Coronavirus update: Case surges spark fear in markets globally; experts wary about a vaccine by the end of the year

Global markets slid Wednesday as a mix of factors increase uncertainty for investors, including the upcoming U.S. election and spiking coronavirus cases in both Europe and the U.S.

Countries including Spain and France are experiencing sharp rises in cases, and France and Germany are likely to announce new lockdown measures to help curb the second wave.

Globally, cases have surpassed 44 million Wednesday, with deaths hovering at 1.1 million. In the U.S. more than 8.7 million have been affected and nearly 227,000 have died.

Parts of the U.S. are also exploring or implementing stricter measures as infections continue to rise at a pace of more than 80,000 cases daily.

El Paso, Texas, and Newark, N.J., are among the cities implementing such measures. Newark announced businesses will face 8 p.m. closures beginning Tuesday, after El Paso implemented a 10 p.m. curfew and stay-at-home orders for two weeks on Sunday.

In addition to lockdown fears, the outcome of the U.S. election, and possibility of a contested election, are hanging over investor sentiment.

Investopedia editor-in-chief Caleb Silver told Yahoo Finance Wednesday that a recent survey showed even more than the lockdowns, the election and aftermath are a reason for volatility.

“Even more than a resurgence in COVID, they’re concerned about the presidential election, they’re concerned about the aftermath to the presidential election— the potential social unrest,” Silver said.

Meanwhile, hopes pinned on a vaccine to help return life to normal had helped buoy markets, but science and health experts remain wary about a vaccine being authorized by the end of the year — and what that means for 2021.

In an op-ed in USA Today, the U.S. Food and Drug Administration’s (FDA) lead person on vaccines, Dr. Peter Marks, defended and explained the vaccine approval process — especially the 50% efficacy benchmark the FDA established.

“Of course, it is hoped that the vaccines will prevent a much higher percentage of cases, but the 50% figure establishes the minimum efficacy of a COVID-19 vaccine that FDA could find acceptable,” Marks said.

Marks previously declared he would resign if political pressure resulted in a premature authorization of a vaccine.

What a 50% effectiveness translates to is that at least 50% of the population receiving a vaccine would be protected, according to UC Davis Health CEO Dr. David Lubarsky.

“The vaccine is not going to fix this problem,” Lubarsky told Yahoo Finance Tuesday.

“If you just run the numbers, you need 60% of people to be immunized or infected in order to get to herd immunity. We have 330 million people in the U.S. That means 200 million either need to be effectively vaccinated or have the disease,” Lubarsky said, explaining that 50% efficacy rate would mean 10% of the population would need to be infected — which is the current rate — and 100% of the population, or all 330 million, would need to be vaccinated to provide protection for 50% of the population.

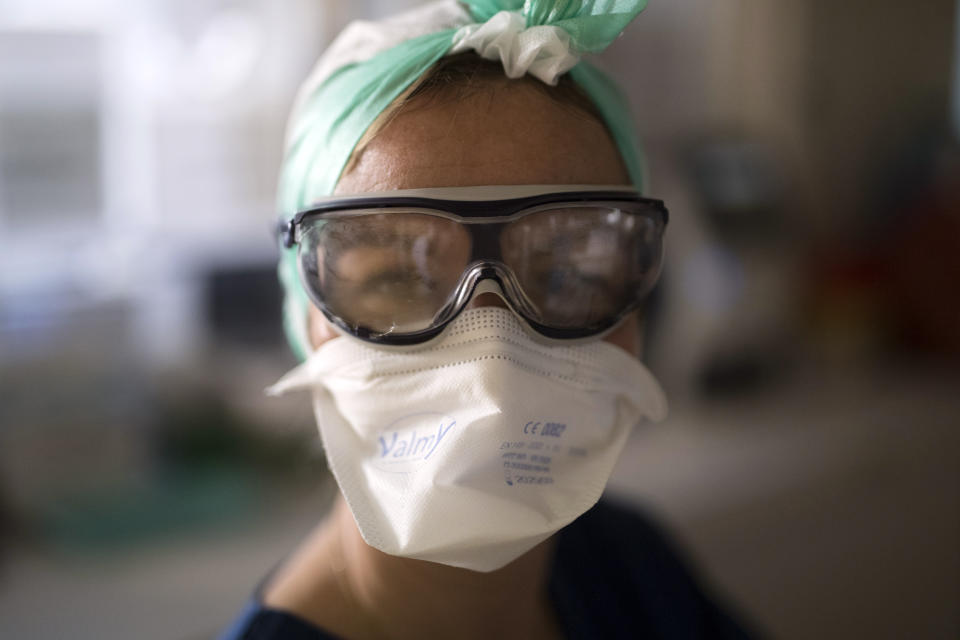

“There is no way that is happening,” he said. “Not only will it not happen this year, it may not happen the subsequent year. So we all have to get used to wearing masks.”

Even the CEO of Pfizer (PFE), who had been confident of early results being available by the end of the month, hedged in an earnings call Tuesday.

“I'm not bullish that the vaccine will work, I'm cautiously optimistic that the vaccine will work,” Pfizer’s Albert Bourla said Tuesday, borrowing the phrase oft-used by the. U.S. top epidemiologist Dr. Anthony Fauci.

Meanwhile, treatments, which have not received as much funding or attention, are also in focus as a potential stop-gap for the virus. To that end, Operation Warp Speed announced it would purchase 300,000 doses of Eli Lilly’s (LLY) antibody treatment for $375 million in advance. The agreement also gives the government a chance to purchase up to 650,000 more doses until June 2021, for up to $812.5 million.

Eli Lilly recently said its treatment was not effective in severe COVID-19 patients, and therefore applied for an emergency use authorization for mild to moderate patients this month.

More from Anjalee:

Fauci: Vaccines will only prevent symptoms, not block the virus

India's tech giants navigate 'literally spiking' WFH demand, H1-B fears in coronavirus era

How protests spurred Corporate America into action on race, inequality

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube.