The days of trying to 'haggle' over your cable TV fee are gone: analyst

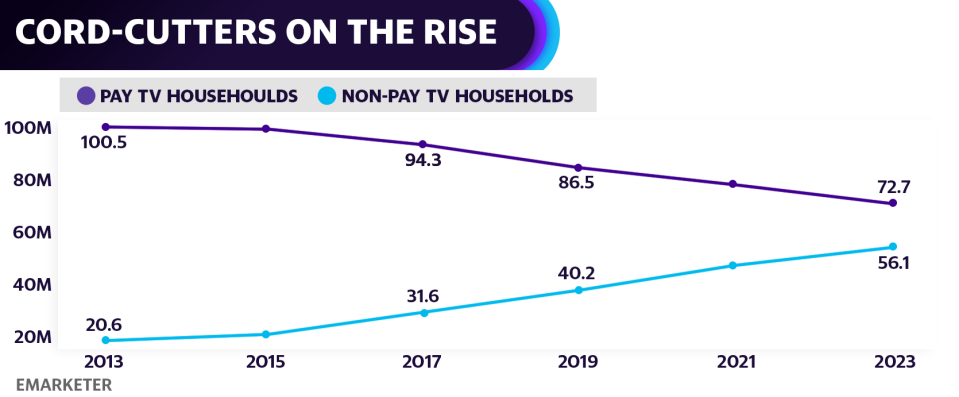

Americans’ wave of cord-cutting is climbing toward a landmark threshold — the number of U.S. homes without a pay TV subscription surpassing those that do.

A new report from eMarketer reveals a whopping 19.2% jump in households cutting the cord in 2019. That’s brought the total number of households with a pay TV subscription down to 86.5 million compared to 100.5 million just five years ago, according to the research firm. It estimates 21.9 million homes have now officially cut the cord.

The trend is rapidly turning up pressure on cable operators to prevent profits from bleeding away.

“The actual providers of cable — your Comcasts (CMCSA), your Cable ONEs (CABO), as well as your satellite providers — are actually raising prices, and removing people from promotional pricing,” Eric Haggstrom, the author of the eMarketer report, told Yahoo Finance’s The Ticker. “For many people, the days of calling your cable provider and trying to haggle for a better rate are gone.”

Recapturing lost audiences

Content giants also realize that time is not on their side. The time Americans spend watching TV will drop by 3.0% this year, according to eMarketer — with that rate two to three times higher for viewers under age 24.

“Various media companies like Disney (DIS) or WarnerMedia (T) are seeing this,” Haggstrom says. “While this hasn’t really affected their revenues too much yet, they’ve been able to make up for declining audiences through higher ad prices and higher carriage fees that they’re charging to the [pay TV providers].”

This temporary solution is giving media companies limited breathing room to ramp up their streaming services. “With Disney+ or HBO Max, they’re looking to recapture some of these lost audiences,” Haggstrom explains.

Haggstrom is optimistic about upcoming streaming offerings like Disney+, which will be available for $12.99 per month beginning in November.

“Disney+, with their recent bundle with Hulu, is a great competitor to Netflix,” Haggstrom argues. “There’s no single Netflix (NFLX) killer out there. But a bundle of Disney+, Hulu, and ESPN+ is a great competitor—especially given the price that’s cheaper than the most popular Netflix plan.”

The flood of new streaming services will only escalate cord-cutting and increase the difficulty for pay TV operators to turn a profit in Haggstrom’s view. “Disney, Apple and HBO are entering this market and pouring money into it,” he says. “They’re looking to the future.”

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.