Goldman Sachs: The Olympics won't save Brazil

The Olympics are always a time to celebrate the highest physical and mental achievements while celebrating cultural diversity. But according to Alberto Ramos and his team at Goldman Sachs, this doesn’t translate to economic prowess for the hosting country.

“These are not the happiest of times in Brazil as the economy is going through one of the longest and deepest economic contractions in recorded history, the unemployment rate has surged to double digits, and federal and local governments are grappling with deteriorating public finances,” he wrote in a note to clients.

Investment in Brazil relating to the 2014 FIFA Soccer World Cup and the upcoming 2016 Summer Olympic Games did pick up significantly.

The operating cost to run the events—sourced and funded by the private sector, including sponsors—is estimated to be about $2.4 billion, according to Ramos. Investment and expenses related to sports facilities and other projects are estimated to exceed $2.1 billion, about 60% of which is funded by the private sector. And projects that increase federal, state and municipal investment in infrastructure—like the expansion of subway lines—are estimated to cost $7.6 billion. The majority of these investments have been funded through public-private partnerships (PPPs), according to Garzarelli, with about 40% of the cost funded by private sector sources.

Nonetheless,Ramos notes that this investment is nowhere near large enough to boost the $1.8 trillion economy of Brazil.

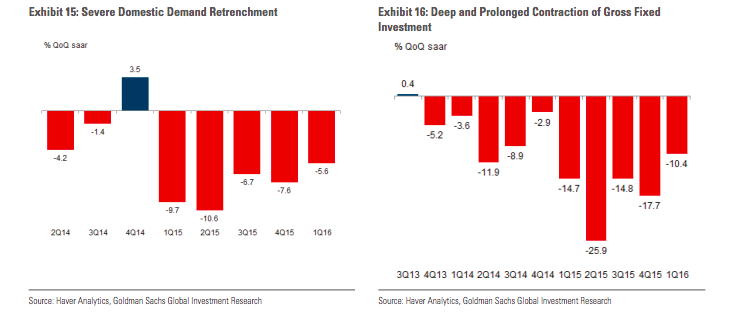

“We believe the World Cup and Olympics related investment was just too small to generate a significant economic dividend/impulse given the sheer size of the economy,” he wrote. “Furthermore, due to a number of large macroeconomic imbalances that have grown and permeated the economy and the severe drop in confidence indicators, total investment spending has actually been contracting uninterruptedly for 2 and a half years.”

Overall, gross fixed investment has declined by 27.0% between the fourth quarter of 2013 and the first quarter of 2016, now hovering at the same level as the second quarter of 2009.

Difficult economic times

Brazil went from strong single-digit growth 5 years ago to a deep 2-year economic recession that brought the GDP level to that of the fourth quarter in 2010, with a cumulative decline in per capita real GDP of 9%, according to Ramos.

This was due to a combination of domestic and external factors.

“The external backdrop turned less friendly: commodity prices declined, which resulted in a deterioration in Brazil’s terms of trade, and global liquidity conditions,” he said. “But the main driver of the sharp deterioration in the economy was the … interventionist domestic policy mix, which ended up creating a number of large imbalances. Expansionary fiscal and credit policies led to a meaningful decline in the savings rate of the economy and a deterioration in both the current account and the fiscal balances.”

This all comes as the country is struggling with the Zika epidemic.

A potential political light at the end of the tunnel

Meanwhile, Brazil is going through the early stages of a complex political transition. The 36th president of Brazil is suspended for an impeachment trial, with the final vote expected at the end of the summer.

“Given the economic performance of recent years and unsettled political backdrop, markets have invested a significant amount of hope in this transition, sustained by the expectation that it could lead to a macro policy regime-shift, and a more stable and cooperative political equilibrium,” Ramos wrote.

But the Brazilian markets have responded positive in recent months, on hopes that the administration could embrace reforms needed to rebalance the economy and move forward with much-needed reform, according to Ramos.

There are now some preliminary signs—including consumer confidence and business confidence measures—that recessionary forces are easing.

“This could be a prelude to the end of the recession and better days ahead, particularly if the recovery in sentiment is supported and hauled up by tangible measures to deepen the needed fiscal adjustment and rebalance the economy,” Ramos wrote.

In the end, as thousands of visitors enter Brazil, hope runs strong.

“As the country welcomes thousands of athletes and visitors and cheers the local favorites, it silently hopes that the soaring Olympic spirit will also help lift the animal spirits of the Brazilian economy and bring it back to the podium reserved for the top performers,” Ramos wrote.

And there’s one other positive to the land of Copacabana.

According to Ramos’ analysis, the hosting country gets a boost in gold medals during the competition.

“Our model predicts a 30% boost to Brazil’s overall medal tally relative to 2012 and a greater than 50% boost to gold alone—bringing their total to a record 22,” he wrote.

—

Nicole Sinclair is a markets correspondent at Yahoo Finance.

Read more Olympics coverage from Yahoo Finance:

How to follow the Rio Olympics from your smartphone

Facebook challenges Twitter with new Olympics features

The biggest business story at the Rio Olympics is this marketing rule change

Here’s what the stock market does during the Summer Olympics