Bandhan Bank And 2 Other Stocks That May Be Undervalued On The Indian Exchange

In the last week, the Indian market has been flat, although it is up 44% over the past year with earnings forecast to grow by 17% annually. In this environment, identifying undervalued stocks like Bandhan Bank can offer potential opportunities for investors looking to capitalize on future growth.

Top 10 Undervalued Stocks Based On Cash Flows In India

Name | Current Price | Fair Value (Est) | Discount (Est) |

Apollo Pipes (BSE:531761) | ₹587.90 | ₹1136.77 | 48.3% |

Titagarh Rail Systems (NSEI:TITAGARH) | ₹1188.60 | ₹2154.40 | 44.8% |

RITES (NSEI:RITES) | ₹334.25 | ₹516.97 | 35.3% |

IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹474.90 | ₹762.32 | 37.7% |

Vedanta (NSEI:VEDL) | ₹516.15 | ₹936.58 | 44.9% |

Patel Engineering (BSE:531120) | ₹56.88 | ₹93.04 | 38.9% |

Orchid Pharma (NSEI:ORCHPHARMA) | ₹1334.65 | ₹2142.32 | 37.7% |

Artemis Medicare Services (NSEI:ARTEMISMED) | ₹284.55 | ₹445.15 | 36.1% |

Tarsons Products (NSEI:TARSONS) | ₹448.50 | ₹708.73 | 36.7% |

Strides Pharma Science (NSEI:STAR) | ₹1401.00 | ₹2704.30 | 48.2% |

We're going to check out a few of the best picks from our screener tool.

Bandhan Bank

Overview: Bandhan Bank Limited provides banking and financial services to personal and business customers in India, with a market cap of ₹314.59 billion.

Operations: Bandhan Bank's revenue segments include Treasury (₹22.72 billion), Retail Banking (₹190.31 billion), Wholesale Banking (₹17.10 billion), and Other Banking Business (₹3.13 billion).

Estimated Discount To Fair Value: 10.1%

Bandhan Bank is trading at ₹195.28, slightly below its estimated fair value of ₹217.27. Despite a high level of bad loans (3.8%) and low allowance for bad loans (72%), the bank's earnings are expected to grow significantly at 23.6% annually over the next three years, outpacing the Indian market's growth rate of 17.2%. Recent regulatory issues related to GST matters have had minimal financial impact on the bank's operations.

The growth report we've compiled suggests that Bandhan Bank's future prospects could be on the up.

Click to explore a detailed breakdown of our findings in Bandhan Bank's balance sheet health report.

Strides Pharma Science

Overview: Strides Pharma Science Limited develops, manufactures, and sells pharmaceutical products across Africa, Australia, North America, Europe, Asia, India, and internationally with a market cap of ₹128.83 billion.

Operations: The company generates ₹42.09 billion in revenue from its pharmaceutical business, excluding bio-pharmaceuticals.

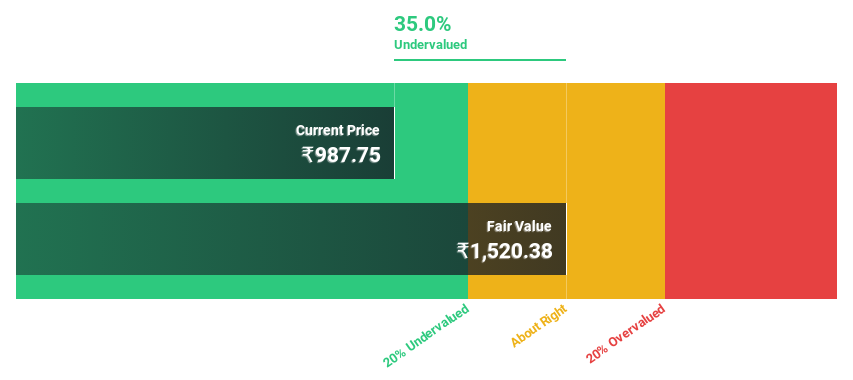

Estimated Discount To Fair Value: 48.2%

Strides Pharma Science is trading at ₹1,401, significantly below its estimated fair value of ₹2,704.3. Despite recent executive changes and partial redemption of non-convertible debentures worth ₹740 million, the company’s earnings are forecast to grow 65.18% annually over the next three years. Strides' revenue growth rate of 11% per year is expected to outpace the Indian market average of 10.1%, making it an attractive option for investors seeking undervalued stocks based on cash flows.

Titagarh Rail Systems

Overview: Titagarh Rail Systems Limited manufactures and sells freight and passenger rail systems in India and internationally, with a market cap of ₹160.07 billion.

Operations: The company's revenue segments include ₹3.32 billion from passenger rail systems and ₹35.14 billion from freight rail systems, including shipbuilding, bridges, and defense.

Estimated Discount To Fair Value: 44.8%

Titagarh Rail Systems is trading at ₹1,188.6, well below its estimated fair value of ₹2,154.4. Despite shareholder dilution over the past year, the company’s earnings are forecast to grow 30.1% annually over the next three years, significantly outpacing the Indian market average of 17.2%. Recent earnings showed a net income increase to ₹670.1 million from ₹617.9 million a year ago, reinforcing its position as an undervalued stock based on cash flows.

Seize The Opportunity

Get an in-depth perspective on all 26 Undervalued Indian Stocks Based On Cash Flows by using our screener here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:BANDHANBNK NSEI:STAR and NSEI:TITAGARH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com