Here's Why You Should Retain Synchrony Financial Stock Now

Synchrony Financial SYF is well positioned for growth, driven by increasing net interest income, higher average loan receivables, and a decline in delinquencies. However, softer consumer spending could somewhat temper this progress.

Synchrony Financial — with a market cap of $20.5 billion — is a premier consumer financial services company that offers a wide range of credit products. Courtesy of solid prospects, this Zacks Rank #3 (Hold) stock is worth retaining in your portfolio at the moment.

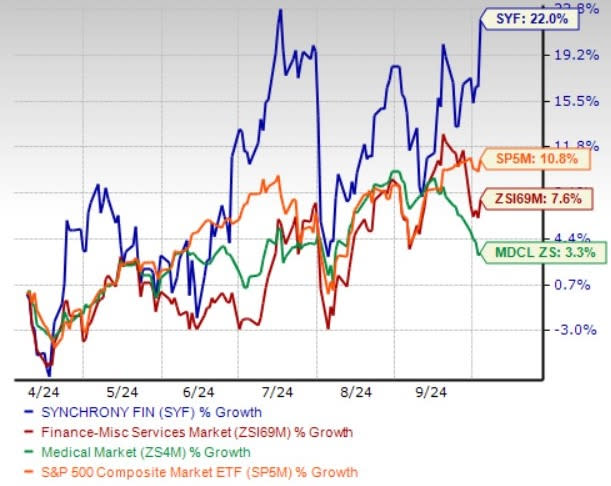

SYF's Price Performance

Shares of Synchrony Financial have soared 22% in the past six months, outperforming the industry, sector and the S&P 500 Index’s 7.6%, 3.3%, and 10.8% growth, respectively. Currently priced at $51.86, the stock is below its 52-week high of $52.67. This proximity underscores investors’ confidence and market optimism about this company’s prospects despite a slowdown in consumer spending. It has the ingredients for further price appreciation.

Image Source: Zacks Investment Research

SYF’s Key Tailwinds

Higher loan balances, a strong labor market and normalizing payment rates should further fuel growth in net interest income. The company’s Health & Wellness platform is expected to continue its growth track thanks to a solid CareCredit brand.

SYF’s focus on growing the brand with partnerships and collaborations is noteworthy. Its recent partnerships with PSIvet and DICK'S Sporting Goods strengthen its position in the market. By expanding CareCredit to over 5,500 veterinary practices and extending its long-standing relationship with DKS, SYF is poised to boost customer engagement through tailored financing options and reward programs, enhancing both loyalty and growth opportunities.

Higher loan balances and stable delinquencies would further help the company’s financials in the future. 30+ day and 90+ day delinquency rates have declined quarter to quarter in the second quarter of 2024. Although the year-over-year increase persists, it is moderating each quarter. These metrics provide a good understanding of SYF’s asset quality, which is an important characteristic in determining its growth in the coming days.

Dual and co-branded cards comprised 42.1% of the total purchase volume in the second quarter. Synchrony Financial is enhancing its core value proposition by expanding its product utility, enabling customers to use digital wallets, make out-of-partner purchases, and get rewarded. Moreover, the consensus mark for current-year net interest income is $17.9 billion, indicating a 5.5% rise from the prior-year reported number.

SYF’s Earnings Estimates

The Zacks Consensus Estimate for SYF’s 2024 earnings is pegged at $5.79 per share, which indicates an increase of 11.6% year over year. The estimate witnessed downward revisions over the past 60 days. The consensus mark for 2025 earnings suggests 3.2% year-over-year growth. SYF beat on earnings in three of the last four quarters and missed once, the average surprise being 2.8%. This is depicted in the graph below.

The consensus mark for 2024 and 2025 revenues indicates 4.7% and 3.7% year-over-year growth, respectively.

SYF’s Valuation

From a valuation perspective, Synchrony Financial is trading relatively cheap. Going by its price/earnings ratio, the company is trading at forward earnings multiple of 8.74X, lower than the industry average of 14.94X.

Key Risks

However, there are a few factors that investors should keep an eye on.

The company expects purchase volumes to decline flat to low single-digit year over year in the second half of 2024. Even though it expects the net charge-off rate in the second half to be lower than the first half of 2024, the metric is going to be worse than the previous year's figure of 4.87%. Nevertheless, we believe that a systematic and strategic plan of action will drive SYF’s growth in the long term.

Stocks to Consider

Some better-ranked stocks in the insurance space are Kemper Corporation KMPR, CNO Financial Group, Inc. CNO and Brighthouse Financial, Inc. BHF. Kemper sports a Zacks Rank #1 (Strong Buy), and CNO Financial and Brighthouse Financial carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kemper’s earnings surpassed the Zacks Consensus Estimate in two of the last four quarters, matched the mark once and missed the same on the remaining one occasion, the average surprise being 6.9%. The consensus estimate for KMPR’s 2024 earnings is pegged at $5.17 per share. A loss of 74 cents per share was incurred in the prior-year quarter. The consensus mark for KMPR’s earnings has moved 7.9% north in the past 60 days.

CNO Financial’s earnings surpassed estimates in three of the last four quarters and missed the mark once, the average surprise being 21.2%. The Zacks Consensus Estimate for CNO’s 2024 earnings indicates an 11% rise from the prior-year figure. The consensus mark for CNO’s 2024 earnings has moved 3% north in the past 60 days.

Brighthouse Financial’s earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 3.8%. The Zacks Consensus Estimate for BHF’s 2024 earnings indicates a 30% rise while the estimate for revenues implies an improvement of 3.9% from the respective prior-year figures. The consensus mark for BHF’s 2024 earnings has moved up 14.5% in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNO Financial Group, Inc. (CNO) : Free Stock Analysis Report

Kemper Corporation (KMPR) : Free Stock Analysis Report

Synchrony Financial (SYF) : Free Stock Analysis Report

Brighthouse Financial, Inc. (BHF) : Free Stock Analysis Report