AMD records its highest server market share in decades — Intel fights back in client PCs

When you buy through links on our articles, Future and its syndication partners may earn a commission.

AMD enjoyed another great quarter in Q2 2024 as it gained share in data center and laptop CPU markets, according to a new report from CPU market tracker Mercury Research. Still, Intel gained share in desktops and continues to lead in terms of units in general.

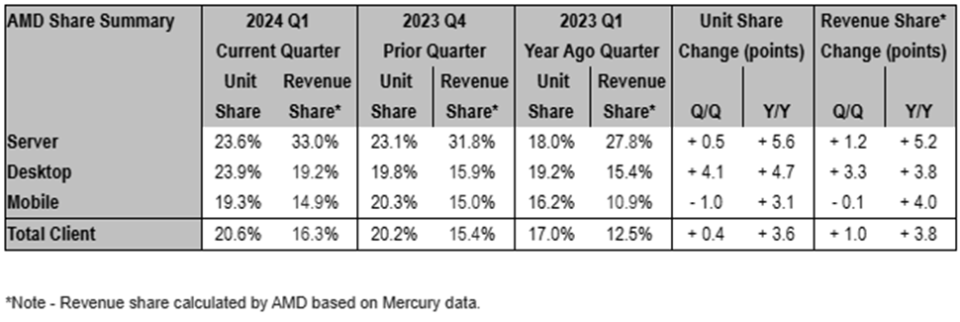

Intel continued to dominate the client PC market in the second quarter of 2024, securing a 78.9% market share, while AMD held 21.1%. This outcome is expected, considering the strength and variety of Intel's client product lineup. Still, AMD managed to increase its unit share by 0.5% sequentially and by 3.8% year-over-year. Despite AMD's ongoing success, it will likely take the company years to achieve the sales growth needed to fully shift the market in its favor, not only because Intel dominates corporate PC sales but also because of Intel's access to vast production capacity.

Desktop PC, Mobile, Client Revenue / Unit Share

AMD lost 1% of market share to Intel in desktop PCs in the second quarter of 2024 and now controls 23%, leaving 77% to Intel. Considering that AMD was preparing to release its all-new Zen 5-based CPUs for desktops in August, we doubt the company was too aggressive with stuffing the channel with its previous-generation Zen 4-based offerings, which might be one of the reasons why the company lost a small chunk of the market to its rival. Then again, when compared to the second quarter of 2023, AMD gained a 3.6% share in Q2 2024, which is quite a good result.

On the laptop front, AMD made gains both sequentially and year-over-year. The company commanded 20.3% of x86 processors for laptops in Q2 2024: this is 1% higher than in the first quarter of this year and 3.8% higher than in the same quarter a year ago.

Apparently, even the upcoming launch of Zen 5-based Ryzen AI and Copilot+ and the AI PC frenzy are not expected to lower demand for AMD's existing offerings for notebooks, which is why PC makers accelerated purchases of these products. Another reason for AMD's success could be Intel's issues with supplying enough Meteor Lake PCs.

Still, AMD does not seem to have sold many expensive ('expensive' does not mean highest-end, though) Ryzen CPUs. Its laptop CPU revenue share is 17.7%, which is well below its 20.3% unit market share. Again, AMD's position improved as it increased its revenue share by 2.8% compared to the second quarter of this year and by a rather noticeable 4.5% compared to the second quarter of 2023.

Server Revenue / Unit share

AMD's biggest success for the second quarter probably lies in the server space. The company has managed to capture another 0.5% share away from Intel and now controls 24.1% of the data center CPU market with its EPYC CPUs. When compared to the second quarter of 2024, AMD's gain looks even more impressive, as the company grabbed 5.6% from Intel.

Although Intel is an indisputable leader when it comes to volumes, as it still controlled some 75.9% of datacenter CPU shipments in the second quarter, it is necessary to note that AMD seems to lead in high-end crème-de-la-crème machines that require the most powerful and expensive processors, as we can conclude from the financial results of the two companies in Q2 2024. While Intel earned $3.0 billion selling 75.9% of data center CPUs (in terms of units), AMD earned $2.8 billion selling 24.1% of server CPUs (in terms of units), which signals that the average selling price of an AMD EPYC is considerably higher than the ASP of an Intel Xeon.

Indeed, AMD's revenue share of the server market in Q2 2024 was 33.7%, as calculated by AMD itself based on data from Mercury Research. That is up 0.7% QoQ and 6.6% YoY, an impressive result. Then again, Intel has nothing to offer against AMD's 96-core and 128-core processors for now, so AMD controls the market for high-end servers.