‘An administrative trainwreck’: Documents show chaos over whether Dreamers qualify for FHA loans

Since 2012, undocumented immigrants called Dreamers have received deferred deportation, work permits and — at one time — federally-backed mortgages, which have lower credit score and downpayment requirements for potential homebuyers.

The Deferred Action for Childhood Arrivals (DACA) program gives protections to about 800,000 children who grew up in the United States without immigration documentation. Major U.S. lenders, including Wells Fargo, assumed that these Dreamers qualified as lawful U.S. residents and granted them federally-backed mortgages (FHA loans).

But as early as 2018, the U.S. Department of Housing and Urban Development started telling lenders that Dreamers have never been eligible for FHA loans. The communication that ensued was confusing, contradictory and even misleading, according to a complaint filed on June 9 by Rep. Pete Aguilar (D-Calif.), Senator Bob Menendez (D-N.J.) and Rep. Juan Vargas (D-Calif.).

“It was an administrative trainwreck — and yet another example of what happens when the Trump administration’s disregard for immigrants and inability to govern collide,” said a statement by Robin Thurston, senior counsel for Democracy Forward, a Washington D.C.-based legal services and public policy research organization that requested an investigation into HUD’s actions, on June 5.

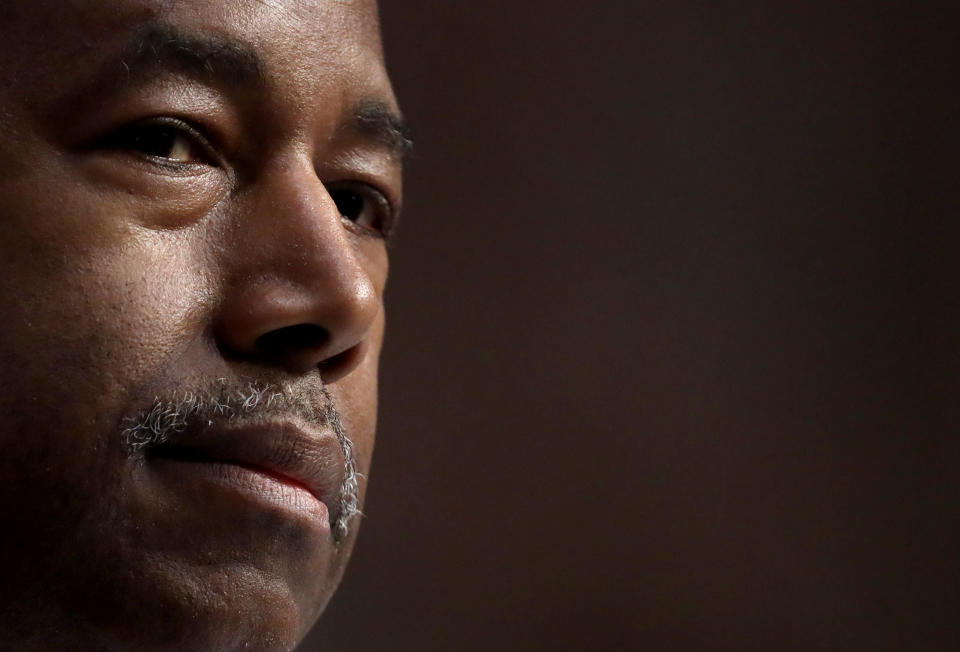

HUD’s Office of the Inspector General would not confirm or deny an investigation, but HUD Secretary Ben Carson agreed to cooperate with any investigation. In the meantime, HUD has denied a “formal or informal policy change” on multiple occasions, including in a letter to Rep. Maxine Waters, chairwoman of the House Financial Services Committee, in December 2018, according to records.

“FHA’s policy has not changed… Any entity asserting that the Obama Administration deemed DACA recipients eligible for FHA loans or that the Trump Administration changed this policy is incorrect,” a HUD spokesperson told Yahoo Finance in an email, explaining that FHA’s 2015 handbook “clearly states that ‘non-U.S. citizens without lawful residency in the U.S. are not eligible for FHA-insured mortgages.’ This policy has never changed.”

But internally, HUD employees admitted that HUD began enforcing DACA ineligibility recently, when the housing agency noticed that U.S. Citizenship and Immigration Services (USCIS) defines Dreamers as unlawful residents, according to internal emails, memos and documents that Democracy Forward obtained by a Freedom of Information Act Request.

“The decision was made to enforce [Dreamer ineligibility] only at this time… Everyone just assumed they [Dreamers] had lawful status,” said an email from the assistant secretary for housing - Federal Housing Administration commissioner to the Philadelphia quality assurance director in November 2018.

HUD made its decision based on USCIS’s definition, but the law is not consistent on whether Dreamers are “lawful.” According to regulations by the Department of Homeland Security, which is the parent organization of USCIS, a person “who has approved deferred action status” is in “lawful status.”

“HUD made a choice to exclude DACA recipients from FHA loans by defining lawful residency in a different way, in a manner to exclude them, which is made clear in the FOIA documents,” said Menendez.

‘Wide eyes and a puzzled look’ among lenders

For U.S. mortgage lenders, the confusion began at a May 2018 HUD training session, where a mid-level HUD employee allegedly told lenders that DACA recipients are ineligible for federally-backed mortgages.

“Just about every lender representative at the roundtable had wide eyes and a puzzled look on their face” when it was stated, wrote Jana Holmstrup, CEO of Kings Mortgage Services in an email to HUD officials in August 2018, adding that the mortgage industry was at odds on the matter and the policy needed to be officially announced.

After May 2018, HUD doubled down on the Dreamer exclusion in private emails, internal memos, a confidential briefing book and a HUD roundtable discussion. HUD explained that the government has “deferred” prosecution against Dreamers — not made them legal. But when lenders sought official public guidance, internal documents showed that HUD did not provide any.

Lenders complained that private correspondence about the issue resulted in some lenders advertising and granting federally-backed mortgages to Dreamers, while others — like Northwest Mortgage Group (Ore.), Kings Mortgage Services (Calif.) and Fairway Independent Mortgage Corporation (Wisc.) — were obliged to stop offering loans to Dreamers.

“Due to the fact that I was invited and attended [the discussion where HUD staff stated DACA recipients are ineligible for FHA financing] — and heard [them] say it — we now find ourselves at a competitive disadvantage,” said Holmstrup, who said that Kings Mortgage’s competitors, including Alterra Home Loans (Nev.), American Pacific Mortgage (Calif.) and Country Club Mortgage (Calif.), continued to offer FHA financing to Dreamers because they hadn’t “heard” of the change. Altera, American Pacific and Country Club Mortgage did not respond to requests for comment.

Wells Fargo also told Yahoo Finance that they offered a “small number of FHA loans to borrowers with DACA status prior to HUD’s definitive statement on the issue.”

Some local HUD bureaus, like the Denver Homeownership Center, also advised lenders to go ahead with loans to qualifying DACA recipients, according to a letter from a lender on October 18, 2018.

The lack of guidance from HUD has hurt not only lenders but Dreamers as well. In December 2018, Direct Mortgage Loans (Md.) denied an FHA loan to a DACA recipient who was about to close on the purchase of a house, according to a letter from Senator Chris Van Hollen (D-Md.).

“My family is so excited about this house we are giving up Christmas, and I pawned all my jewelry to get the money to buy the house. Because the lender said everything looked good, I gave my landlord notice that I would be leaving the end of December. Now I find out that because I have DACA, I don’t qualify to buy a house with FHA,” wrote the DACA recipient, who has lived in the U.S. over 20 years, has a social security number and pays taxes.

It is unknown how many Dreamers have applied for or received a federally-backed mortgage, but some 13.6% of Dreamers have purchased a home, according to a 2019 survey of over 1,000 DACA recipients by the National Immigration Law Center, the Center for American Progress and a University of California professor.

‘Just post the freaking DACA FAQ’

In response to lenders’ requests for clarification, mid-level HUD staff drafted a short DACA policy explanation for a HUD “Frequently Asked Questions” web page in May 2018, which was actually never published for the public.

“FHA’s longstanding policy has been that Non-U.S. citizens without lawful residency in the U.S. are not eligible for FHA insured mortgages. According to the USCIS [U.S. Citizenship and Immigration Services]... DACA recipients are not granted lawful residency status… and therefore are not eligible for FHA financing,” an amended draft of HUD’s unpublished DACA policy reads, according to an email on October 11, 2018.

Employees insisted in emails that the FAQ get published but it was never posted. Internal emails, memos and documents reveal a year-and-a-half long correspondence between employees and high-level officials about publicizing the FAQ.

“It wouldn’t be private if [a HUD manager] would just post the freaking DACA FAQ,” wrote a HUD employee in an email some six months into the battle, calling for clarity.

The first record of management action on the FAQ came on December 19, 2018, five days after a BuzzFeed News article alleged that the Trump administration is ‘Quietly denying federal housing loans to DACA recipients.’

The draft FAQ on DACA “was reviewed by program counsel but I do not know if it was shared with OGC [Office of General Counsel] leadership,” wrote a manager. According to an OGC email two weeks prior, OGC had in fact reviewed the FAQ and was told by management not to publish it.

“[The documents] don’t say exactly why the FAQ wasn’t published, and honestly I don’t think there’s any reasonable explanation why. They had internally reached a conclusion that would have provided clarity to the lending market and borrowers, and for no reason we can tell, failed to publish it,” said Thurston.

But HUD Secretary Carson told a different story before Congress on April 3, 2019. Democracy Forward alleges that Carson deceived Congress about DACA eligibility in a testimony to the House Committee on Appropriations Subcommittee on Transportation, Housing and Urban Development, and related agencies.

“His failure to reveal that there was at least an informal policy change and imply DACA recipients were still getting loans suggests either an unwillingness to reveal the policy change, or that [he was] unaware of a significant change within his own agency,” said Thurston.

At the Appropriations Subcommittee meeting, Aguilar asked Carson whether DACA recipients are eligible for FHA-backed loans and whether it was possible someone outside of HUD had issued guidance.

“I inquired of the appropriate people, including the FHA commissioner [Brian Montgomery], and no one was aware of any changes that had been made to the policy whatsoever. I’m sure we have plenty of DACA recipients who have FHA mortgages,” replied Carson. “That would surprise me,” if folks in the mortgage industry heard guidance that DACA recipients should not receive FHA mortgages, he said, adding that it was possible that an unauthorized entity had provided guidance.

Thurston told Yahoo Finance that Carson’s answer showed either ignorance of a significant change within his own agency, or an unwillingness to reveal the policy change.

Homeownership for Dreamers

In June 2019, Vargas introduced the “Homeownership for Dreamers Act”, which would make Dreamers eligible for FHA loans, but the bill never passed the U.S. House of Representatives even though it was backed by Waters, chairwoman of the house financial services committee.

The National Association of Hispanic Real Estate Professionals (NAHREP) has urged Congress to pass the Homeownership for Dreamers Act, citing that 92.6% of Dreamers are Hispanic or Latino — a demographic group that is responsible for more than half of homeownership growth in the U.S. over the past decade. These homeowners rely on federally-backed mortgages, twice as much as other groups: some 42.8% of hispanic homebuyers have an FHA loan compared to 20.6% of non-hispanics, according to NAHREP.

“We must ensure that DACA recipients eager to contribute to our economy through homeownership are given the tools to do so,” said Noerena Limón, senior vice president of public policy and industry relations at NAHREP. “Reviving and rebuilding our economy will require input from all sectors of our economy, including from our DREAMers.”

Sarah Paynter is a reporter at Yahoo Finance. Follow her on Twitter @sarahapaynter

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

More from Sarah:

Why some brokers are suing the nation’s biggest real estate trade group

Most residential brokers may be women, but inequality is still prevalent in the real estate industry

Facebook comes under fire for housing discrimination and redlining