3 UK Growth Stocks With Up To 38% Insider Ownership

Over the last 7 days, the United Kingdom market has dropped 1.3%, but it remains up 8.3% over the past year with earnings projected to grow by 14% annually in the coming years. In this context, growth companies with substantial insider ownership can be particularly appealing as they often demonstrate strong alignment between management and shareholder interests, potentially driving robust performance even in fluctuating markets.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

Helios Underwriting (AIM:HUW) | 23.9% | 16.1% |

Foresight Group Holdings (LSE:FSG) | 31.7% | 27.9% |

LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

Belluscura (AIM:BELL) | 36.1% | 113.4% |

B90 Holdings (AIM:B90) | 24.4% | 142.7% |

Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

Judges Scientific (AIM:JDG) | 11.9% | 26.9% |

Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

Evoke (LSE:EVOK) | 20.5% | 105.2% |

Here we highlight a subset of our preferred stocks from the screener.

Craneware

Simply Wall St Growth Rating: ★★★★☆☆

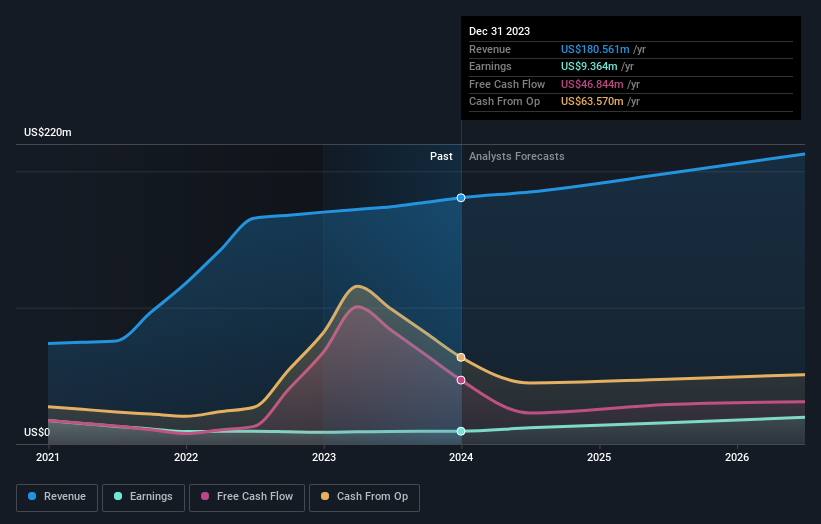

Overview: Craneware plc, with a market cap of £828.40 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: The company's revenue segment includes Healthcare Software, which generated $189.27 million.

Insider Ownership: 17%

Craneware's revenue is forecast to grow at 8.2% per year, outpacing the UK market's 3.7%. Earnings are expected to rise significantly at 25.6% annually, surpassing the market average of 14.4%. Recent earnings showed a net income increase to US$11.7 million from US$9.23 million last year, and Craneware is actively seeking acquisitions while expanding its collaboration with Microsoft Azure for enhanced cloud capabilities and AI integration in healthcare solutions.

Take a closer look at Craneware's potential here in our earnings growth report.

Our valuation report here indicates Craneware may be overvalued.

Judges Scientific

Simply Wall St Growth Rating: ★★★★★☆

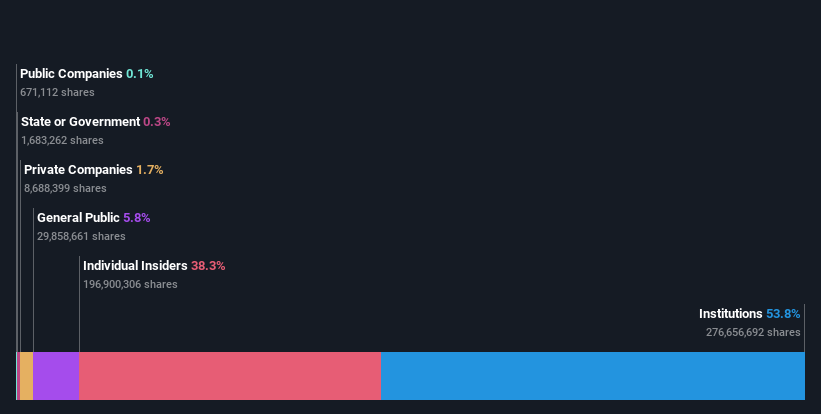

Overview: Judges Scientific plc designs, manufactures, and sells scientific instruments with a market cap of £703.98 million.

Operations: The company generates revenue from two main segments: Vacuum (£63.60 million) and Materials Sciences (£72.50 million).

Insider Ownership: 11.9%

Judges Scientific's revenue is forecast to grow at 6.3% annually, outpacing the UK market's 3.7%. Earnings are expected to rise significantly at 26.88% per year, with a high forecasted return on equity of 20.9%. Despite recent volatility and lower profit margins (7%) compared to last year (11%), the appointment of Dr. Ian Wilcock as Group Commercial Director brings extensive leadership and innovation experience, potentially driving future growth and development initiatives within the company.

Hochschild Mining

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £843.71 million.

Operations: The company's revenue segments include $266.70 million from San Jose and $451.91 million from Inmaculada, with a segment adjustment of $79.60 million.

Insider Ownership: 38.4%

Hochschild Mining has shown a strong turnaround, reporting H1 2024 sales of US$391.74 million and net income of US$39.52 million, compared to a net loss last year. Despite high debt levels, the company is trading significantly below its estimated fair value and analysts predict a 41.9% rise in stock price. With earnings expected to grow at 43.88% annually over the next three years, Hochschild's revenue growth is forecasted to outpace the UK market average.

Turning Ideas Into Actions

Discover the full array of 65 Fast Growing UK Companies With High Insider Ownership right here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:CRW AIM:JDG and LSE:HOC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com