generates revenue primarily from three segments: Gaming (₹3.90 billion), E-Sports (₹6.46 billion), and AD Tech Business (₹1.02 billion). The company operates in diverse international markets, leveraging its platform to target a broad audience across India, Africa, the Middle East, the Asia Pacific, and the United States.

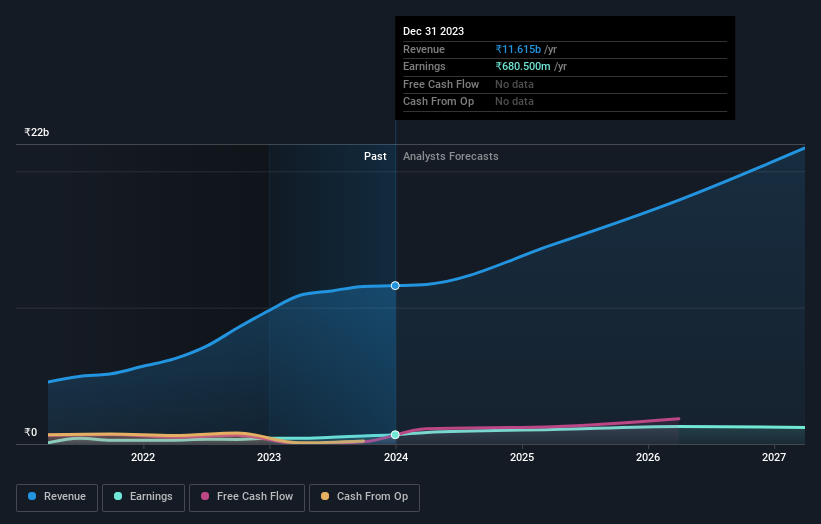

Nazara Technologies, a key player in India's tech scene, is navigating a transformative phase with strategic board and executive changes alongside significant financial maneuvers. Recently, the company approved a substantial private placement of over 9 million shares at INR 954.27 each, aiming to raise nearly INR 9 billion. This move underscores its aggressive expansion strategy and commitment to innovation, particularly in gaming and digital entertainment sectors where it has shown robust revenue growth of 17.9% annually. Furthermore, Nazara's earnings are expected to surge by an impressive 24.9% per year, outpacing the broader Indian market’s growth rates significantly. These developments reflect Nazara’s proactive approach in scaling operations and enhancing shareholder value through focused R&D investments and strategic market positioning.

Navigate through the intricacies of Nazara Technologies with our comprehensive health report here.

Examine Nazara Technologies' past performance report to understand how it has performed in the past.

Tech Mahindra

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tech Mahindra Limited offers information technology services and solutions across the Americas, Europe, India, and globally with a market capitalization of ₹1.50 trillion.

Operations: The company generates revenue primarily from IT Services, contributing ₹439.48 billion, and Business Process Outsourcing (BPO), which adds ₹78.94 billion.

Tech Mahindra, amidst a challenging landscape, has demonstrated resilience with a revenue growth forecast of 6.9% per year and an impressive earnings projection increase of 28.9% annually. These figures suggest a strategic realignment towards high-demand sectors such as digital transformation and cybersecurity, despite the broader market's faster pace. The company's commitment to innovation is evident from its R&D investments which have been pivotal in driving these growth metrics. Recent executive board changes and strategic partnerships, like the one with Northeastern University for ORAN and 6G tech advancements, underscore its proactive approach in maintaining competitiveness and adapting to rapid technological evolutions.

Where To Now?

Gain an insight into the universe of 39 Indian High Growth Tech and AI Stocks by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:FSL NSEI:NAZARA and NSEI:TECHM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com