First American Shares More Profits, Increases Dividend by 2%

First American Financial Corporation FAF recently announced an increase in its quarterly cash dividend, showcasing its commitment to rewarding its shareholders. This move is a testament to the insurer’s strong financial position and long-term growth prospects.

Approved by the board of directors, the regular quarterly dividend has now been increased to 53 cents per share of common stock from 52 cents. This increment represents a remarkable 2% rise over the previously declared rate.

Based on the stock’s Sept. 10 closing price of $65, the new dividend will yield 3.2%, which is better than the industry average of 0.3%. Also, the payout ratio of 58.4 compares favorably with the industry average of 6.5. This makes First American an attractive pick for yield-seeking investors. Shareholders of record on Sept. 20 will receive the increased dividend on Sept. 27.

Historically, FAF has a solid track record of dividend increase, with the metric witnessing an eight-year (2017-2024) CAGR of 6%.

Financial Strength and Capital Management

Besides regular dividend hikes, this provider of title insurance, settlement services and risk solutions remains committed to returning excess cash to shareholders through share repurchases. First American also engages in share buybacks. Pursuant to the share repurchase program approved by the board of directors in June 2022, First American may repurchase up to $400 million of FAF’s issued and outstanding common stock.

Cumulatively, as of June 30, 2024, First American had repurchased $230.4 million of its shares authorized under the share repurchase program and had the authority to repurchase an additional $169.6 million under that program. The dividend hike and increase in repurchase authorization reflect the insurer’s strong financial condition, liquidity and long-standing commitment to return capital to stockholders.

First American enjoys a strong liquidity position to enhance operating leverage. Its strong liquidity not only mitigates balance sheet risks but also paves the way for accelerated capital deployment.

As of June 30, 2024, the holding company’s sources of liquidity included $79.8 million of cash and cash equivalents and $900 million available on the company’s revolving credit facility. Management believes that liquidity at the holding company is sufficient to satisfy anticipated cash requirements and obligations for at least the next 12 months.

Robust operational performance, solid investment performance and strong capital management are likely to help FAF in sustaining the dividend streak.

Zacks Rank and Price Performance

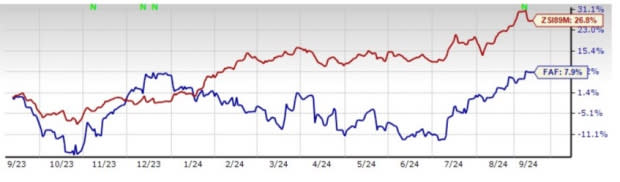

Shares of this Zacks Rank #3 (Hold) title insurer have gained 7.9% in the past year compared with the industry’s growth of 26.8%. FAF’s policy of ramping up growth and capital position should help the stock retain momentum.

Image Source: Zacks Investment Research

Other Insurers on the Same Path

MGIC Investment Corporation’s MTG board of directors approved a 13% hike in its quarterly dividend to return more profits to stockholders. The insurer will pay out 13 cents per share compared with the previous payout of 12 cents.

The insurer distributes wealth to its shareholders via dividend increases and share buybacks. This reflects continued strong mortgage credit performance and financial results and share price valuation levels that are expected to be attractive to generate long-term value for remaining shareholders. By virtue of capital contribution, reinsurance transaction and improving cash position, MTG has significantly improved its capital position. Its strong liquidity not only mitigates balance sheet risks but also paves the way for accelerated capital deployment.

The board of directors of American Financial Group AFG has increased the regular annual dividend to $3.20 per share of common stock from $2.84, which represents a remarkable 12.7% rise over the previously declared rate.

The robust operating profitability at the P&C segment, a stellar investment performance and effective capital management support effective shareholders return. AFG expects its operations to continue to generate significant excess capital throughout the remainder of 2024, which provides ample opportunity for additional share repurchases or special dividends over the next year.

Stock to Consider

Another better-ranked stock from the property and casualty insurance industry is Arch Capital Group Ltd. ACGL, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arch Capital’s earnings surpassed estimates in each of the last four quarters, the average surprise being 28.93%. Shares of ACGL have jumped 41.2% in the past year. The Zacks Consensus Estimate for ACGL’s 2024 and 2025 earnings implies year-over-year growth of 6.6% and 2.4%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

First American Financial Corporation (FAF) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report