HVAC and Water Systems Stocks Q2 Results: Benchmarking Advanced Drainage (NYSE:WMS)

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Advanced Drainage (NYSE:WMS) and the best and worst performers in the hvac and water systems industry.

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

The 8 hvac and water systems stocks we track reported a solid Q2. As a group, revenues beat analysts’ consensus estimates by 2.3%.

Stocks--especially those trading at higher multiples--had a strong end of 2023, but this year has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts. However, hvac and water systems stocks have held steady amidst all this with share prices up 4.7% on average since the latest earnings results.

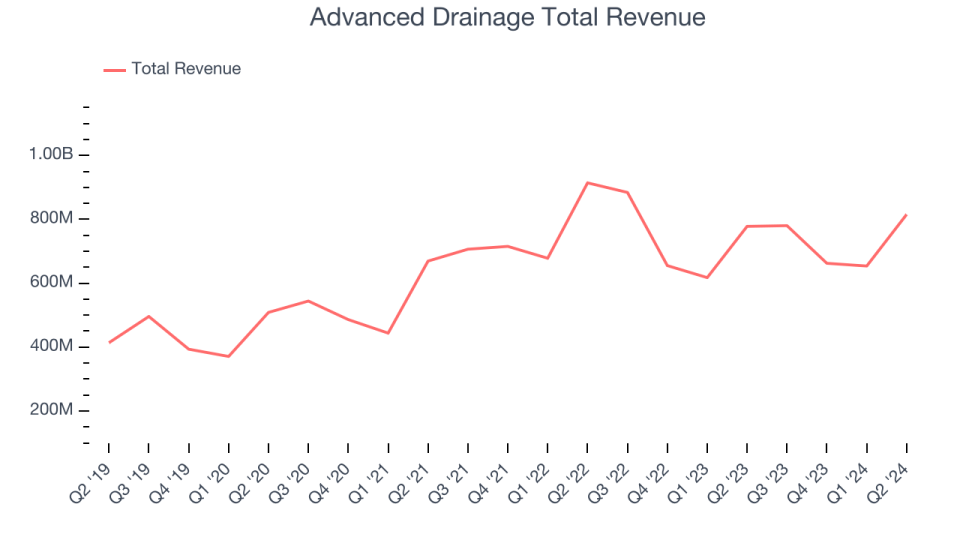

Weakest Q2: Advanced Drainage (NYSE:WMS)

Originally started as a farm water drainage company, Advanced Drainage Systems (NYSE:WMS) provides clean water management solutions to communities across America.

Advanced Drainage reported revenues of $815.3 million, up 4.8% year on year. This print fell short of analysts’ expectations by 2%. Overall, it was a weak quarter for the company with a miss of analysts’ Pipe revenue estimates and full-year revenue guidance missing analysts’ expectations.

Scott Barbour, President and Chief Executive Officer of ADS commented, “We are pleased with the fiscal first quarter results, which were right in line with the plan. Revenue growth was led by an 8% increase in Allied product sales and a 6% increase in sales from the Infiltrator business. Revenue in the domestic construction markets increased 6% overall, driven by volume growth in the non-residential, residential and infrastructure end markets at both ADS and Infiltrator. Infrastructure revenue remains a bright spot for the Company as we see the tailwind from the IIJA and ADS’ products gain market share in the segment.”

Advanced Drainage delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 9.7% since reporting and currently trades at $163.73.

Is now the time to buy Advanced Drainage? Access our full analysis of the earnings results here, it’s free.

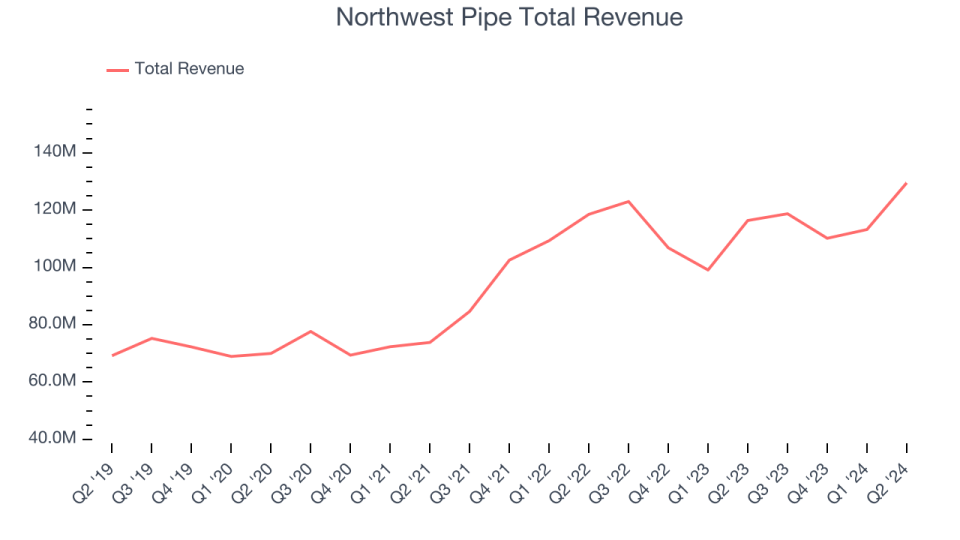

Best Q2: Northwest Pipe (NASDAQ:NWPX)

Playing a large role in the Integrated Pipeline (IPL) project in Texas to deliver ~350 million gallons of water per day, Northwest Pipe (NASDAQ:NWPX) is a manufacturer of pipeline systems for water infrastructure.

Northwest Pipe reported revenues of $129.5 million, up 11.3% year on year, outperforming analysts’ expectations by 8.7%. It was an incredible quarter for the company with an impressive beat of analysts’ earnings estimates.

The market seems happy with the results as the stock is up 18.7% since reporting. It currently trades at $45.27.

Is now the time to buy Northwest Pipe? Access our full analysis of the earnings results here, it’s free.

Carrier Global (NYSE:CARR)

Founded by the inventor of air conditioning, Carrier Global (NYSE:CARR) manufactures heating, ventilation, air conditioning, and refrigeration products.

Carrier Global reported revenues of $6.69 billion, up 11.6% year on year, falling short of analysts’ expectations by 5.4%. It was a weak quarter for the company with a miss of analysts’ organic revenue estimates and full-year revenue guidance missing analysts’ expectations.

Carrier Global had the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 7.3% since the results and currently trades at $70.80.

Read our full analysis of Carrier Global’s results here.

AAON (NASDAQ:AAON)

Backed by two million square feet of lab testing space, AAON (NASDAQ:AAON) makes heating, ventilation, and air conditioning equipment for different types of buildings.

AAON reported revenues of $313.6 million, up 10.4% year on year, surpassing analysts’ expectations by 10.5%. Zooming out, it was a stunning quarter for the company with an impressive beat of analysts’ earnings estimates.

AAON scored the biggest analyst estimates beat among its peers. The stock is up 8% since reporting and currently trades at $93.85.

Read our full, actionable report on AAON here, it’s free.

CSW (NASDAQ:CSWI)

With over two centuries of combined operations manufacturing and supplying, CSW (NASDAQ:CSWI) offers special chemicals, coatings, sealants, and lubricants for various industries.

CSW reported revenues of $226.2 million, up 11.2% year on year, surpassing analysts’ expectations by 4.9%. More broadly, it was an exceptional quarter for the company with a solid beat of analysts’ earnings estimates.

The stock is up 9% since reporting and currently trades at $326.46.

Read our full, actionable report on CSW here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.