Should You Buy, Hold or Sell Costco Stock After Q4 Earnings?

Costco Wholesale Corporation COST reported its fourth-quarter fiscal 2024 results last week, sparking fresh debate among investors about the stock's future direction. As a dominant player in the retail sector, Costco has long been known for its stability and strong customer base, even in the face of broader economic headwinds. Now that its latest earnings are out, investors are contemplating whether to increase their stake or hold tight to their current investments.

Breaking Down Costco's Performance: A Mixed Bag of Results

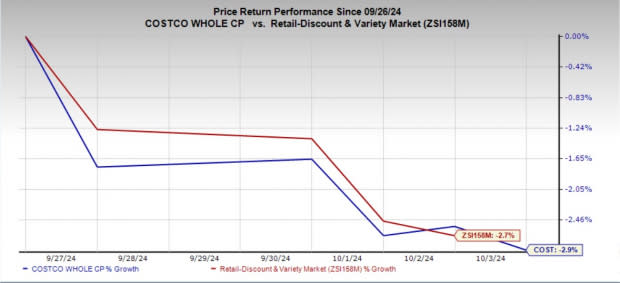

Shares of Costco have declined 2.9% since its fourth-quarter earnings release. This drop can be attributed, in part, to the prevailing negative sentiment in the market driven by ongoing geopolitical tensions, as well as Costco’s mixed performance in the last reported quarter.

Image Source: Zacks Investment Research

While the quarterly earnings exceeded the Zacks Consensus Estimate, revenues fell short of the same. Investors also took note of the moderated pace of comparable sales growth, which suggests a more cautious consumer environment. (Read: Costco Q4 Earnings Beat Estimates Even Though Revenues Miss)

There was a slight dip in the U.S. and Canada renewal rates to 92.9% in the fourth quarter from 93% in the preceding quarter, although this is expected to normalize. Membership fees saw modest growth of 0.2% in the quarter. However, when adjusted for the extra week in the last fiscal and foreign exchange impacts, membership fees grew 7.4%.

Costco ended the quarter with 76.2 million paid household members, up 7.3% from the prior year. Executive memberships, a more profitable category for Costco, grew by 9.6% year over year to reach 35.4 million, now accounting for 46.5% of all paid members and driving 73.5% of worldwide sales. The company's commitment to value and quality has fostered strong loyalty among members.

How Consensus Estimates Stack Up for Costco Post Q4 Earnings

Reflecting the positive sentiment around Costco, the Zacks Consensus Estimate for earnings per share has seen upward revisions. Over the past seven days, analysts have increased their estimates for both the current and next fiscal year by 0.5% to $17.73 and 0.8% to $19.29 per share, respectively. These estimates indicate expected year-over-year growth rates of 10.1% and 8.8%, respectively.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Image Source: Zacks Investment Research

Why Analysts Are Optimistic About Costco Stock

Costco’s resilient business model, centered around a membership-based structure, continues to be a major growth driver. The company’s high membership renewal rates, coupled with its efficient supply chain management and bulk purchasing power, ensure competitive pricing. This robust model has allowed Costco to thrive, even during economic downturns.

Members pay an annual fee for access to Costco's warehouses, where they can purchase goods at significant discounts. This model not only ensures a steady inflow of revenues but also creates a sense of exclusivity and value among its members. The company's recent increase in membership fees is likely to play a key role in future performance, potentially boosting revenues but also testing customer loyalty.

Costco continuously adapts to market trends and consumer preferences. The company regularly updates its product offerings to include a mix of everyday essentials and unique, high-demand items. Through market analysis and tailored offerings, Costco has expanded its presence, both domestically and internationally.

In fiscal 2024, the company successfully opened 30 new warehouses, including one relocation. With plans to add 29 warehouses, including three relocations in fiscal 2025, the company aims to enhance its market presence and drive top-line growth. The Zacks Consensus Estimate for sales for fiscal 2025 and 2026 suggests growth of 7.5% and 6.5%, respectively.

Costco's digital and e-commerce initiatives continue to gain traction, contributing to overall sales growth. The company registered e-commerce comparable sales growth of 18.9% in the fourth quarter. Deliveries through Costco Logistics rose 29% year over year in fiscal 2024. As more consumers shift to online shopping, Costco is positioning itself to capture a greater market share.

Competitive Landscape: Can Costco Stay Ahead?

Costco's impressive sales figures are part of a larger retail picture where competition is intensifying. Rivals like Walmart WMT and BJ’s Wholesale Club BJ, which also cater to value-conscious consumers, are investing in expanding their e-commerce capabilities and enhancing customer experience. Amazon AMZN continues to dominate online shopping, pushing traditional retailers to innovate rapidly.

With the decline of stimulus-driven spending, the industry finds itself at a pivotal juncture. Underlying Inflationary pressures are causing consumers to be more judicious with their disposable income, affecting various merchandise categories and creating hurdles for retailers.

It is essential to acknowledge the presence of the aforementioned headwinds, which may pose challenges to Costco's stock. Moreover, margins remain a critical area to monitor, with potential concerns stemming from any deleverage in the selling, general and administrative (SG&A) rate. In the last reported quarter, the company raised wages in the United States and Canada, which added pressure to its SG&A expenses.

Valuation: Is Costco's Stock Price Justified?

Costco stock has been a standout performer, with shares rallying 22.7% over the past six months, outpacing the industry's rise of 10.2%. This impressive growth underscores investor confidence in Costco’s business model.

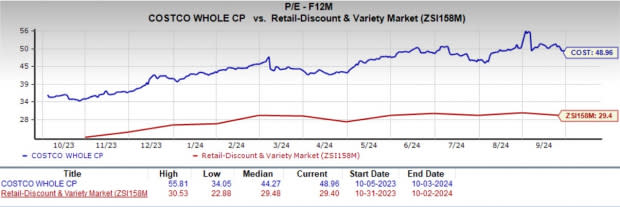

Image Source: Zacks Investment Research

However, the stock is trading at a significant premium to its peers. Costco's forward 12-month price-to-earnings ratio stands at 48.96, higher than the industry’s ratio of 29.4 and the S&P 500's ratio of 21.57.

Image Source: Zacks Investment Research

Investors should evaluate whether Costco's growth trajectory justifies its premium valuation while considering the associated risks, particularly in a changing macroeconomic environment. For those with a long-term investment horizon, Costco's historical performance and strategic initiatives may present a compelling case for holding the stock.

Is Costco Stock Worth Holding After Q4 Earnings?

Costco's fourth-quarter results highlight both strengths and challenges for investors to consider. While the company’s earnings beat estimates and membership growth remains solid, the revenue miss raises concerns. Costco’s strategic expansions, strong customer loyalty and growing e-commerce presence provide a positive long-term outlook. However, its premium valuation compared to peers and ongoing macroeconomic pressures may limit immediate upside potential. For long-term investors, Costco’s proven business model may justify holding, but others might be cautious of the stock’s high price amid uncertain market conditions. Costco currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report