Is e.l.f. Beauty Stock a Buy, Sell or Hold at a P/E Multiple of 28.8X?

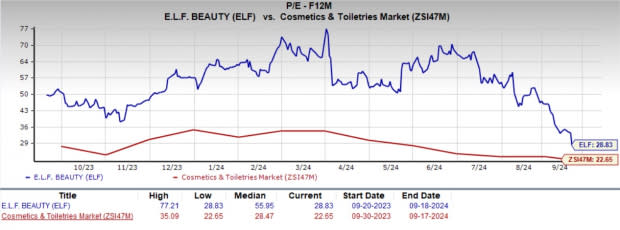

e.l.f. Beauty, Inc. ELF is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 28.83, higher than the industry average of 22.65 and the S&P 500’s 21.55. This inflated valuation suggests that the market is pricing in high growth expectations, but it also raises questions about whether the company can deliver results that justify such a premium. ELF's Value Score of F adds to these concerns.

Image Source: Zacks Investment Research

Shares of e.l.f. Beauty have plummeted 45.2% in the past three months compared with the industry’s decline of 23.4%. The cosmetic and skin care product company trailed the broader Zacks Consumer Staples sector and the S&P 500's respective growth of 8.4% and 2.6% during the same period. ELF is also trading below its 50 and 200-day moving averages, indicating potential weakness in the stock's momentum.

Image Source: Zacks Investment Research

While a high valuation and the stock's recent underperformance suggest caution, the company's strong brand and long-term growth prospects may still appeal to investors.

Current Pressures on e.l.f. Beauty

Despite its strong market position, ELF faces significant competition from major players like The Estee Lauder Companies EL and Coty COTY. The beauty industry, particularly in the color cosmetics and skincare segments, remains highly competitive. e.l.f. Beauty's expansion into new categories like foundation, where its share remains less than 2%, indicates that it still underperforms in crucial categories. Competing against both mass-market and prestige brands that dominate this space could hinder faster growth.

With broader economic uncertainties looming, including inflationary pressures and soft consumer spending, e.l.f. Beauty could face headwinds from a weaker retail environment. If consumers cut back on discretionary spending, beauty products, particularly in the color cosmetics segment, might experience slower sales growth. While e.l.f. offers value-oriented products, the prolonged economic uncertainty could still dampen overall demand.

On its first-quarter fiscal 2025 earnings call, e.l.f. Beauty stated that its second-quarter performance is expected to face strong comparisons from the previous year. The gross margin for the second quarter is expected to remain stable compared to the previous year due to the timing of retailer activities and costs associated with space expansion.

ELF plans to increase its marketing and digital investments in the second quarter, with expenditures projected to rise from approximately 21% of net sales last year to a higher level. This increase is part of e.l.f. Beauty's strategy to boost growth through enhanced brand visibility and digital engagement.

However, this additional spending is likely to impact the adjusted EBITDA margin, which may be constrained to the low teens for the second quarter. Significant margin improvements are only anticipated to materialize in the latter half of the fiscal year as marketing expenses normalize and the Naturium acquisition completes a year in October.

e.l.f. Beauty’s Estimates: What’s on the Horizon?

The Zacks Consensus Estimate for EPS has seen downward revisions. Over the past 30 days, analysts have lowered their estimates for the current and next fiscal year by a penny each to $3.53 per share and $4.47, respectively. This downward adjustment reflects a negative sentiment among analysts and suggests potential challenges in achieving projected profitability.

Image Source: Zacks Investment Research

Can Growth Initiatives Turn the Tide for ELF?

e.l.f. Beauty has earned a solid reputation for delivering exceptional sales and market share growth consistently. In the first quarter of fiscal 2025, the company reported a 50% rise in net sales, marking its 22nd consecutive quarter of sales and market share expansion. This success is attributed to its innovative product lineup, effective distribution channels, strategic marketing and keen understanding of consumer trends.

A major driver of e.l.f. Beauty’s growth is its commitment to innovation. The company has secured leading positions in color cosmetics, holding the top or second spot in 18 categories, which account for more than 80% of its cosmetics sales. Recent product launches, such as the Soft Glam Satin Foundation and new Naturium offerings, have garnered strong sales and positive consumer feedback, highlighting the effectiveness of its innovation-driven approach.

e.l.f. Beauty is actively expanding its retail presence and distribution channels to enhance brand visibility and accessibility. Strategic partnerships with major retailers like Target TGT and Ulta Beauty have secured prime shelf space in key markets. At Target, e.l.f. Beauty has been the top brand for six consecutive quarters, with its market share rising from 13% to more than 20%. By diversifying its retail channels, the company aims to strengthen its market position and reach a broader customer base.

Recognizing the surge in online shopping, e.l.f. Beauty has invested heavily in improving its digital and e-commerce platforms. The company is enhancing its website experience, optimizing mobile interfaces and deploying digital marketing strategies to boost online sales and customer engagement. These efforts are crucial for expanding its reach and driving growth in the competitive digital beauty landscape.

e.l.f. Beauty's focus on streamlining operations, optimizing the supply chain and managing costs has played a significant role in its growth trajectory. These initiatives have enabled the company to maintain robust margins despite broader economic challenges.

Investor Strategy for e.l.f. Beauty

e.l.f. Beauty's elevated valuation and recent underperformance relative to peers are concerning. The company is contending with significant industry competition and fluctuating consumer spending. Although increased marketing and digital investments might pressure short-term margins, they could pave the way for future growth. With a solid track record of growth, innovative products and strategic expansions, e.l.f. Beauty shows potential for long-term success. Current investors should retain their positions in ELF stock, while new investors might wait for a more favorable entry point.

e.l.f. Beauty currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report