Hotels, Resorts and Cruise Lines Stocks Q2 Earnings Review: Norwegian Cruise Line (NYSE:NCLH) Shines

As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the hotels, resorts and cruise lines industry, including Norwegian Cruise Line (NYSE:NCLH) and its peers.

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 15 hotels, resorts and cruise lines stocks we track reported a mixed Q2. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Inflation progressed towards the Fed's 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

In light of this news, hotels, resorts and cruise lines stocks have held steady with share prices up 2.5% on average since the latest earnings results.

Best Q2: Norwegian Cruise Line (NYSE:NCLH)

With amenities like a full go-kart race track built into its ships, Norwegian Cruise Line (NYSE:NCLH) is a premier global cruise company.

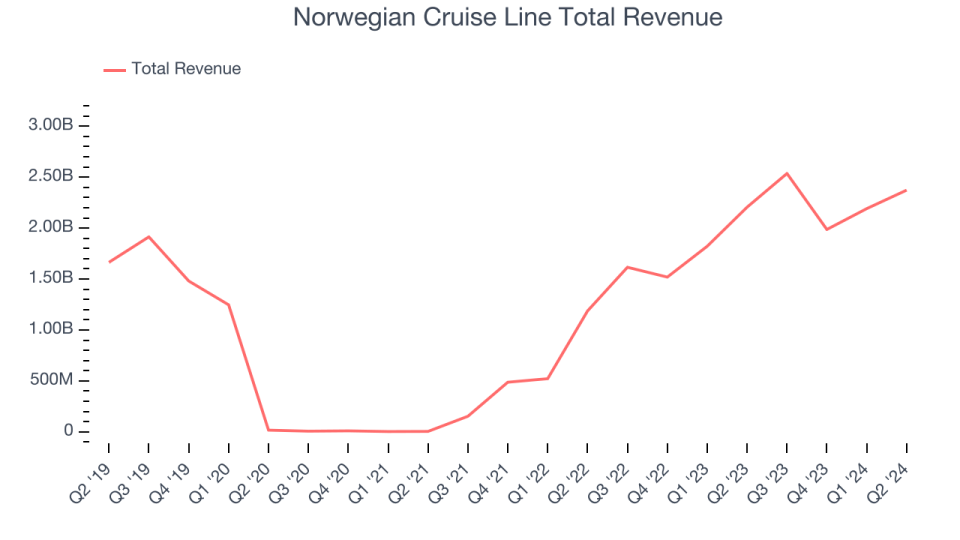

Norwegian Cruise Line reported revenues of $2.37 billion, up 7.6% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with optimistic earnings guidance for the full year and a solid beat of analysts’ earnings estimates.

“We enter the second half of 2024 with strong momentum, exceeding our guidance metrics in each quarter of 2024 on the back of strong execution. We continue to see robust demand heading into the back half of the year and are committed to improving efficiencies, reducing costs, and restoring our margins in a strategic and disciplined manner. Given our strong progress to date and current demand expectations, we are raising our 2024 full-year guidance for a third time this year for key metrics resulting in expected Adjusted EPS growth of 120% versus 2023, while keeping our cost guidance for the year unchanged at flat to prior year,” said Mark A. Kempa, executive vice president and chief financial officer of Norwegian Cruise Line Holdings Ltd.

Interestingly, the stock is up 7.7% since reporting and currently trades at $20.

Is now the time to buy Norwegian Cruise Line? Access our full analysis of the earnings results here, it’s free.

Carnival (NYSE:CCL)

Boasting outrageous amenities like a planetarium on board its ships, Carnival (NYSE:CCL) is one of the world's largest leisure travel companies and a prominent player in the cruise industry.

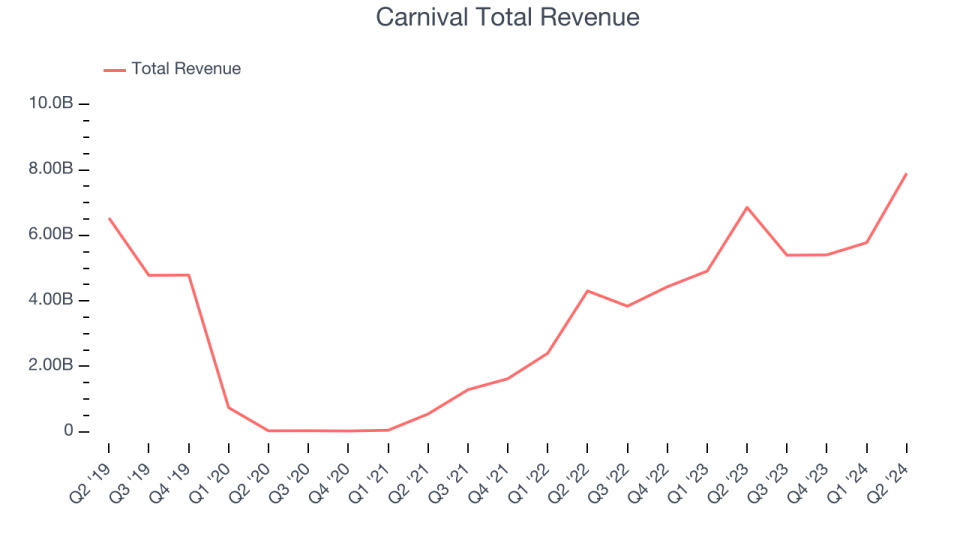

Carnival reported revenues of $7.90 billion, up 15.2% year on year, in line with analysts’ expectations. The business had a satisfactory quarter with optimistic earnings guidance for the full year.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 3.1% since reporting. It currently trades at $17.97.

Is now the time to buy Carnival? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Hilton Grand Vacations (NYSE:HGV)

Spun off from Hilton Worldwide in 2017, Hilton Grand Vacations (NYSE:HGV) is a global timeshare company that provides travel experiences for its customers through its timeshare resorts and club membership programs.

Hilton Grand Vacations reported revenues of $1.24 billion, up 22.6% year on year, falling short of analysts’ expectations by 7.7%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

Hilton Grand Vacations delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. As expected, the stock is down 6% since the results and currently trades at $36.29.

Read our full analysis of Hilton Grand Vacations’s results here.

Lindblad Expeditions (NASDAQ:LIND)

Founded by explorer Sven-Olof Lindblad in 1979, Lindblad Expeditions (NASDAQ:LIND) offers cruising experiences to remote destinations in partnership with National Geographic.

Lindblad Expeditions reported revenues of $136.5 million, up 9.4% year on year. This number was in line with analysts’ expectations. However, it was a softer quarter as it logged a miss of analysts’ earnings estimates.

The stock is up 21.7% since reporting and currently trades at $9.27.

Read our full, actionable report on Lindblad Expeditions here, it’s free.

Hilton (NYSE:HLT)

Founded in 1919, Hilton Worldwide (NYSE:HLT) is a global hospitality company with a portfolio of hotel brands.

Hilton reported revenues of $2.95 billion, up 10.9% year on year. This number was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also logged a decent beat of analysts’ operating margin estimates but underwhelming earnings guidance for the full year.

The stock is up 12.3% since reporting and currently trades at $232.50.

Read our full, actionable report on Hilton here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.