Education Services Stocks Q2 Results: Benchmarking Adtalem (NYSE:ATGE)

Looking back on education services stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Adtalem (NYSE:ATGE) and its peers.

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

The 8 education services stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was 0.7% below.

After much suspense, the Federal Reserve cut its policy rate by 50bps (half a percent) in September 2024. This marks the central bank’s first easing of monetary policy since 2020 and the end of its most pointed inflation-busting campaign since the 1980s. Inflation had begun to run hot in 2021 post-COVID due to a confluence of factors such as supply chain disruptions, labor shortages, and stimulus spending. While CPI (inflation) readings have been supportive lately, employment measures have prompted some concern. Going forward, the markets will debate whether this rate cut (and more potential ones in 2024 and 2025) is perfect timing to support the economy or a bit too late for a macro that has already cooled too much.

While some education services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.6% since the latest earnings results.

Adtalem (NYSE:ATGE)

Formerly known as DeVry Education Group, Adtalem Global Education (NYSE:ATGE) is a global provider of workforce solutions and educational services.

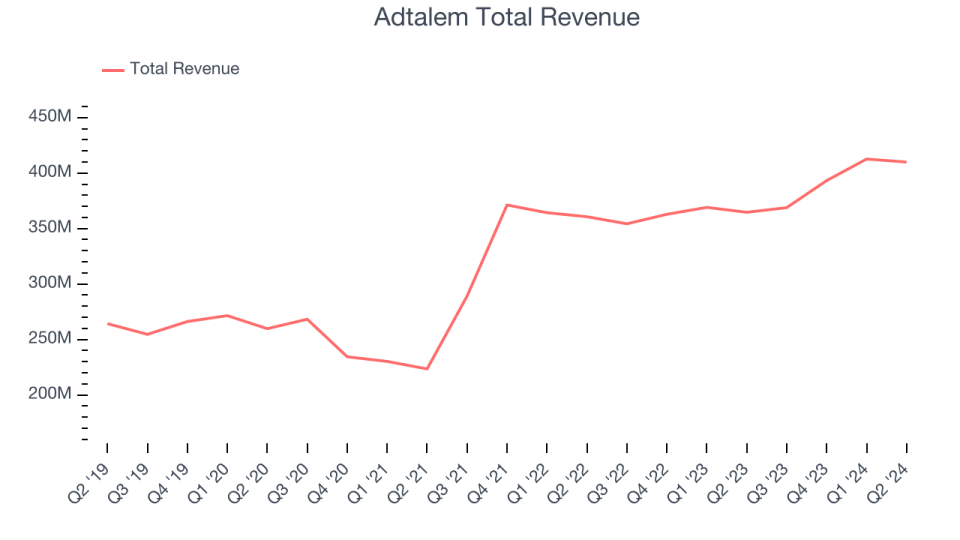

Adtalem reported revenues of $409.9 million, up 12.4% year on year. This print exceeded analysts’ expectations by 2.8%. Overall, it was a strong quarter for the company with a decent beat of analysts’ operating margin estimates and full-year revenue guidance beating analysts’ expectations.

“This year was a fundamental chapter in Adtalem's journey, further solidifying our market leading position in healthcare education. Through the rigorous implementation of our Growth with Purpose strategy, we have significantly broadened our impact culminating in 10% enrollment growth during the fourth quarter. This trajectory is a testament to our unwavering commitment to excellence,” said Steve Beard, president and chief executive officer, Adtalem Global Education.

Adtalem pulled off the highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 4.1% since reporting and currently trades at $77.70.

Is now the time to buy Adtalem? Access our full analysis of the earnings results here, it’s free.

Best Q2: Universal Technical Institute (NYSE:UTI)

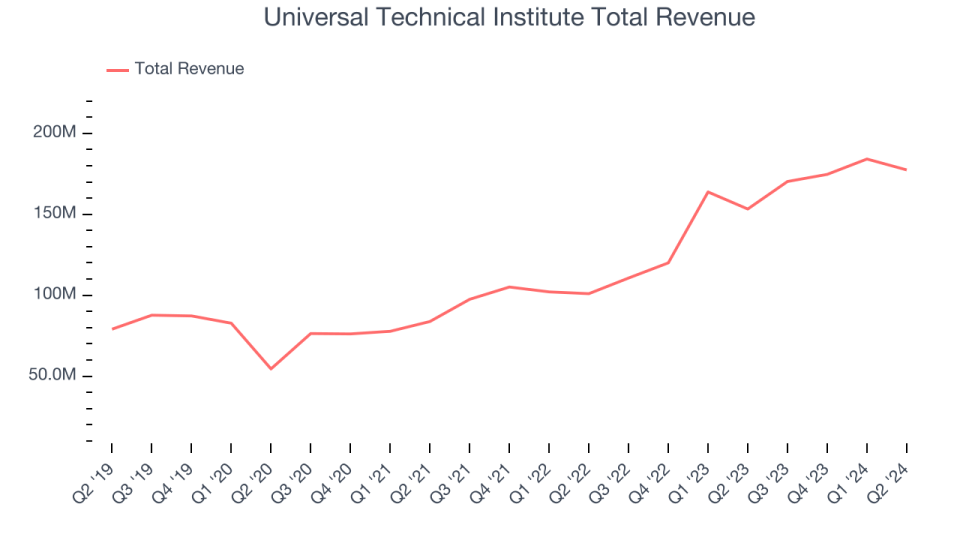

Founded in 1965, Universal Technical Institute (NYSE: UTI) is a leading provider of technical training programs, specializing in automotive, diesel, collision repair, motorcycle, and marine technicians.

Universal Technical Institute reported revenues of $177.5 million, up 15.8% year on year, outperforming analysts’ expectations by 2.7%. The business had a very strong quarter with an impressive beat of analysts’ earnings estimates and a decent beat of analysts’ operating margin estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 7.2% since reporting. It currently trades at $16.26.

Is now the time to buy Universal Technical Institute? Access our full analysis of the earnings results here, it’s free.

Lincoln Educational (NASDAQ:LINC)

Established in 1946, Lincoln Educational (NASDAQ:LINC) is a provider of specialized technical training in the United States, offering career-oriented programs to provide practical skills required in the workforce.

Lincoln Educational reported revenues of $102.9 million, up 16.1% year on year, exceeding analysts’ expectations by 2.3%. Still, it was a slower quarter as it posted a miss of analysts’ earnings estimates.

Interestingly, the stock is up 2.5% since the results and currently trades at $11.94.

Read our full analysis of Lincoln Educational’s results here.

Laureate Education (NASDAQ:LAUR)

Founded in 1998 by Douglas L. Becker and based in Miami, Laureate Education (NASDAQ:LAUR) is a global network of higher education institutions.

Laureate Education reported revenues of $499.2 million, up 8% year on year. This result topped analysts’ expectations by 3.2%. It was a strong quarter as it also recorded an impressive beat of analysts’ earnings estimates and a decent beat of analysts’ operating margin estimates.

The stock is up 7% since reporting and currently trades at $16.61.

Read our full, actionable report on Laureate Education here, it’s free.

Bright Horizons (NYSE:BFAM)

Founded in 1986, Bright Horizons (NYSE:BFAM) is a global provider of child care, early education, and workforce support solutions.

Bright Horizons reported revenues of $670.1 million, up 11.1% year on year. This number was in line with analysts’ expectations. It was a strong quarter as it also recorded an impressive beat of analysts’ operating margin estimates and a solid beat of analysts’ earnings estimates.

Bright Horizons had the weakest performance against analyst estimates among its peers. The stock is up 19% since reporting and currently trades at $140.70.

Read our full, actionable report on Bright Horizons here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.