Bitcoin price soars, but it isn't about Trump and Clinton

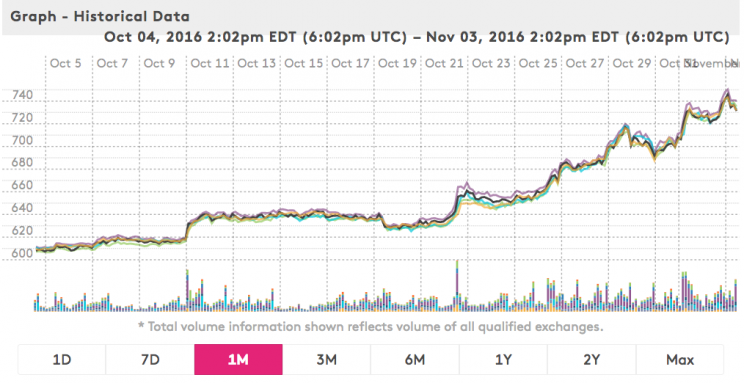

The price of bitcoin has soared 23% in the last month and is now approaching its 2016 peak of around $765 in June. The coin is up 66% since January. At its current price of $728 at the time of writing, bitcoin’s market cap is nearly $12 billion.

So, what’s stoking the ride?

You might think the US presidential election, just five days away now, has something to do with it. And indeed, a Juniper Research study from back in May (“Will Bitcoins Bite Back?“) predicted the bitcoin price would spike right before the election, due to market uncertainty. Specifically, the study determined that a win by Donald Trump would boost the bitcoin price: “If Donald Trump becomes President of the US, there is the very real prospect of turmoil on world markets,” said Dr. Winslow Holden in a Juniper press release about the report. “Bitcoin would thrive in such an environment, at least until the impact on major fiat currencies becomes clear.”

Meanwhile, Hillary Clinton’s campaign considered accepting donations in the form of bitcoin, a leaked email thread revealed. But John Podesta was more intrigued by the digital currency Ven, writing: “I don’t send all the crazy ideas I hear about at fundraisers your way, but this seems interesting and legit. Essentially digital currency with a green angle as opposed to bitcoin’s libertarian Ayn Rand schtick… see if it’s worth a real conversation?” Ultimately Clinton’s campaign decided not to accept bitcoin. Trump’s campaign did accept bitcoin.

Despite the timing so close to the election, the bitcoin community consensus is that the October price spike isn’t from Clinton or Trump: it’s China driving the surge.

Chinese investors are buying up bitcoin

The Chinese yuan has fallen 4.3% against the US dollar in the last six months, and the People’s Bank of China has cracked down with stricter capital controls.

China and a falling yuan is almost always cited as the biggest factor when the price of bitcoin rises. The thinking is that Chinese investors seek a safe haven in bitcoin, which is an asset largely untied to mainstream markets. (This also happened to an extent in Greece during its bank shutdown last year and is happening right now in Venezuela.) Often, it’s actually something else. This time around, the data supports the idea that the interest is coming from China.

Nearly 99% of all global bitcoin trading activity happening right now is happening in Chinese yuan. (It’s worth noting that some bitcoin people doubt Chinese exchange data because it could be inflated or meaningless due to very low fees that prompt empty trading activity.)

Bitcoin trading volume in the Chinese yuan is up more than 20% in the past 30 days, based on charts from bitcoincharts.com, bitcoinity.org and coinmarketcap.com. If you check out the site fiatleak.com, which maps bitcoin purchases in real-time, the overwhelming majority of activity right now is in yuan (CNY).

“It does seem like a cop-out sometimes when everyone says it’s China, but in this case, the data supports it,” says Alex Sunnarborg, CFO of Lawnmower, a digital currency trading and data app. Bitcoin trading volume on Lawnmower is up 40% in the past two weeks from the typical two-week average.

Sunnarborg adds that whenever the bitcoin price spikes significantly, regardless of the reason, it feeds on itself and drives it higher. “People see that demand and feel that FOMO [fear of missing out], which drives a lot of new people in. The market is so thin and new, people are hunting for news, so anything you hear has an immediate effect. It goes the opposite way as well—if you read bad news about bitcoin prices, the market has a tendency to panic. That’s what Ethereum is doing right now.”

Other digital currencies are falling

Indeed, the price of ether (ETH), a rival coin that trades on the separate Ethereum blockchain, is down 17% in the past month. In July, Ethereum completed a “hard fork” that essentially reset its network after a major hack in June. Keep in mind that ether only launched just over one year ago, and is up nearly 300% since then, to $11 per coin. But its recent fall has been a boon to bitcoin, Sunnarborg reasons.

“If you look at ethereum communities right now, people are a little scared, and the bitcoin vs ethereum chasm does go back and forth,” says Sunnarborg. “Whenever you see strength in the bitcoin network, volume goes back into bitcoin.”

Ripple, another popular digital currency (XRP) that came along after bitcoin (in 2012), is also down 4% in the last week.

Bitcoin investors are excited about Segregated Witness

There’s one other bitcoin factor driving the price up: this month, a sort of voting period will begin for whether to implement “segregated witness,” a proposed solution to bitcoin’s ongoing block-size debate.

Huh? Let’s step back: bitcoin is traded on the bitcoin blockchain, a decentralized, permissionless, peer-to-peer ledger that records every single bitcoin transaction. On the bitcoin blockchain, bundles of transactions are added to the chain by “miners” who receive a small reward in bitcoin for doing the mining; think of them as librarians recording the date and borrower of a book, or as court stenographers recording the history of bitcoin trades. (For more, watch the below video.)

The speed of the blockchain has slowed in the last year under the weight of activity, and the bitcoin community has argued amongst itself over whether to raise the size limit of each block. The speed at which the bitcoin blockchain operates is of crucial importance, since it is often compared to the payment rails of big mainstream processors like Visa.

“Segregated witness” was one popular proposal: an update to the bitcoin software that would allow miners to raise the size capacity on individual blocks without raising the capacity of the entire blockchain for good, and without doing a “hard fork” (which would split the blockchain into two) like Ethereum just did. Think of it like a Brinks armored car, which hauls bags of cash. Rather than having all the cars start using bigger bags, Segregated Witness (bitcoin people are calling it SegWit for short) is like allowing each driver to start using a few bigger bags just in cases where a bigger bag is needed.

Beginning on Nov. 15, bitcoin miners can signal, with each block they mine, whether or not they support Segregated Witness. It should help more transactions go through faster. After one year, if 95% of the blocks have signaled that they like it, Segregated Witness will go into full effect for the Bitcoin Core software.

Why does all this matter for the price of bitcoin? It might not matter for the casual outside speculator, but for wonky bitcoin insiders, the implementation of SegWit is an exciting milestone, and may contribute a little bit to the price hike. “I think SegWit was a big market move,” says Sunnarborg. “SegWit has been talked about for so long that if there had been a huge delay or problem announced, we would have seen the market swing the other way. But now it’s bringing demand from the community to go back into bitcoin.”

While the Chinese yuan has been the biggest factor in boosting the bitcoin price, the beginning of SegWit and general US market uncertainty are not unrelated. And the election almost certainly will play a larger role right after it ends. If Trump somehow wins, expect bitcoin to soar.

—

Daniel Roberts is a writer at Yahoo Finance, covering technology and sports business. Follow him on Twitter at @readDanwrite.

Read more:

The latest bitcoin price surge isn’t just about Brexit

Here’s where big banks stand on blockchain