American Express, Boost to Streamline Virtual Card Payment Processing

American Express Company AXP recently teamed up with Boost Payment Solutions to optimize virtual card payment processing for its U.S. merchants. This collaboration would launch Boost Intercept, a patented Straight-Through Processing solution, for qualified American Express merchants to automate their acceptance of virtual card payments at no extra cost.

This move bodes well for AXP as it addresses the need for automation in B2B payments, which will help with the retention of clients. Virtual card transactions are expected to represent 52% of U.S. commercial card spending by 2025. Previously, many suppliers processed virtual card payments manually, which was time-consuming and prone to errors. With Boost Intercept, the entire process — from receiving and parsing to processing payments — has become streamlined and automated, significantly reducing payment cycles and improving cash flow management.

By eliminating the manual handling of tokenized card data, suppliers can focus more on their core business operations. The automation not only speeds up the payment process but also simplifies reconciliations, providing detailed transaction data for easier invoice matching. Per the Amex Trendex B2B Edition, businesses utilizing payment automation reportedly save an average of 9.9 hours weekly, equating to more than 500 hours annually.

Improving supplier capabilities should attract more merchants to AXP’s network, leading to improved transaction volumes in the future. Moves like this are expected to strengthen AXP's position in the competitive B2B payment landscape. AXP anticipates revenues to increase between 9% and 11% in 2024 from the 2023 level of $60.5 billion.

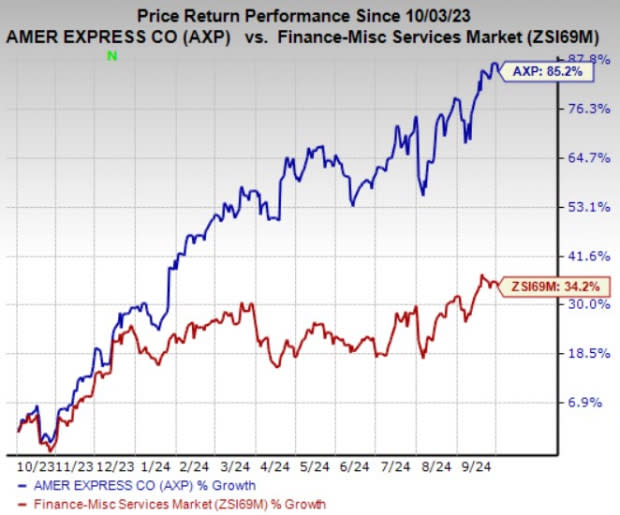

AXP Stock’s Price Performance

Shares of American Express have gained 85.2% in the past year compared with the industry’s 34.2% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

AXP currently carries a Zacks Rank #2 (Buy).

Investors interested in the broader Finance space may look at some other top-ranked players like Jackson Financial Inc. JXN, Aflac Incorporated AFL and WisdomTree, Inc. WT. Each stock presently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Jackson Financial’s current-year earnings is pegged at $18.49 per share, which indicates 44% year-over-year growth. It witnessed two upward estimate revisions in the past 60 days against no downward movement. The consensus mark for JXN’s current-year revenues indicates a 116.7% surge from a year ago.

The Zacks Consensus Estimate for Aflac’s current-year earnings is pegged at $6.75 per share, which indicates 8.4% year-over-year growth. It witnessed one upward estimate revision in the past 30 days against no downward movement. AFL beat earnings estimates in three of the trailing four quarters and missed once, with an average surprise of 8.2%.

The Zacks Consensus Estimate for WisdomTree’s 2024 earnings indicates 67.6% year-over-year growth. In the past two months, WT has witnessed two upward estimate revisions against none in the opposite direction. It beat earnings estimates twice in the past four quarters and met on the other occasions, with an average surprise of 5.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Express Company (AXP) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

Jackson Financial Inc. (JXN) : Free Stock Analysis Report

WisdomTree, Inc. (WT) : Free Stock Analysis Report