Epwin Group And 2 Other Leading UK Dividend Stocks

Over the last 7 days, the United Kingdom market has remained flat, though it is up 6.6% over the past year with earnings forecast to grow by 14% annually. In this context of steady growth and positive earnings outlook, identifying strong dividend stocks like Epwin Group and others can be a strategic approach for investors seeking reliable income streams alongside potential capital appreciation.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 5.71% | ★★★★★★ |

4imprint Group (LSE:FOUR) | 3.09% | ★★★★★☆ |

OSB Group (LSE:OSB) | 8.41% | ★★★★★☆ |

Impax Asset Management Group (AIM:IPX) | 7.12% | ★★★★★☆ |

Man Group (LSE:EMG) | 6.06% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.05% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.75% | ★★★★★☆ |

NWF Group (AIM:NWF) | 5.06% | ★★★★★☆ |

DCC (LSE:DCC) | 3.92% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.53% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Epwin Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Epwin Group Plc manufactures and sells building products in the United Kingdom, Europe, and internationally with a market cap of £144.98 million.

Operations: Epwin Group Plc's revenue is primarily derived from its Extrusion and Moulding segment, which accounts for £233.30 million, and its Fabrication and Distribution segment, contributing £130.40 million.

Dividend Yield: 4.7%

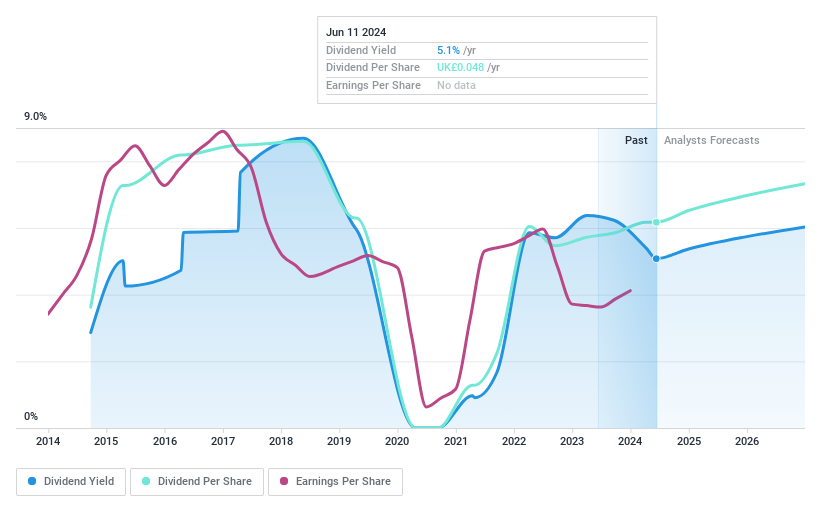

Epwin Group's recent dividend increase to 2.10 pence per share reflects a commitment to shareholder returns, supported by a low cash payout ratio of 27.4%, indicating dividends are well-covered by cash flows. Despite earnings coverage being higher at 77.5%, the company's dividend yield remains below top-tier UK payers. The stock has seen volatile dividend payments over the past decade, but recent buybacks and strategic financial management suggest a focus on stability and growth opportunities with £55 million available for acquisitions.

Burberry Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Burberry Group plc, along with its subsidiaries, is involved in the manufacturing, retailing, and wholesaling of luxury goods under the Burberry brand, with a market cap of approximately £2.36 billion.

Operations: Burberry Group's revenue is primarily derived from its Retail/Wholesale segment, which accounts for £2.91 billion, complemented by £63 million from Licensing.

Dividend Yield: 9.2%

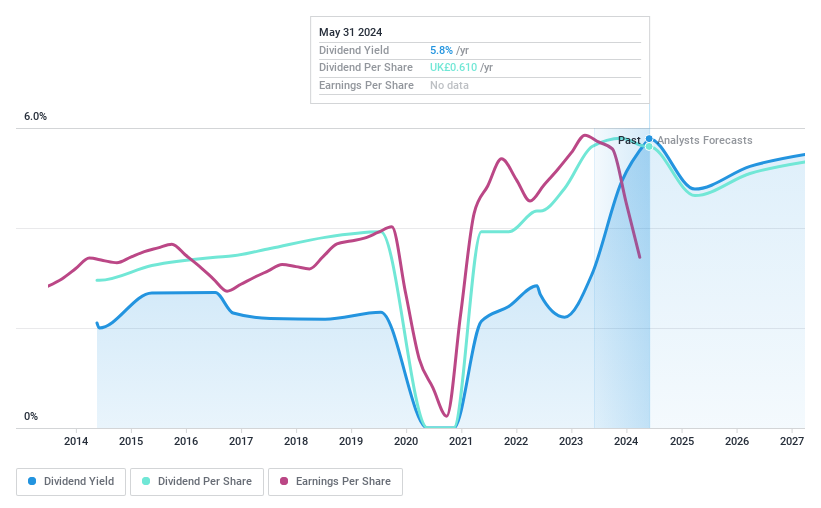

Burberry Group's dividends are covered by earnings and cash flows, with a payout ratio of 82.5% and a cash payout ratio of 73%. Despite being in the top 25% for UK dividend yield at 9.23%, the company's dividend history is volatile, reflecting instability over the past decade. Recent financial challenges include a drop in retail revenue to £458 million and negative comparable store sales, alongside management changes with Joshua Schulman appointed as CEO amidst strategic shifts.

TBC Bank Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates through its subsidiaries to offer banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan with a market cap of £1.43 billion.

Operations: The revenue segments for TBC Bank Group include GEL 2.13 billion from segment adjustments and GEL 236.42 million from Uzbekistan operations.

Dividend Yield: 7.8%

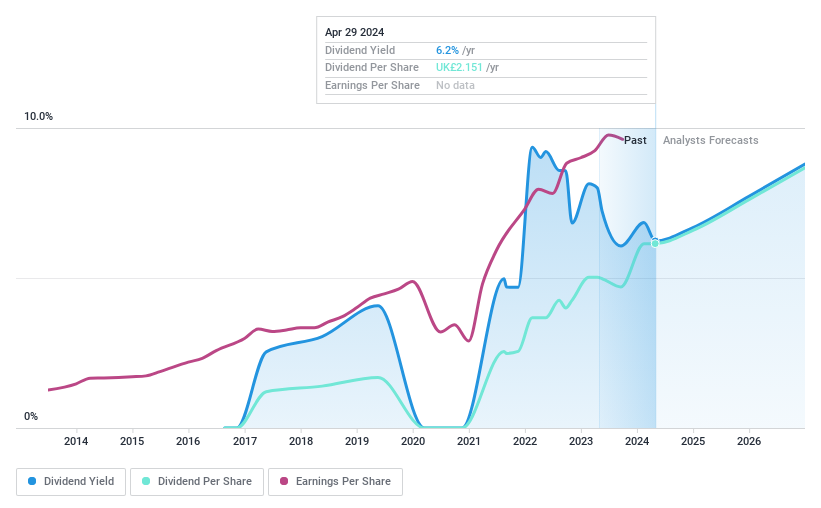

TBC Bank Group's dividend yield ranks in the top 25% of UK payers, supported by a low payout ratio of 32.6%, indicating strong coverage by earnings. Although dividends have been stable and growing, TBC has a short payment history of seven years. Recent interim dividend affirmations and robust earnings growth underscore financial health, with net income rising to GEL 617.4 million for H1 2024. Leadership changes include Giorgi Giguashvili's appointment as Company Secretary.

Where To Now?

Access the full spectrum of 60 Top UK Dividend Stocks by clicking on this link.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:EPWN LSE:BRBY and LSE:TBCG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com