Retail sales plunge a record 16.4% in April amid COVID-19

With the majority of the country still under strict stay-at-home mandates as a result of the COVID-19 pandemic, U.S. consumer activity took another massive blow in April following a record plunge in March.

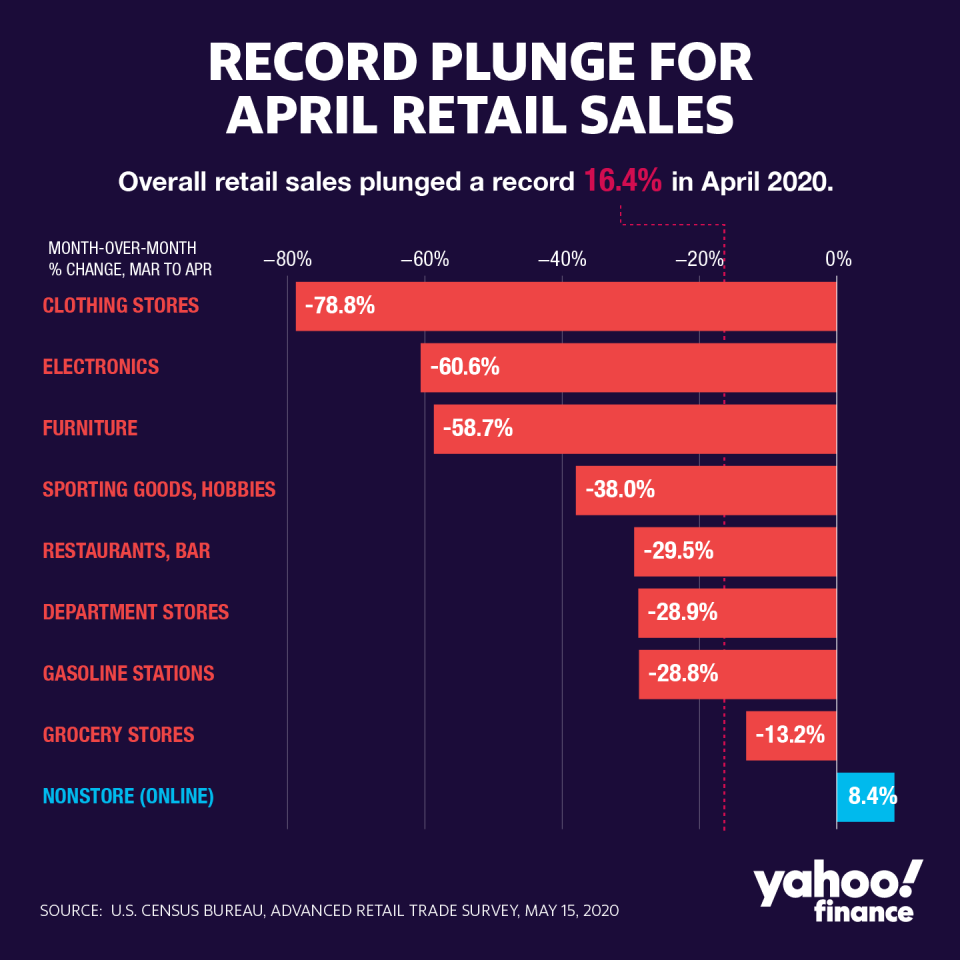

Headline retail sales nosedived a record 16.4% in April which was much worse than the 12% plunge expected by economists. March retail sales was revised to a decline of 8.4% from the previously reported 8.7% decrease. Core retail sales, excluding the volatile auto and gas components, tumbled 16.2% following a decrease of 2.8% in the prior month. Economists were predicting a 7.6% drop in core retail sales for the month.

Within core components, consumer spending online rose 8.4% and fell 13.2% at grocery stores in April. Sales at department stores sank 28.9%, furniture stores saw a 58.7% drop in spending, sporting goods sales fell 38%, sales at electronics stores tumbled 60.6% and spending at clothing retailers plummeted the most at 78.8%.

Meanwhile non-core components also saw some hefty declines in activity in April. Auto and auto parts sales plunged 12.4% and gas sales fell 28.8%. Sales from food services was down 29.5% and spending on building materials decreased 3.5%.

“Consumers couldn't get out to shop last month as the pandemic virus fight kept them at home, and the result is an economy that has simply collapsed. We have never seen economic data like this before in history. It is sobering if not downright scary,” MUFG economist Chris Rupkey wrote in an email Friday.

“If you were looking for a bottom to the recession or light at the end of the tunnel, it isn't to be found in today's retail sales report. The states may be opening back up in May, but consumers are going to be slow to reengage and spend like they did just a few months ago when the economy was the best in 50 years,” Rupkey added.

Consumer spending represents about 70% of GDP and was considered the bright spot within the U.S. economy prior to the COVID-19 outbreak. Though there have been and will likely be sharp declines in consumer activity in the near term, economists generally expect improvement in the coming months.

“This report was always going to be terrible, but it likely marks the floor, given the gradual reopening now underway or soon to be underway in 42 states,” Pantheon Macroeconomics Chief Economist Ian Shepherdson said in an email Friday. “We expect a modest increase in in May sales and then a bigger jump in June, but sales will remain well below their pre-Covid peak.”

Wells Fargo economist Jay Bryson echoed Shepherdson’s prediction, “If the government’s preferred forecasts are right, and the virus retreats quickly this summer, the broader reopening and pent-up demand suggest the retailers who have been able to survive the shutdown should see sales normalize in the second half of the year.”

According to Bank of America debit and credit card transaction data, consumer activity improved meaningfully in May. “Total card spending is now running at a pace of -10% yoy over the 5- day period of May 3- May 7, a big shift from the low of -36% yoy during the last 5 days of March,” the firm wrote in a note Wednesday.

Bank of America outlined two key reasons for the recent improvement. First, stimulus checks started to get distributed around mid-April through direct deposits which was then followed by paper checks. Second, after weeks of unsuccessful attempts at filing unemployment claims, backlogs have been processed in many states.

As of Friday morning, there were more than 4.4 million coronavirus cases and 302,000 deaths worldwide, according to Johns Hopkins University data. In the U.S., there were 1.42 million cases and 85,900 deaths.

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

Jobless claims: Another 2.98 million Americans file for unemployment benefits

Jobless claims: Another 3.169 million Americans file for unemployment benefits

Find live stock market quotes and the latest business and finance news

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.