Impro Precision Industries And 2 Other SEHK Dividend Stocks To Consider

As global markets react to escalating tensions in the Middle East and fluctuating oil prices, investors are keeping a close eye on Hong Kong's stock market, which has shown resilience amid these uncertainties. In this environment, dividend stocks can offer a potential source of steady income and stability, making them an attractive consideration for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 7.65% | ★★★★★★ |

China Construction Bank (SEHK:939) | 7.46% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 7.84% | ★★★★★☆ |

China Hongqiao Group (SEHK:1378) | 9.19% | ★★★★★☆ |

Bank of China (SEHK:3988) | 7.22% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 8.96% | ★★★★★☆ |

Lion Rock Group (SEHK:1127) | 8.09% | ★★★★★☆ |

PC Partner Group (SEHK:1263) | 8.83% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.52% | ★★★★★☆ |

China Shenhua Energy (SEHK:1088) | 7.38% | ★★★★★☆ |

Click here to see the full list of 95 stocks from our Top SEHK Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Impro Precision Industries

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Impro Precision Industries Limited supplies casting products and precision machining parts across the Americas, Europe, and Asia with a market cap of HK$4.06 billion.

Operations: Impro Precision Industries Limited generates revenue from Sand Casting (HK$901.74 million), Surface Treatment (HK$87.25 million), Investment Casting (HK$1.88 billion), and Precision Machining and Others (HK$1.76 billion).

Dividend Yield: 7.4%

Impro Precision Industries recently affirmed an interim dividend of HK$0.08 per share, supported by a payout ratio of 51.5% from earnings and 67.3% from cash flows, suggesting dividends are well-covered. However, its dividend history is unstable with only five years of payments and volatility over time. Trading at 41.5% below estimated fair value, the stock offers a high yield in Hong Kong's top quartile but lacks reliability due to inconsistent past payouts.

Shanghai Industrial Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Industrial Holdings Limited is an investment holding company involved in infrastructure and environmental protection, real estate, consumer products, and comprehensive healthcare operations across Hong Kong, China, the rest of Asia, and internationally with a market cap of HK$13.89 billion.

Operations: Shanghai Industrial Holdings Limited generates revenue from several segments, including Real Estate (HK$17.26 billion), Infrastructure and Environmental Protection (HK$9.42 billion), and Consumer Products (HK$3.59 billion).

Dividend Yield: 7.4%

Shanghai Industrial Holdings declared an interim dividend of HK$0.42 per share, maintaining last year's level despite declining sales and net income. The dividend yield is high at 7.36%, placing it among the top 25% in Hong Kong, but sustainability is questionable due to a lack of free cash flow coverage and historical volatility in payments. Although earnings cover the payout with a low ratio of 31.5%, past dividend reliability remains a concern for investors seeking stable income streams.

Tianjin Development Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tianjin Development Holdings Limited, with a market cap of HK$2.15 billion, operates through its subsidiaries to supply water, heat, thermal power, and electricity to industrial, commercial, and residential customers in the Tianjin Economic and Technological Development Area in China.

Operations: Tianjin Development Holdings Limited generates revenue from several segments, including Utilities (HK$1.51 billion), Pharmaceutical (HK$1.50 billion), Electrical and Mechanical (HK$176.09 million), and Hotel operations (HK$136.51 million).

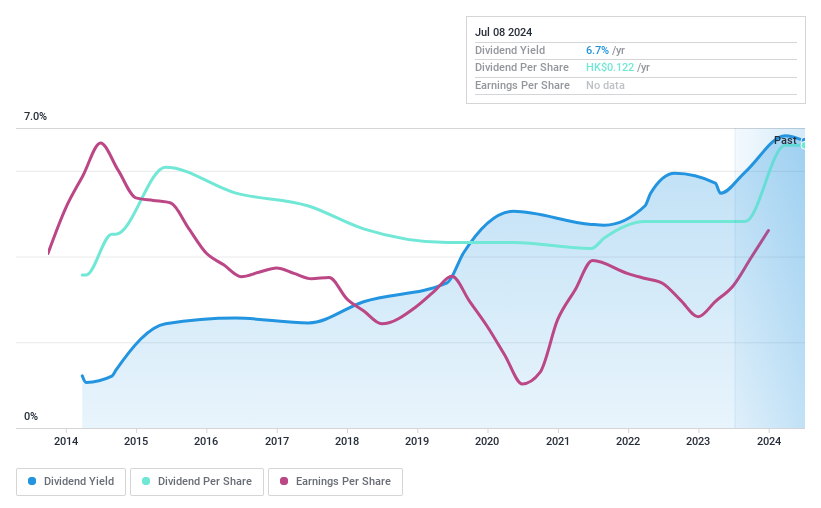

Dividend Yield: 7.0%

Tianjin Development Holdings announced an interim dividend of HK$0.0518 per share, with a yield of 6.99%, slightly below the top quartile in Hong Kong. Despite a decrease in net income to HK$288.08 million for H1 2024, dividends remain well-covered by earnings (payout ratio: 27.2%) and cash flows (cash payout ratio: 72.6%). The company has maintained stable and reliable dividends over the past decade, reflecting consistent growth and coverage despite recent earnings volatility due to large one-off items.

Key Takeaways

Delve into our full catalog of 95 Top SEHK Dividend Stocks here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1286 SEHK:363 and SEHK:882.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com