German Exchange Growth Stocks With Insider Ownership Expecting Up To 51% Earnings Growth

As global markets respond to robust stimulus measures from China, the European market has shown resilience with Germany's DAX index surging over 4%. Amidst this backdrop, identifying growth companies with high insider ownership becomes particularly relevant as these firms often demonstrate strong confidence from those closest to their operations. In the current economic climate, stocks that exhibit significant insider ownership can be appealing due to the alignment of interests between company insiders and shareholders. This article will explore three such German growth stocks expecting up to 51% earnings growth.

Top 10 Growth Companies With High Insider Ownership In Germany

Name | Insider Ownership | Earnings Growth |

Stemmer Imaging (XTRA:S9I) | 24.8% | 23.2% |

Exasol (XTRA:EXL) | 25.3% | 117.1% |

Deutsche Beteiligungs (XTRA:DBAN) | 39.5% | 54.1% |

adidas (XTRA:ADS) | 16.6% | 41.8% |

pferdewetten.de (XTRA:EMH) | 26.8% | 97.9% |

Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

Stratec (XTRA:SBS) | 30.9% | 20% |

R. STAHL (XTRA:RSL2) | 37.9% | 59.3% |

Friedrich Vorwerk Group (XTRA:VH2) | 18.8% | 24.6% |

Your Family Entertainment (DB:RTV) | 17.3% | 124.4% |

Let's review some notable picks from our screened stocks.

adidas

Simply Wall St Growth Rating: ★★★★★☆

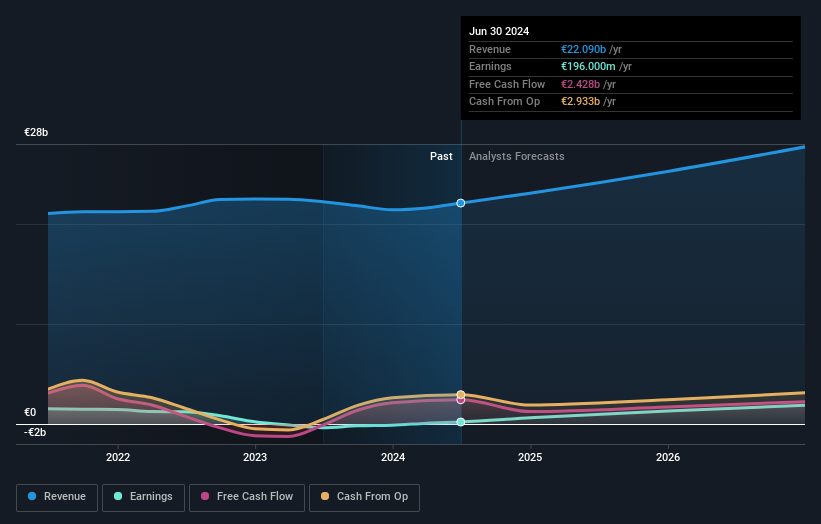

Overview: adidas AG, with a market cap of €41.57 billion, designs, develops, produces, and markets athletic and sports lifestyle products across Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific region, and Latin America.

Operations: The company's revenue segments include €3.26 billion from Greater China, €2.39 billion from Latin America, and €5.07 billion from North America.

Insider Ownership: 16.6%

Earnings Growth Forecast: 41.8% p.a.

adidas AG showcases strong growth potential with earnings forecasted to grow 41.85% annually, significantly outpacing the German market's 20.2%. The company reported robust second-quarter results, with sales reaching €5.82 billion and net income rising to €190 million from €84 million a year ago. Insider ownership remains substantial, supporting investor confidence. Despite facing unfavorable currency effects, adidas has raised its full-year guidance and expects operating profit around €1 billion for 2024.

Redcare Pharmacy

Simply Wall St Growth Rating: ★★★★☆☆

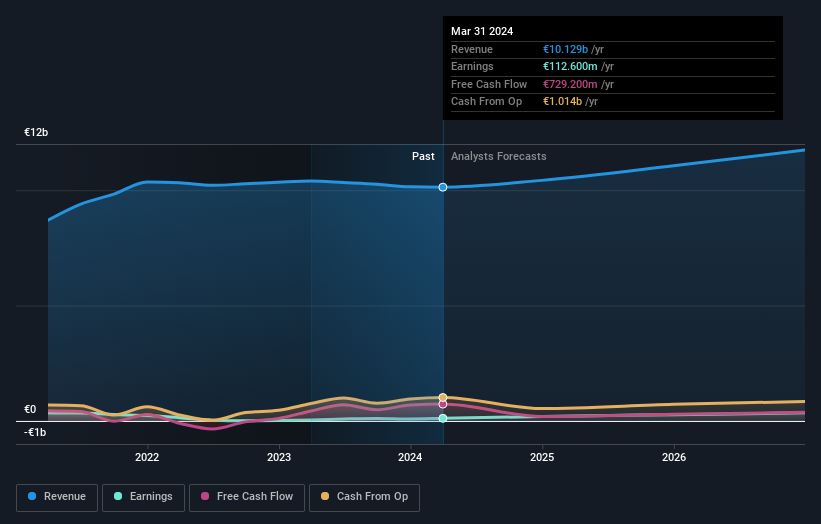

Overview: Redcare Pharmacy NV operates an online pharmacy business across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market cap of €2.74 billion.

Operations: The company's revenue segments include €1.74 billion from the DACH region and €391 million from International markets.

Insider Ownership: 17.4%

Earnings Growth Forecast: 51.8% p.a.

Redcare Pharmacy NV has demonstrated significant growth potential with half-year sales reaching €1.12 billion, up from €791.94 million a year ago, and a reduced net loss of €12.07 million compared to €14.78 million previously. Despite recent volatility in its share price and insider selling over the past three months, the company is expected to achieve profitability within three years with earnings forecasted to grow 51.83% annually, outpacing the German market's revenue growth rate of 5.4%.

Unlock comprehensive insights into our analysis of Redcare Pharmacy stock in this growth report.

Upon reviewing our latest valuation report, Redcare Pharmacy's share price might be too optimistic.

Zalando

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE operates an online platform for fashion and lifestyle products, with a market cap of approximately €7.45 billion.

Operations: The company's revenue segments include a Reconciliation of -€275 million and a Segment Adjustment of €10.49 billion.

Insider Ownership: 10.4%

Earnings Growth Forecast: 25% p.a.

Zalando SE, a growth company with high insider ownership, reported strong financial performance for Q2 2024 with sales of €2.64 billion and net income of €95.7 million, up from €56.6 million a year ago. Earnings are forecast to grow nearly 25% annually, outpacing the German market's 20%. Despite CFO Dr. Sandra Dembeck's upcoming departure, Zalando remains undervalued by approximately 50% relative to its estimated fair value and continues to exhibit robust profit growth.

Navigate through the intricacies of Zalando with our comprehensive analyst estimates report here.

Our valuation report unveils the possibility Zalando's shares may be trading at a premium.

Next Steps

Access the full spectrum of 22 Fast Growing German Companies With High Insider Ownership by clicking on this link.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include XTRA:ADS XTRA:RDC and XTRA:ZAL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com